Calcasieu Parish Sales Tax Form 2010-2026

What is the Calcasieu Parish Sales Tax Form

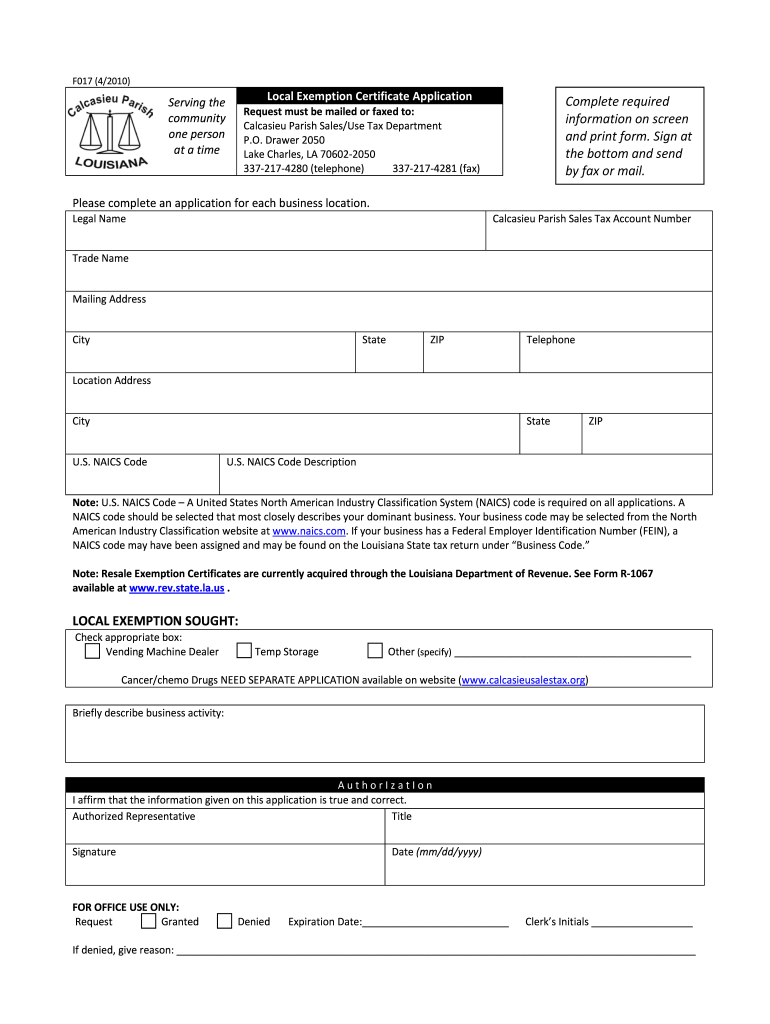

The Calcasieu Parish Sales Tax Form is a crucial document used by businesses and individuals to report and remit sales tax collected on taxable sales within Calcasieu Parish, Louisiana. This form ensures compliance with local tax regulations and helps maintain accurate records for both the taxpayer and the parish. It is essential for businesses operating in this area to understand the specific requirements associated with this form to avoid penalties.

How to use the Calcasieu Parish Sales Tax Form

Using the Calcasieu Parish Sales Tax Form involves several key steps. First, gather all necessary sales records for the reporting period. This includes total sales, exempt sales, and any deductions. Next, accurately fill out the form with the required information, including the total sales tax collected. After completing the form, it must be submitted by the designated deadline to ensure compliance with local tax laws.

Steps to complete the Calcasieu Parish Sales Tax Form

Completing the Calcasieu Parish Sales Tax Form requires careful attention to detail. Follow these steps:

- Collect sales data for the reporting period.

- Determine the total taxable sales and any exempt sales.

- Calculate the total sales tax due based on the applicable rates.

- Fill out the form with accurate figures, ensuring all fields are completed.

- Review the form for accuracy before submission.

Legal use of the Calcasieu Parish Sales Tax Form

The legal use of the Calcasieu Parish Sales Tax Form is governed by Louisiana state tax laws. It is essential for businesses to use this form in accordance with these regulations to avoid legal repercussions. Properly completing and submitting the form ensures that businesses fulfill their tax obligations and maintain compliance with local ordinances.

Filing Deadlines / Important Dates

Filing deadlines for the Calcasieu Parish Sales Tax Form are typically set by the local tax authority. It is important to be aware of these dates to avoid late fees and penalties. Generally, forms are due on a monthly or quarterly basis, depending on the volume of sales. Keeping a calendar of these deadlines can help ensure timely submissions.

Required Documents

To complete the Calcasieu Parish Sales Tax Form, certain documents are required. These may include:

- Sales records for the reporting period.

- Documentation of exempt sales.

- Any previous tax returns filed with the parish.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

The Calcasieu Parish Sales Tax Form can typically be submitted through several methods. Taxpayers may have the option to file online via the parish's tax authority website, submit the form by mail, or deliver it in person to the local tax office. Each method may have specific instructions and requirements, so it is advisable to check the latest guidelines from the tax authority.

Quick guide on how to complete calcasieu parish sales tax application online form

Manage Calcasieu Parish Sales Tax Form everywhere, at any moment

Your daily organizational tasks may require extra focus when handling state-specific business documents. Regain your office hours and reduce the expenses related to paperwork with airSlate SignNow. airSlate SignNow provides a variety of pre-uploaded business documents, including Calcasieu Parish Sales Tax Form, that you can utilize and distribute to your business associates. Manage your Calcasieu Parish Sales Tax Form seamlessly with robust editing and eSignature capabilities and send it directly to your recipients.

How to obtain Calcasieu Parish Sales Tax Form in just a few clicks:

- Choose a document applicable to your state.

- Click Learn More to view the document and confirm its accuracy.

- Click Get Form to start using it.

- Calcasieu Parish Sales Tax Form will open automatically in the editor. No further steps are necessary.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or modify the form.

- Select the Sign feature to generate your signature and eSign your document.

- When you’re ready, click Done, save your changes, and access your document.

- Share the form via email or text, or use a link-to-fill option with your partners or allow them to download the document.

airSlate SignNow signNowly enhances your efficiency when managing Calcasieu Parish Sales Tax Form and enables you to find essential documents in one location. A comprehensive library of forms is organized and designed to cover vital business processes necessary for your organization. The advanced editor minimizes the likelihood of errors, allowing you to easily correct mistakes and review your documents on any device before sending them out. Start your free trial today to discover all the benefits of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

FAQs

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out the application for a Schengen visa?

Dear Rick,A Schengen visa application form requires the information about your passport, intended dates and duration of visit, sponsor’s or inviting person's details, previous schengen visa history etc. If you have these details with you, it is very easy to fill out the visa application.

-

How should I fill out an online application form for the KVPY exam?

KVPY Registration 2018 is starting from 11th July 2018. Indian Institute of Science (IISC), Bangalore conducts a national level scholarship programme.How to Fill KVPY Application FormVisit the official and register as a new user by mentioning Name, date of birth, stream, nationality etc.Enter the captcha and click on submit.Enter your basic details such as Name, Date of Birth, Age, E-mail id, the Mobile number for registration, etc. Also select from the drop down menu your class, gender, category & nationality.Now click on the ‘Submit’ tab.

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

Create this form in 5 minutes!

How to create an eSignature for the calcasieu parish sales tax application online form

How to create an electronic signature for the Calcasieu Parish Sales Tax Application Online Form online

How to generate an eSignature for the Calcasieu Parish Sales Tax Application Online Form in Chrome

How to create an eSignature for putting it on the Calcasieu Parish Sales Tax Application Online Form in Gmail

How to create an eSignature for the Calcasieu Parish Sales Tax Application Online Form straight from your smartphone

How to create an eSignature for the Calcasieu Parish Sales Tax Application Online Form on iOS

How to create an eSignature for the Calcasieu Parish Sales Tax Application Online Form on Android OS

People also ask

-

What is the Calcasieu Parish Sales Tax Form?

The Calcasieu Parish Sales Tax Form is a document required for businesses operating in Calcasieu Parish to report and remit sales tax. This form ensures compliance with local tax regulations and helps streamline the tax filing process for businesses.

-

How can airSlate SignNow help with the Calcasieu Parish Sales Tax Form?

airSlate SignNow simplifies the process of completing and submitting the Calcasieu Parish Sales Tax Form by allowing users to easily fill out, sign, and send the document electronically. This reduces the likelihood of errors and saves time for businesses.

-

Is there a cost associated with using airSlate SignNow for the Calcasieu Parish Sales Tax Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost-effective solutions ensure that businesses can efficiently manage their Calcasieu Parish Sales Tax Form and other document signing needs without breaking the bank.

-

Can I integrate airSlate SignNow with other software for the Calcasieu Parish Sales Tax Form?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software and business tools, making it easier to manage your Calcasieu Parish Sales Tax Form alongside other financial documents. This integration streamlines your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax forms like the Calcasieu Parish Sales Tax Form?

Using airSlate SignNow for the Calcasieu Parish Sales Tax Form provides numerous benefits, including increased efficiency, reduced paper usage, and improved accuracy. With electronic signatures and easy document management, businesses can focus more on their operations rather than paperwork.

-

How secure is airSlate SignNow when handling the Calcasieu Parish Sales Tax Form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance protocols to protect sensitive information related to the Calcasieu Parish Sales Tax Form. Users can trust that their data is safe and secure throughout the signing process.

-

Can I access my Calcasieu Parish Sales Tax Form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing you to access and complete your Calcasieu Parish Sales Tax Form from any device. Whether you’re in the office or on the go, you can manage your documents conveniently.

Get more for Calcasieu Parish Sales Tax Form

- Whereas the parties are about to contract marriage and execute this agreement in form

- Instructions to complete the will leaving the reference numbers and placing the names form

- Note if your home is jointly owned with another and held as joint tenants with rights of form

- All property to trust pour over will form

- Field 30 31 form

- Bill of sale form wisconsin last will and testament sample

- Article five form

- Tennessee probate forms state specificus legal forms

Find out other Calcasieu Parish Sales Tax Form

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple