Nelnet Com Income Driven Repayment Plans Form

What is the Nelnet Income Driven Repayment Plan?

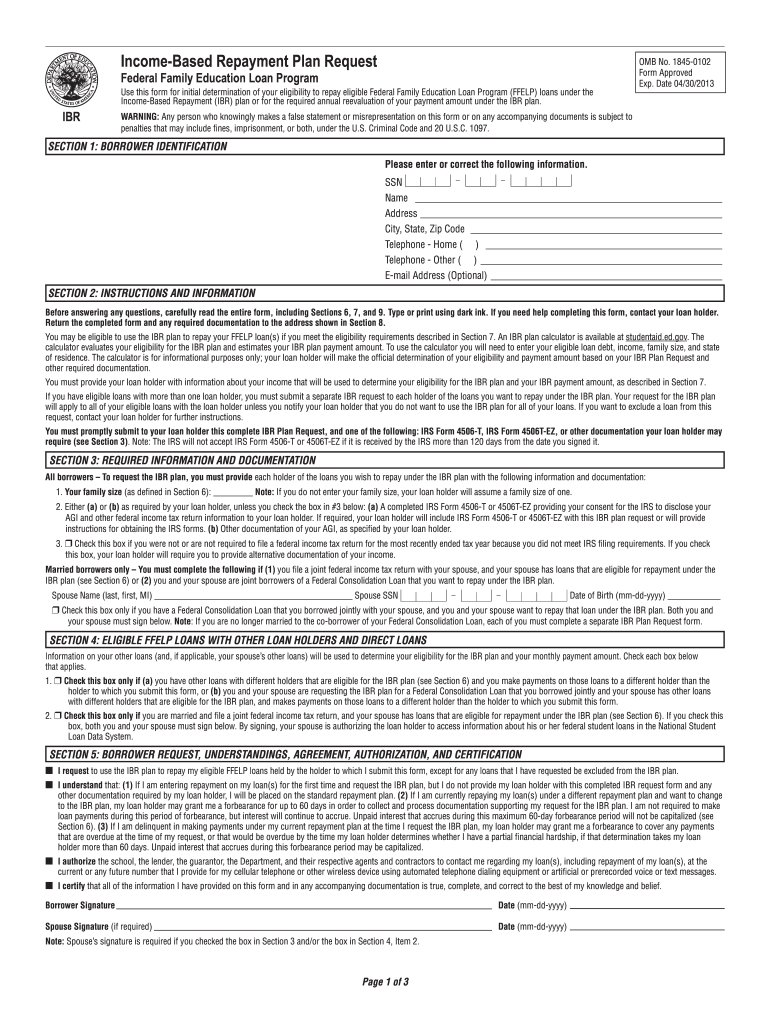

The Nelnet income driven repayment plan is designed to help borrowers manage their student loan payments based on their income and family size. This plan adjusts monthly payments to ensure they are affordable, allowing borrowers to pay a percentage of their discretionary income. The goal is to provide financial relief while keeping borrowers on track to repay their loans over time. It is important for borrowers to understand the terms and conditions associated with this plan, including eligibility criteria and how it may affect loan forgiveness options.

Steps to Complete the Nelnet Income Driven Repayment Plan

Completing the Nelnet income driven repayment plan involves several key steps:

- Gather Required Documents: Collect necessary financial documents, including income verification and family size details.

- Access the Nelnet Portal: Log into your Nelnet account or create one if you do not have an existing account.

- Complete the Income Driven Repayment Plan Form: Fill out the form accurately, providing all required information about your income and household.

- Submit Your Form: Review your form for accuracy and submit it through the Nelnet portal.

- Monitor Your Application Status: Keep track of your application status through your Nelnet account.

Eligibility Criteria for the Nelnet Income Driven Repayment Plan

To qualify for the Nelnet income driven repayment plan, borrowers must meet specific eligibility criteria. Generally, these include:

- Having federal student loans serviced by Nelnet.

- Demonstrating financial need based on income and family size.

- Being in a repayment status, not currently in default.

- Providing accurate income documentation as required.

It is essential for borrowers to review these criteria carefully to ensure they meet all requirements before applying.

Required Documents for the Nelnet Income Driven Repayment Plan

When applying for the Nelnet income driven repayment plan, borrowers need to submit several documents to verify their income and household size. These typically include:

- Most recent tax return or IRS Form 1040.

- Pay stubs or income statements for the past month.

- Documentation of any additional income sources.

- Proof of family size, such as birth certificates or court documents.

Having these documents ready can streamline the application process and help prevent delays.

Form Submission Methods for the Nelnet Income Driven Repayment Plan

Borrowers can submit their Nelnet income driven repayment plan form through various methods. The primary submission options include:

- Online Submission: The most efficient way is to submit the form through the Nelnet online portal, which allows for immediate processing.

- Mail Submission: Borrowers can print the completed form and mail it to the designated Nelnet address, though this may take longer to process.

- In-Person Submission: Some borrowers may choose to visit a Nelnet office for assistance, although this option may not be available in all areas.

Legal Use of the Nelnet Income Driven Repayment Plan

The Nelnet income driven repayment plan is legally binding when completed correctly and submitted according to the guidelines. Borrowers must ensure that all provided information is accurate and truthful, as submitting false information can lead to penalties or loss of eligibility. Additionally, understanding the legal implications of the repayment plan, including potential loan forgiveness options, is crucial for borrowers navigating their student loan repayment journey.

Quick guide on how to complete how to download income driven plan on nelnet form

Complete Nelnet Com Income Driven Repayment Plans seamlessly on any device

Online document management has surged in popularity among businesses and individuals. It presents an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Nelnet Com Income Driven Repayment Plans on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to alter and electronically sign Nelnet Com Income Driven Repayment Plans with ease

- Obtain Nelnet Com Income Driven Repayment Plans and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Nelnet Com Income Driven Repayment Plans to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

After filling out Form 6, how many days does it require to get your voter ID? Should I download it online?

I think it takes 2-3 months to verify your application and further other process then will get registered as voter in electoral roll. Then the voter Id will dispatch to you through BLO of your part of constituency.If you fill the form 6 on nvsp.in then you can check or track the status of your application.You will not supposed to get the digital copy of your voter Id online.I hope this will help you…..

Create this form in 5 minutes!

How to create an eSignature for the how to download income driven plan on nelnet form

How to generate an eSignature for your How To Download Income Driven Plan On Nelnet Form online

How to make an electronic signature for your How To Download Income Driven Plan On Nelnet Form in Google Chrome

How to make an electronic signature for signing the How To Download Income Driven Plan On Nelnet Form in Gmail

How to generate an eSignature for the How To Download Income Driven Plan On Nelnet Form right from your smartphone

How to create an electronic signature for the How To Download Income Driven Plan On Nelnet Form on iOS

How to generate an electronic signature for the How To Download Income Driven Plan On Nelnet Form on Android

People also ask

-

What are Nelnet Com Income Driven Repayment Plans?

Nelnet Com Income Driven Repayment Plans are designed to make student loan repayments more manageable by adjusting monthly payments based on your income and family size. These plans help borrowers avoid default by ensuring that payments are affordable. By enrolling in these plans through Nelnet, you can tailor your repayment strategy to fit your financial situation.

-

How can I apply for Nelnet Com Income Driven Repayment Plans?

To apply for Nelnet Com Income Driven Repayment Plans, visit the Nelnet website and log in to your account. From there, you can access the application for income-driven repayment, which will guide you through the necessary steps. Be prepared to provide documentation of your income and family size to complete the process.

-

What are the benefits of Nelnet Com Income Driven Repayment Plans?

The benefits of Nelnet Com Income Driven Repayment Plans include lower monthly payments based on your income, potential loan forgiveness after a certain period, and the flexibility to adjust your payment as your financial situation changes. This can relieve financial stress and help you stay on track with your student loan obligations.

-

Are there any fees associated with Nelnet Com Income Driven Repayment Plans?

There are no fees associated with enrolling in Nelnet Com Income Driven Repayment Plans. However, it's essential to understand that while there are no fees for the plan itself, interest will continue to accrue on your loans, which may increase your total repayment amount over time.

-

Can I switch back to a standard repayment plan from Nelnet Com Income Driven Repayment Plans?

Yes, you can switch back to a standard repayment plan from Nelnet Com Income Driven Repayment Plans at any time. If your financial situation improves, you may want to consider this option to pay off your loans faster. Simply contact Nelnet customer service to initiate the change.

-

How do Nelnet Com Income Driven Repayment Plans affect my credit score?

Nelnet Com Income Driven Repayment Plans can have a positive impact on your credit score if you make your payments on time. Staying enrolled in an income-driven plan helps you avoid default and late payments, which are crucial factors in maintaining a good credit score.

-

What documents do I need to provide for Nelnet Com Income Driven Repayment Plans?

When applying for Nelnet Com Income Driven Repayment Plans, you will typically need to provide proof of income, such as recent pay stubs or tax returns, and information about your household size. This documentation helps determine your eligibility and monthly payment amount.

Get more for Nelnet Com Income Driven Repayment Plans

- Pdf contemporary families as contexts for development form

- If you do not go on your toolbar form

- Affidavit for collection of personal property ndgov form

- You should now be able to see the form

- To view toolbars and check forms

- Disposing mind and memory law and legal definitionuslegal inc form

- State of wyoming hereinafter referred to as the trustor whether one or more form

- How to avoid financial tangles american institute for economic form

Find out other Nelnet Com Income Driven Repayment Plans

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast