Application for Credit Forms

What is the Application For Credit Forms

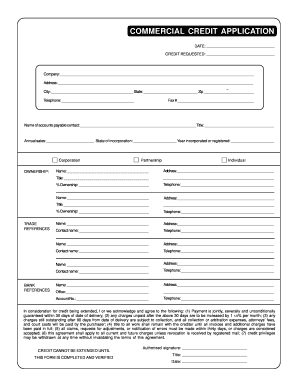

The application for credit forms are essential documents used by individuals and businesses to request credit from financial institutions or suppliers. These forms typically require detailed information about the applicant's financial history, business operations, and creditworthiness. The information provided helps the lender assess the risk of extending credit and determine the terms of the credit line. Common types of credit applications include those for personal loans, business loans, and commercial credit lines.

Key elements of the Application For Credit Forms

When filling out an application for credit, it is crucial to include specific key elements to ensure a smooth approval process. These elements often include:

- Personal Information: Full name, address, contact information, and Social Security number for individuals; business name, address, and Employer Identification Number (EIN) for businesses.

- Financial Information: Details about income, assets, liabilities, and existing debts.

- Business Information: For business applications, include information about the type of business entity, years in operation, and industry type.

- Credit History: A summary of past credit accounts, including payment history and any defaults.

Steps to complete the Application For Credit Forms

Completing an application for credit involves several important steps to ensure accuracy and completeness. Follow these steps for a successful submission:

- Gather all necessary documents and information, including financial statements and identification.

- Carefully fill out the application form, ensuring that all fields are completed accurately.

- Review the application for any errors or omissions before submission.

- Submit the application through the designated method, whether online, by mail, or in person.

Legal use of the Application For Credit Forms

The legal use of application for credit forms is governed by various regulations to protect both lenders and borrowers. It is essential to ensure that the information provided is truthful and accurate, as providing false information can lead to legal consequences, including denial of credit or criminal charges. Additionally, lenders must comply with federal and state laws regarding data privacy and consumer protection when processing these applications.

Eligibility Criteria

Eligibility criteria for obtaining credit through an application form can vary widely depending on the lender and the type of credit being requested. Common criteria include:

- Minimum credit score requirements.

- Proof of income or revenue.

- Length of time in business for commercial applications.

- Debt-to-income ratio assessments.

Form Submission Methods

Application for credit forms can typically be submitted through various methods, depending on the lender's preferences. Common submission methods include:

- Online: Many lenders offer digital forms that can be completed and submitted through their websites.

- Mail: Applicants can print the form, fill it out, and send it via postal service.

- In-Person: Some lenders may require or allow applicants to submit forms in person at their branches.

Quick guide on how to complete application for credit forms

Effortlessly Prepare Application For Credit Forms on Any Device

Digital document management has gained traction among enterprises and individuals alike. It offers an ideal eco-conscious substitute to traditional printed and signed papers, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents rapidly without any holdups. Manage Application For Credit Forms on any device with the airSlate SignNow applications available for Android or iOS and simplify your document-related tasks today.

How to Alter and Electronically Sign Application For Credit Forms with Ease

- Obtain Application For Credit Forms and then click Get Form to begin.

- Utilize the tools provided to complete your form.

- Mark important sections of the documents or obscure sensitive information using the tools specifically available through airSlate SignNow.

- Create your signature with the Sign feature, which only takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Application For Credit Forms while ensuring clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for credit forms

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is a credit application template?

A credit application template is a standardized form that businesses use to collect necessary information from applicants seeking credit. This template streamlines the credit application process, ensuring you gather all required data efficiently and effectively. By using a credit application template, you can improve organization and consistency within your financial operations.

-

How can airSlate SignNow help with my credit application template?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your credit application template. With its easy-to-use interface, you can customize the template to suit your specific needs. Additionally, the eSignature feature allows applicants to sign the document quickly, speeding up the approval process.

-

Is there a cost associated with using the credit application template?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost associated with using a credit application template varies depending on the plan you choose, which can include features such as document storage, team collaboration, and advanced security. You can select a plan that best fits your budget while effectively managing your credit applications.

-

What features does the credit application template include?

The credit application template includes several features designed to enhance user experience. These features typically consist of customizable fields, conditional logic for personalized responses, and the ability to upload supporting documents. These elements help streamline data collection and improve the efficiency of managing credit applications.

-

Can I integrate the credit application template with other software?

Yes, airSlate SignNow allows for seamless integration with various software and applications. This enables you to connect your credit application template with your existing CRM, accounting software, or any other tools your business uses. Integrating enhances productivity and ensures all your applications are centralized.

-

What are the benefits of using an electronic credit application template?

Using an electronic credit application template provides several key benefits, including faster processing times, reduced paper usage, and improved accuracy. Additionally, the eSigning feature allows applicants to sign from anywhere, creating a more convenient experience. Ultimately, this modern approach can signNowly enhance your business's efficiency.

-

How secure is the information collected from the credit application template?

The security of information collected through the credit application template is a top priority for airSlate SignNow. The platform employs advanced encryption and secure servers to protect sensitive data. Furthermore, you can set permissions to control who can access and edit the templates, ensuring your applicants' information remains confidential.

Get more for Application For Credit Forms

Find out other Application For Credit Forms

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document