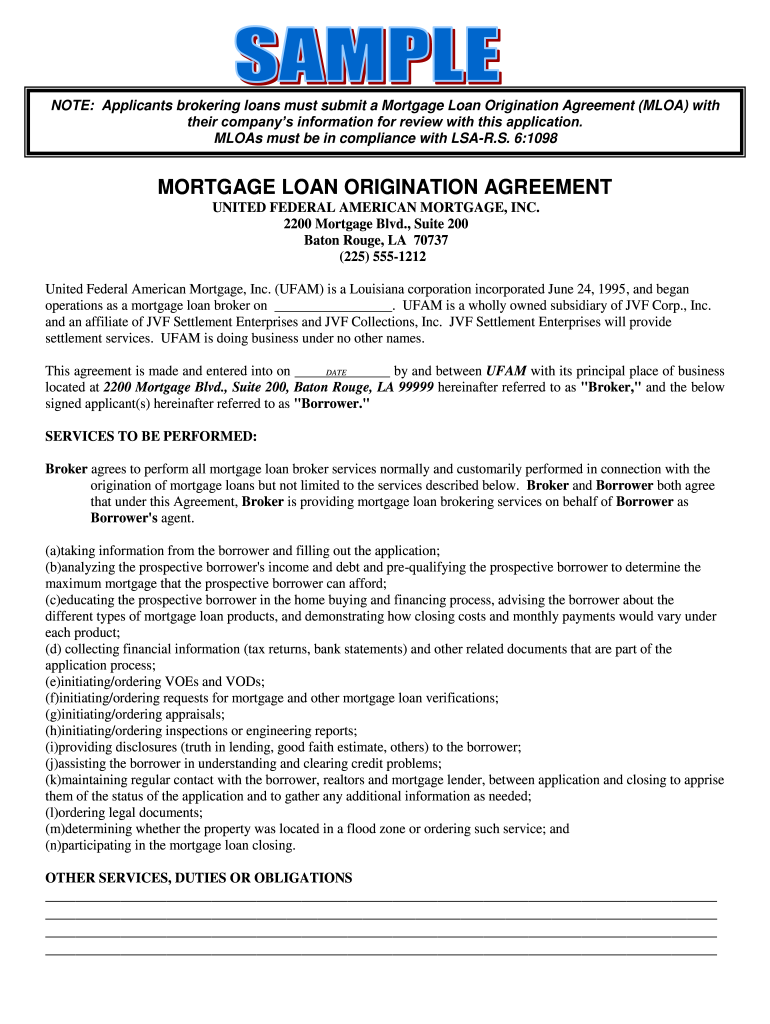

Mortgage Loan Origination Agreement Form

What is the Mortgage Loan Origination Agreement

The mortgage loan origination agreement is a crucial document in the home financing process. It outlines the terms and conditions between the borrower and the lender, detailing the responsibilities of each party. This agreement typically includes information about the loan amount, interest rate, repayment terms, and any fees associated with the loan. By signing this document, borrowers confirm their commitment to the loan terms while lenders secure their right to collect payments and enforce the agreement. Understanding this agreement is essential for anyone seeking a mortgage, as it serves as the foundation for the entire loan process.

Key Elements of the Mortgage Loan Origination Agreement

Several key elements define the mortgage loan origination agreement. These include:

- Loan Amount: The total amount borrowed by the borrower.

- Interest Rate: The cost of borrowing, expressed as a percentage of the loan amount.

- Repayment Terms: The schedule for loan payments, including frequency and duration.

- Fees: Any additional costs associated with the loan, such as origination fees or closing costs.

- Conditions: Specific requirements that must be met for the loan to be approved.

These elements ensure that both parties understand their obligations and protect their interests throughout the mortgage process.

Steps to Complete the Mortgage Loan Origination Agreement

Completing the mortgage loan origination agreement involves several important steps:

- Gather Required Information: Collect personal, financial, and property information needed for the agreement.

- Review Loan Terms: Carefully read through the terms of the loan, including interest rates and fees.

- Fill Out the Agreement: Complete the origination agreement form with accurate information.

- Sign the Agreement: Provide your signature to indicate acceptance of the terms.

- Submit the Agreement: Send the completed agreement to the lender, either electronically or via mail.

Following these steps helps ensure that the agreement is completed correctly and expedites the loan approval process.

Legal Use of the Mortgage Loan Origination Agreement

The mortgage loan origination agreement is legally binding once signed by both parties. It is essential for the agreement to comply with applicable federal and state laws to ensure its enforceability. This includes adherence to regulations such as the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA), which protect consumers by requiring transparency in lending practices. By understanding the legal implications of this agreement, borrowers can better navigate the mortgage process and safeguard their rights.

How to Obtain the Mortgage Loan Origination Agreement

Obtaining a mortgage loan origination agreement can be done through several channels:

- Directly from Lenders: Most lenders provide the agreement as part of the loan application process.

- Online Resources: Various financial websites offer templates and samples of the origination agreement.

- Real Estate Agents: Agents can assist in obtaining the necessary documentation for prospective homebuyers.

It is important to ensure that the version of the agreement used is up-to-date and complies with current regulations.

Examples of Using the Mortgage Loan Origination Agreement

Examples of scenarios where a mortgage loan origination agreement is utilized include:

- Home Purchases: When buying a new home, the agreement outlines the terms of the mortgage.

- Refinancing: Homeowners seeking to refinance their existing mortgage will need to complete a new origination agreement.

- Investment Properties: Investors acquiring rental properties must also engage in this agreement to secure financing.

These examples illustrate the versatility and necessity of the mortgage loan origination agreement in various real estate transactions.

Quick guide on how to complete mortgage loan origination agreement

Complete Mortgage Loan Origination Agreement effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without hurdles. Manage Mortgage Loan Origination Agreement on any device with the airSlate SignNow Android or iOS applications and simplify your document-centric operations today.

How to edit and eSign Mortgage Loan Origination Agreement without any hassle

- Find Mortgage Loan Origination Agreement and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive data using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Edit and eSign Mortgage Loan Origination Agreement to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage loan origination agreement

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is a loan origination agreement?

A loan origination agreement is a legal document that outlines the terms and conditions of a loan between a borrower and a lender. It details important information such as interest rates, repayment schedules, and additional fees. Understanding this agreement is crucial for both parties to ensure clarity and prevent future disputes.

-

How can airSlate SignNow benefit my loan origination agreement process?

airSlate SignNow streamlines the loan origination agreement process by providing a user-friendly platform for creating, sending, and signing documents electronically. Our solutions allow you to easily manage and track the status of agreements, reducing the time it takes to finalize loans. By digitizing the process, you enhance efficiency and improve customer satisfaction.

-

What features does airSlate SignNow offer for loan origination agreements?

airSlate SignNow offers features that include customizable templates, eSignature capabilities, document tracking, and secure cloud storage. These tools simplify the creation and management of loan origination agreements, ensuring that all parties have access to the most current versions of documents. Additionally, our platform enables real-time collaboration, making the process smoother.

-

Is airSlate SignNow affordable for small businesses handling loan origination agreements?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are competitive and cater specifically to small businesses, ensuring they can efficiently manage loan origination agreements without breaking the bank. You can choose from various plans to find the one that best fits your needs.

-

How does airSlate SignNow ensure the security of loan origination agreements?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption technologies and complies with industry standards to ensure that all loan origination agreements are securely transmitted and stored. This means your sensitive financial documents and personal information are always protected.

-

Can airSlate SignNow integrate with other software for loan origination?

Absolutely! airSlate SignNow offers integration capabilities with various software tools commonly used in the loan origination process, including CRM and financial management systems. This allows you to streamline your workflows and enhance the efficiency of managing loan origination agreements by connecting all your essential tools.

-

What is the typical turnaround time for a loan origination agreement with airSlate SignNow?

With airSlate SignNow, the turnaround time for a loan origination agreement can be signNowly reduced. Electronic signatures can be captured instantly, allowing both parties to complete the agreement quickly. This efficiency can speed up the overall lending process, sometimes allowing agreements to be finalized in mere hours.

Get more for Mortgage Loan Origination Agreement

- In the circuit court of the second judicial form

- Acknowledgment of representation form

- Non profit organization by lawsfree legal forms

- Control number al ra 0001 form

- Life document packages for a new residentus legal forms

- State of alabama county of baldwin amendment to the form

- Describe property or attach description and state quotsee attached exhibitquot form

- Sample form 1 complaint on appeal municipal ordinance cases

Find out other Mortgage Loan Origination Agreement

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form