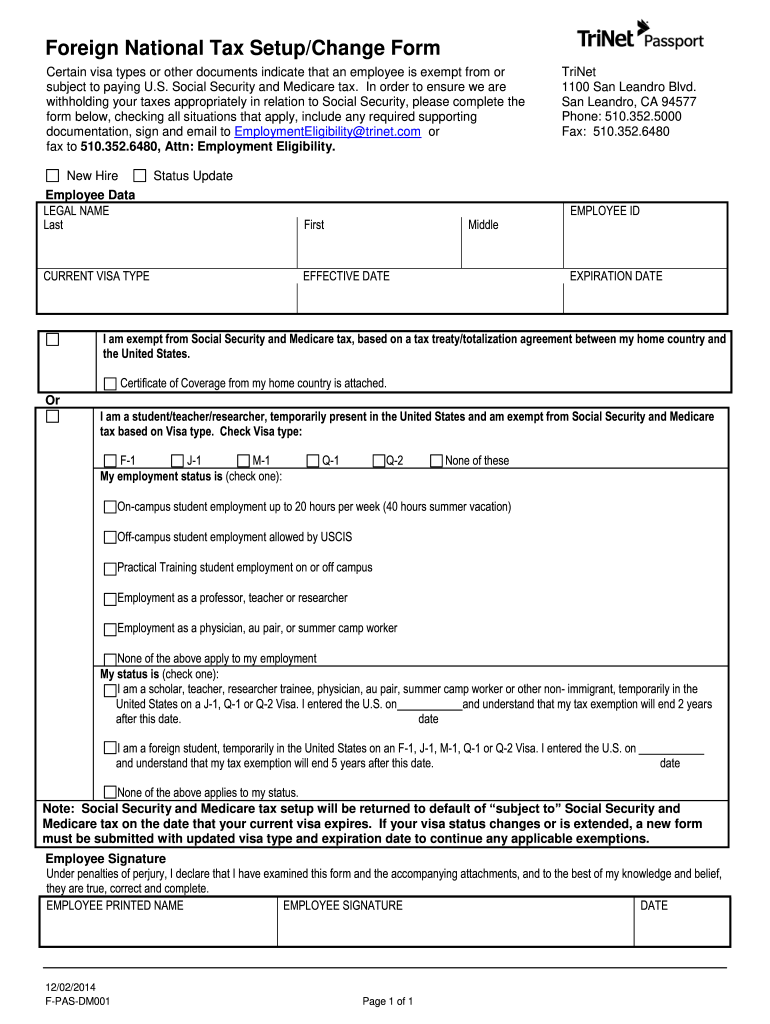

National Tax Setup Change Form 2014-2026

What is the National Tax Setup Change Form

The National Tax Setup Change Form is a crucial document used by individuals and businesses in the United States to update their tax information with the Internal Revenue Service (IRS). This form allows taxpayers to make necessary adjustments to their tax setup, such as changing their filing status, updating personal information, or modifying their withholding allowances. Ensuring that this form is accurately completed and submitted is essential for maintaining compliance with federal tax regulations.

How to Use the National Tax Setup Change Form

Using the National Tax Setup Change Form involves several straightforward steps. First, gather all necessary information, including your Social Security number, current tax status, and any relevant financial details. Next, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors before submitting it to the IRS. This can typically be done online, via mail, or in person, depending on your preference and the specific requirements of the IRS.

Steps to Complete the National Tax Setup Change Form

Completing the National Tax Setup Change Form requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the IRS website or a trusted source.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the changes you are making, such as updates to your filing status or withholding allowances.

- Review the completed form for accuracy and completeness.

- Submit the form according to the IRS guidelines, either electronically or by mail.

Legal Use of the National Tax Setup Change Form

The National Tax Setup Change Form is legally binding when completed and submitted correctly. It is essential to comply with all IRS regulations regarding the use of this form. This includes ensuring that the information provided is accurate and truthful. Misrepresentation or errors can lead to penalties or delays in processing. Utilizing a reliable platform for electronic submission can help ensure compliance with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the National Tax Setup Change Form can vary based on individual circumstances and the specific changes being made. Generally, it is advisable to submit the form well in advance of tax deadlines to ensure that the IRS processes your updates in time. Key dates to keep in mind include the annual tax filing deadline, which is typically April 15, and any specific deadlines related to changes in your tax situation, such as marriage or employment changes.

Required Documents

When completing the National Tax Setup Change Form, certain documents may be required to support your changes. Common documents include:

- Proof of identity, such as a driver's license or Social Security card.

- Previous tax returns, if relevant to the changes being made.

- Any documentation related to changes in income or filing status.

Having these documents on hand can facilitate a smoother completion process.

Quick guide on how to complete national tax setup change form

Effortlessly Prepare National Tax Setup Change Form on Any Device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle National Tax Setup Change Form on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The Easiest Method to Edit and eSign National Tax Setup Change Form with Ease

- Locate National Tax Setup Change Form and select Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign National Tax Setup Change Form to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the national tax setup change form

How to create an electronic signature for your PDF file online

How to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the national tax setup change form and why do I need it?

The national tax setup change form is a crucial document for businesses that need to update their tax classifications or information with the IRS. By completing this form, you ensure that your business remains compliant with tax regulations and avoids potential penalties. Using airSlate SignNow, you can easily complete and eSign this form, streamlining your tax update process.

-

How can airSlate SignNow help me with my national tax setup change form?

airSlate SignNow provides an easy-to-use platform that allows you to fill out, sign, and send your national tax setup change form securely. Our solution helps simplify the eSigning process, saving you time and minimizing the hassle associated with paper forms. Experience the convenience of managing your tax documents digitally.

-

Is airSlate SignNow cost-effective for small businesses needing the national tax setup change form?

Yes, airSlate SignNow offers competitive pricing plans tailored for small businesses. With our cost-effective solution, you can efficiently manage your national tax setup change form without breaking the bank. Enjoy access to essential features that enhance your workflow while maintaining affordability.

-

What features does airSlate SignNow offer for completing a national tax setup change form?

airSlate SignNow includes features like templates, real-time collaboration, and secure eSigning that are perfect for completing your national tax setup change form. You can also track the status of your form and receive reminders, ensuring that you never miss an important deadline. These tools simplify the document management process, allowing for a seamless experience.

-

Can I integrate airSlate SignNow with other software to manage my national tax setup change form?

Absolutely! airSlate SignNow offers integration capabilities with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to seamlessly manage your national tax setup change form within your existing workflows, enhancing productivity and efficiency across your business operations.

-

What benefits does airSlate SignNow provide for businesses dealing with national tax setup changes?

By using airSlate SignNow for your national tax setup change form, you gain numerous benefits such as increased efficiency, reduced turnaround time, and enhanced compliance. Our platform ensures that your documents are securely signed and stored, protecting sensitive information while streamlining your tax update processes.

-

How secure is the information I provide on my national tax setup change form using airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption and security measures to protect the information on your national tax setup change form. You can trust that your data is safeguarded throughout the entire signing and storage process.

Get more for National Tax Setup Change Form

- Rogers v commonwealth 5 va app 337casetext form

- The care and maintenance of your revocable living trust form

- First union national bank form

- Preparing a certificate of trust virginiathe national law review form

- This day came the applicant having filed hisher verified application requesting the change of hisher name from form

- Estate tax vermont department of taxes form

- Landlord creates no obligation of landlord form

- Framing contract form

Find out other National Tax Setup Change Form

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template