Wells Fargo Owned Foreclosures Form

What is the Wells Fargo Owned Foreclosures

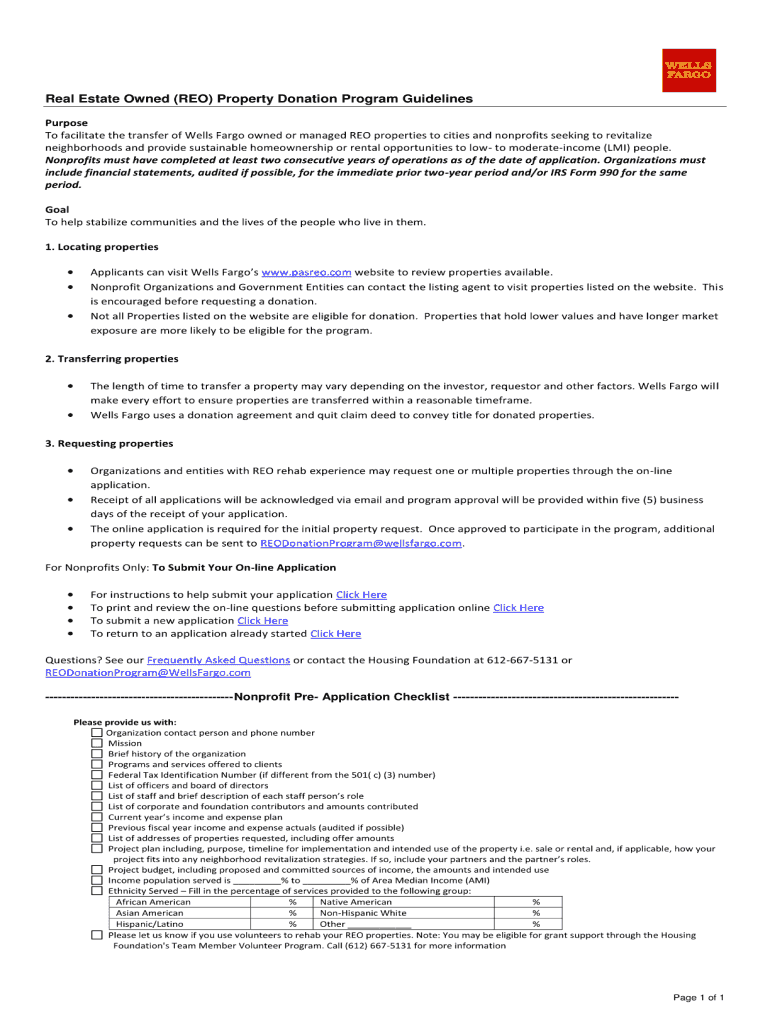

The Wells Fargo owned foreclosures refer to properties that have been repossessed by Wells Fargo due to the previous owner's inability to maintain mortgage payments. These properties are often sold at a reduced price, making them an attractive option for homebuyers and investors. Wells Fargo manages a portfolio of these properties, which can include single-family homes, condominiums, and multi-family units. Buyers can find detailed listings of these properties through various channels, including real estate websites and Wells Fargo's official resources.

How to use the Wells Fargo Owned Foreclosures

Utilizing Wells Fargo owned foreclosures involves several steps. First, potential buyers should research available properties through Wells Fargo's listings. Once a suitable property is identified, interested buyers can arrange for a viewing. It is advisable to conduct thorough inspections and assessments to understand the property's condition. After deciding to proceed, buyers will need to gather necessary documentation, such as proof of financing, to submit an offer. Understanding the purchasing process specific to foreclosures is crucial, as it may differ from traditional home buying.

Steps to complete the Wells Fargo Owned Foreclosures

Completing the purchase of a Wells Fargo owned foreclosure involves a structured process:

- Research available properties through Wells Fargo's listings.

- Schedule property viewings to assess condition and suitability.

- Conduct necessary inspections and appraisals.

- Gather required documentation, including financing proof.

- Submit an offer through the appropriate channels.

- Negotiate terms and finalize the purchase agreement.

- Complete the closing process, ensuring all legal requirements are met.

Legal use of the Wells Fargo Owned Foreclosures

The legal use of Wells Fargo owned foreclosures is governed by specific regulations and requirements. Buyers must ensure compliance with local, state, and federal laws when purchasing these properties. It is essential to understand the legal implications of buying a foreclosure, including potential liens or encumbrances on the property. Engaging a real estate attorney can provide valuable guidance throughout the process, ensuring that all legal aspects are properly addressed.

Key elements of the Wells Fargo Owned Foreclosures

Key elements to consider when dealing with Wells Fargo owned foreclosures include:

- Property condition and any required repairs.

- Market value and pricing strategy.

- Financing options available for foreclosure purchases.

- Potential for investment returns or resale opportunities.

- Understanding the bidding process, if applicable.

Required Documents

When purchasing a Wells Fargo owned foreclosure, buyers typically need to provide several documents, including:

- Proof of income or employment.

- Pre-approval letter from a mortgage lender.

- Identification, such as a driver's license or passport.

- Any additional documentation required by Wells Fargo or local regulations.

Form Submission Methods (Online / Mail / In-Person)

Submitting offers for Wells Fargo owned foreclosures can be done through various methods. Buyers may submit their offers online via Wells Fargo's dedicated platform, ensuring they follow all specified guidelines. Alternatively, offers can be submitted by mail or in person at designated Wells Fargo locations. Each method may have different requirements, so it is essential to confirm the preferred submission process for the specific property of interest.

Quick guide on how to complete wells fargo owned foreclosures

Easily Prepare Wells Fargo Owned Foreclosures on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a perfect environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and effortlessly. Manage Wells Fargo Owned Foreclosures on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and Electronically Sign Wells Fargo Owned Foreclosures

- Find Wells Fargo Owned Foreclosures and click on Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize essential sections of the documents or redact sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information thoroughly and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Wells Fargo Owned Foreclosures and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wells fargo owned foreclosures

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What are Wells Fargo foreclosure listings?

Wells Fargo foreclosure listings are properties that have been repossessed by Wells Fargo due to their previous owner's inability to keep up with mortgage payments. These listings provide opportunities for potential buyers to purchase homes at reduced prices. They can often be found on various real estate websites and auction platforms.

-

How can I access Wells Fargo foreclosure listings?

You can access Wells Fargo foreclosure listings by visiting their official website or through real estate platforms that aggregate such listings. Many third-party websites also provide searchable databases of Wells Fargo foreclosures. Always ensure to check for the most current and accurate information.

-

What should I consider when buying a property from Wells Fargo foreclosure listings?

When considering a property from Wells Fargo foreclosure listings, evaluate the property's condition, location, and market value. It’s also crucial to conduct a thorough inspection and understand the bidding process, as these homes are sold 'as-is.' Consulting a real estate professional can also provide valuable insights.

-

Are Wells Fargo foreclosure listings good investments?

Wells Fargo foreclosure listings can be excellent investment opportunities due to their often lower prices compared to market value. However, it’s essential to conduct due diligence, as there may be risks involved, including repair costs and market fluctuations. Assessing your financial situation and investment goals is critical before proceeding.

-

What is the typical timeline for purchasing a home from Wells Fargo foreclosure listings?

The timeline for purchasing a home from Wells Fargo foreclosure listings can vary signNowly depending on the property and the bidding process. Typically, the process includes a period for offers, negotiations, and closing, which can take anywhere from a few weeks to several months. Patience and preparation are key during this time.

-

Is there a fee associated with Wells Fargo foreclosure listings?

While there may not be direct fees for accessing Wells Fargo foreclosure listings, potential buyers should be prepared for various costs associated with the purchase process. These can include closing costs, inspection fees, and possible bidding deposits. It's essential to budget for these expenses in advance.

-

How often do Wells Fargo foreclosure listings get updated?

Wells Fargo foreclosure listings are updated regularly to reflect current properties available for sale. New listings may come on the market quickly, and some properties can sell within days. It’s advisable to check frequently or set up alerts to stay informed about the latest opportunities.

Get more for Wells Fargo Owned Foreclosures

- Interrogatories to form

- Re contempt form

- What to do with the motion when you have superior court form

- Comes now the petitioner respondent representing form

- Pre trial statement form

- Uniform interrogatories

- Whitepages official sitefind people phone numbers form

- Domestic relations department notice form

Find out other Wells Fargo Owned Foreclosures

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form