Request for Taxpayer Identification Number and Certification Corporate Rfmh Form

Understanding the Request for Taxpayer Identification Number and Certification

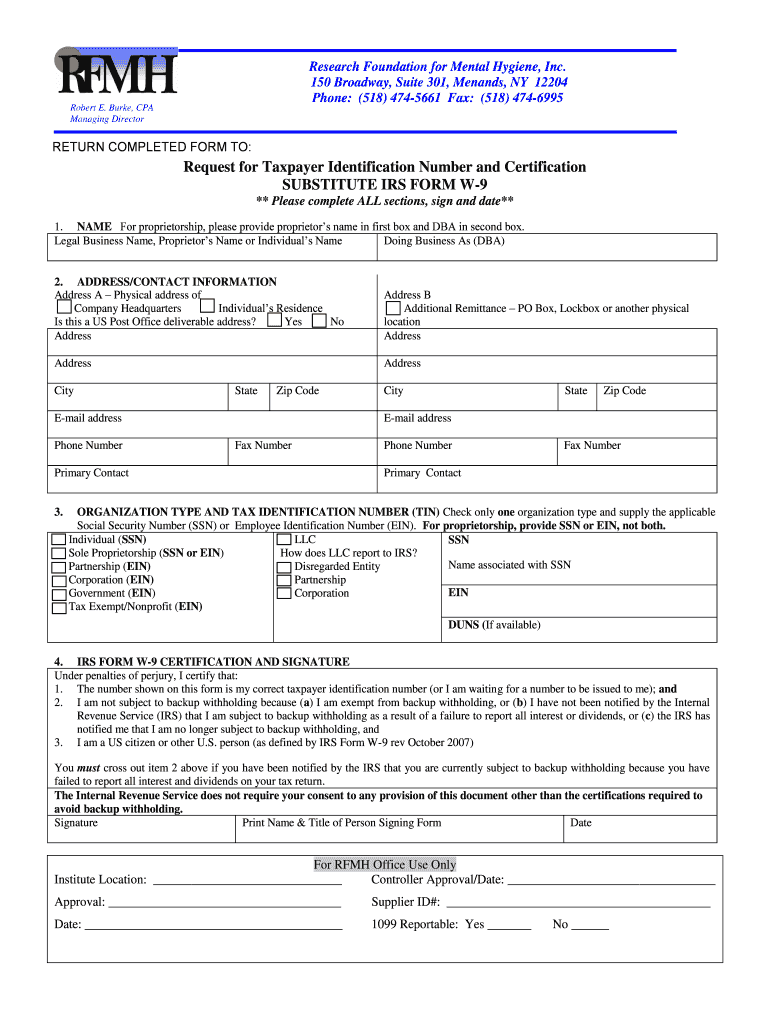

The Request for Taxpayer Identification Number and Certification is a crucial form used by individuals and businesses to provide their taxpayer identification number (TIN) to entities that require it for tax reporting purposes. This form is essential for ensuring compliance with IRS regulations and helps prevent tax-related issues. It is commonly used in various situations, such as when individuals start a new job, open a bank account, or engage in financial transactions that require tax reporting.

Steps to Complete the Request for Taxpayer Identification Number and Certification

Completing the Request for Taxpayer Identification Number and Certification involves several straightforward steps:

- Gather necessary information, including your name, address, and taxpayer identification number.

- Fill out the form accurately, ensuring all fields are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the requesting entity, either electronically or by mail, as per their instructions.

Legal Use of the Request for Taxpayer Identification Number and Certification

This form serves a legal purpose by facilitating the collection of taxpayer identification numbers, which are essential for tax reporting and compliance. The IRS requires that entities collect TINs to accurately report income paid to individuals and businesses. Proper use of this form helps protect both the taxpayer and the requesting entity from potential legal issues related to tax compliance.

IRS Guidelines for the Request for Taxpayer Identification Number and Certification

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the Request for Taxpayer Identification Number and Certification. These guidelines include:

- Ensuring that the form is completed accurately and submitted to the appropriate entity.

- Understanding the implications of providing false information on the form, which can lead to penalties.

- Recognizing the importance of keeping personal information secure to prevent identity theft.

Required Documents for Submitting the Request for Taxpayer Identification Number and Certification

When submitting the Request for Taxpayer Identification Number and Certification, you may need to provide supporting documents. These documents can include:

- Proof of identity, such as a driver's license or passport.

- Social Security card or other documentation that verifies your taxpayer identification number.

- Any additional forms or documentation requested by the entity requiring the TIN.

Examples of Using the Request for Taxpayer Identification Number and Certification

There are various scenarios in which the Request for Taxpayer Identification Number and Certification is utilized:

- When an individual is hired for a new job and needs to provide their TIN to their employer.

- When a freelancer or contractor needs to submit their TIN to a client for tax reporting purposes.

- When opening a new bank account that requires tax identification information.

Quick guide on how to complete request for taxpayer identification number and certification corporate rfmh

Effortlessly Prepare Request For Taxpayer Identification Number And Certification Corporate Rfmh on Any Device

Digital document management has gained popularity among organizations and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the right format and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Request For Taxpayer Identification Number And Certification Corporate Rfmh on any device using the airSlate SignNow Android or iOS applications and simplify your document-centric tasks today.

How to Edit and eSign Request For Taxpayer Identification Number And Certification Corporate Rfmh with Ease

- Locate Request For Taxpayer Identification Number And Certification Corporate Rfmh and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require the printing of new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign Request For Taxpayer Identification Number And Certification Corporate Rfmh and ensure smooth communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Should I send a W-9 form (request for taxpayer identification number and certification) considering the situation below?

W-9 is REQUIRED before work is done. Read it there is a box for a corporation. The requester put there information in but no counter signing.Countersigning a contract is another issue.W-9s do not go to the IRS - only for verification of 1099 status.Yes you are overly paranoid.SOP - Standard Operating Policy for a well run organization.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

When is it too late to return a customer’s call or email? On my website customers can fill out a quote request form and leave their number. If someone sends one at 9 pm should I wait until the morning or should I call immediately?

The longer you leave it, the lower the response rate is.If you look at the advertising for Hubspot, one of the things they do is trigger pop-ups when people open your emails so that you can contact the customer. They cite some research on the effectiveness of doing this rather than contacting the customer the next day.Personally I find this a bit creepy, but I have to acknowledge that it is true. I have a ‘request a free demo’ link on my website. Clicking it triggers an email to my team asking them to create a demo system, which takes about an hour to do. I had the site reviewed a while back and one of the strongest pieces of feedback was that I had to automate the creation of a demo. Everybody who clicks that button will be distracted by something else in an hour.That said, I would not phone a customer at 9PM because I’d be worried about disturbing them at home, I’d email back straight away instead and include in that email a line requesting permission to call. If they reply saying “sure, give me a call now” then you’re all good, and if they don’t reply then I’d wait until regular business hours.

Create this form in 5 minutes!

How to create an eSignature for the request for taxpayer identification number and certification corporate rfmh

How to generate an electronic signature for your Request For Taxpayer Identification Number And Certification Corporate Rfmh online

How to create an electronic signature for your Request For Taxpayer Identification Number And Certification Corporate Rfmh in Google Chrome

How to generate an electronic signature for putting it on the Request For Taxpayer Identification Number And Certification Corporate Rfmh in Gmail

How to make an eSignature for the Request For Taxpayer Identification Number And Certification Corporate Rfmh from your smartphone

How to create an electronic signature for the Request For Taxpayer Identification Number And Certification Corporate Rfmh on iOS

How to generate an electronic signature for the Request For Taxpayer Identification Number And Certification Corporate Rfmh on Android devices

People also ask

-

What is the Request For Taxpayer Identification Number And Certification Corporate Rfmh?

The Request For Taxpayer Identification Number And Certification Corporate Rfmh is a crucial form used by businesses to obtain the taxpayer identification number of individuals or entities. This form ensures compliance with tax regulations and simplifies the process of reporting income to the IRS. airSlate SignNow streamlines this process by allowing users to easily create, send, and electronically sign this essential document.

-

How does airSlate SignNow simplify the Request For Taxpayer Identification Number And Certification Corporate Rfmh process?

airSlate SignNow offers a user-friendly platform that allows businesses to fill out and send the Request For Taxpayer Identification Number And Certification Corporate Rfmh digitally. With features like templates and automated workflows, users can quickly generate and manage these forms, reducing the time spent on paperwork while ensuring accuracy and compliance.

-

Is there a cost associated with using airSlate SignNow for the Request For Taxpayer Identification Number And Certification Corporate Rfmh?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. These plans provide access to features that simplify the Request For Taxpayer Identification Number And Certification Corporate Rfmh process, including unlimited document signing and customizable templates. You can choose a plan that best fits your business requirements and budget.

-

What features does airSlate SignNow provide for managing the Request For Taxpayer Identification Number And Certification Corporate Rfmh?

airSlate SignNow includes powerful features such as eSignature capabilities, document tracking, and customizable templates specifically for the Request For Taxpayer Identification Number And Certification Corporate Rfmh. Additionally, the platform allows users to collaborate in real-time, ensuring that all parties can review and sign documents promptly.

-

Can airSlate SignNow integrate with other software for the Request For Taxpayer Identification Number And Certification Corporate Rfmh?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, such as CRM and accounting software, to enhance your workflow related to the Request For Taxpayer Identification Number And Certification Corporate Rfmh. This integration helps streamline processes and keeps all your documents organized in one place.

-

What are the benefits of using airSlate SignNow for the Request For Taxpayer Identification Number And Certification Corporate Rfmh?

Using airSlate SignNow for the Request For Taxpayer Identification Number And Certification Corporate Rfmh provides numerous benefits, including increased efficiency, reduced paper waste, and enhanced security. The platform's electronic signature feature ensures your documents are legally binding, while customizable templates save time and minimize errors.

-

How secure is airSlate SignNow when handling the Request For Taxpayer Identification Number And Certification Corporate Rfmh?

airSlate SignNow prioritizes the security of your documents, including the Request For Taxpayer Identification Number And Certification Corporate Rfmh. The platform employs advanced encryption and complies with industry regulations to protect sensitive information, ensuring that your data remains safe during the signing process.

Get more for Request For Taxpayer Identification Number And Certification Corporate Rfmh

- Health delivery organization hdo application form

- Short term disability claim form initial report of teamcare

- We are pleased to welcome you as a patient of middlesex hospital primary care form

- Instructions for form i 9 uscis

- Transcript request form legacy students fordham university

- Tax id 470049123 npi 1245413483 cap accreditedclia 28d0454363 form

- Transient study form office of the registrar unc charlotte

- Your employee or hisher family member has applied for assistance at harris health system form

Find out other Request For Taxpayer Identification Number And Certification Corporate Rfmh

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT