Authorization for Payoff and Demand for Title Form

What is the authorization for payoff and demand for title?

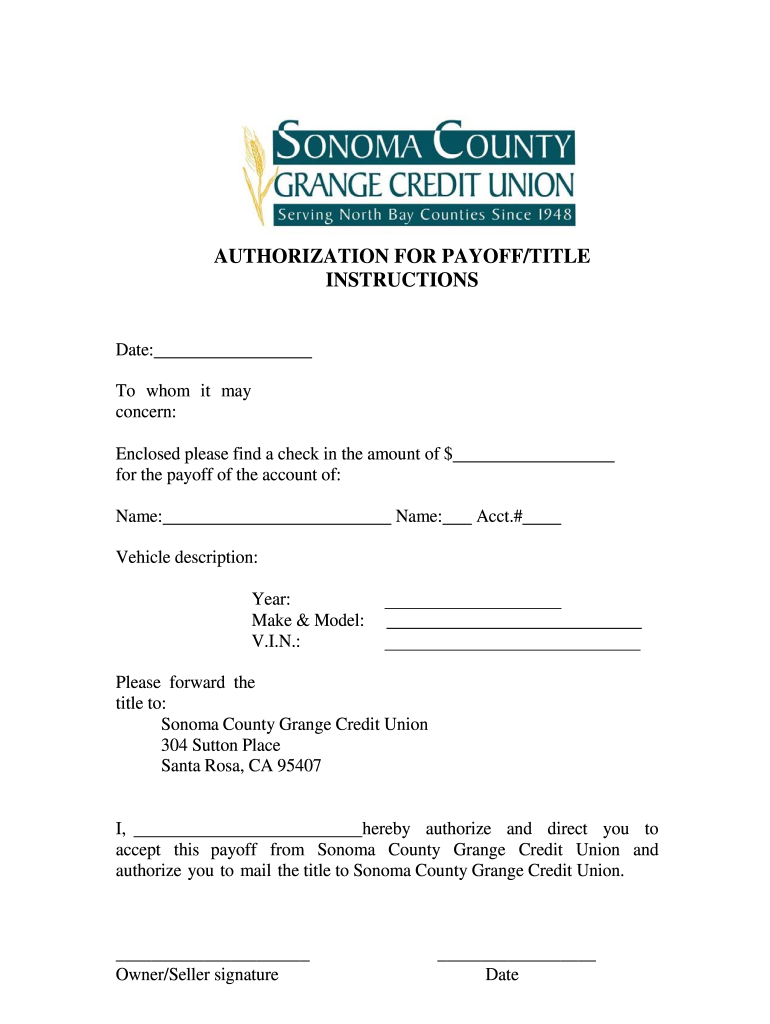

The authorization for payoff and demand for title is a legal document that allows a third party, typically a lender or financial institution, to request the payoff amount for a loan and obtain the title of a vehicle or property. This form is crucial in transactions involving the transfer of ownership, especially in cases of vehicle sales or refinancing. By signing this document, the borrower grants permission for the lender to communicate with the relevant parties to facilitate the payoff process and secure the title, ensuring a smooth transition of ownership.

Steps to complete the authorization for payoff and demand for title

Completing the authorization for payoff and demand for title involves several key steps:

- Gather necessary information, including loan details, vehicle identification number (VIN), and the names of all parties involved.

- Fill out the authorization form accurately, ensuring all required fields are completed to avoid delays.

- Sign the form electronically or manually, depending on the method of submission.

- Submit the completed form to the lender or financial institution, either online, by mail, or in person, as per their requirements.

- Keep a copy of the submitted form for your records, along with any confirmation received from the lender.

Key elements of the authorization for payoff and demand for title

Understanding the key elements of the authorization for payoff and demand for title is essential for proper execution. These elements typically include:

- Borrower Information: Full name, address, and contact details of the borrower.

- Lender Information: Name and contact details of the financial institution or lender.

- Loan Details: Information about the loan, including account number and payoff amount.

- Vehicle or Property Information: Description of the asset, including VIN or property address.

- Signature: The borrower's signature is required to validate the authorization.

Legal use of the authorization for payoff and demand for title

The legal use of the authorization for payoff and demand for title is governed by various state laws and regulations. This document must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) to ensure that electronic signatures are legally binding. Additionally, lenders must adhere to privacy regulations, such as the Gramm-Leach-Bliley Act, when handling sensitive borrower information. Proper use of this form helps protect both the borrower and the lender during the payoff and title transfer process.

Form submission methods

The authorization for payoff and demand for title can be submitted through various methods, depending on the lender's preferences. Common submission methods include:

- Online: Many lenders offer a secure online portal for submitting the form electronically.

- Mail: The form can be printed and mailed to the lender's designated address.

- In-Person: Borrowers may also have the option to deliver the form directly to a branch location of the lender.

Examples of using the authorization for payoff and demand for title

Examples of scenarios where the authorization for payoff and demand for title is applicable include:

- When selling a vehicle, the seller provides this authorization to the buyer's lender to facilitate the payoff of the existing loan.

- In a refinancing situation, the borrower uses this form to allow the new lender to obtain the title from the previous lender.

- During a divorce settlement, one spouse may need to use this authorization to transfer the title of a jointly owned vehicle.

Quick guide on how to complete authorization for payoff and demand for title

Effortlessly Prepare Authorization For Payoff And Demand For Title on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documentation, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Authorization For Payoff And Demand For Title on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest method to modify and eSign Authorization For Payoff And Demand For Title effortlessly

- Find Authorization For Payoff And Demand For Title and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using features that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Authorization For Payoff And Demand For Title and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the authorization for payoff and demand for title

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is authorization for payoff and title processing?

Authorization for payoff and title processing refers to the permission granted to a third party to handle the payoff of a loan and manage the title transfer during real estate transactions. This process is crucial for ensuring that dues are settled appropriately and that the title is accurately transferred to the new owner.

-

How does airSlate SignNow facilitate authorization for payoff and title processing?

airSlate SignNow simplifies authorization for payoff and title processing by providing a secure platform to eSign documents remotely. This allows stakeholders to collaborate efficiently, ensuring that necessary authorizations are processed quickly and accurately, reducing the overall transaction time.

-

What features does airSlate SignNow offer for authorization for payoff and title processing?

Our platform includes features such as customizable templates, real-time tracking, and advanced security options, all tailored for authorization for payoff and title processing. These tools help streamline workflows, maintain compliance, and enhance collaboration among parties involved in the transaction.

-

What are the benefits of using airSlate SignNow for authorization for payoff and title processing?

Using airSlate SignNow for authorization for payoff and title processing offers several key benefits, including faster transaction completion, reduced paperwork, and enhanced security. Additionally, our user-friendly interface ensures a seamless experience for all parties, leading to higher satisfaction and efficiency.

-

Is airSlate SignNow cost-effective for authorization for payoff and title processing?

Yes, airSlate SignNow is designed to be a cost-effective solution for authorization for payoff and title processing. With flexible pricing plans that cater to businesses of all sizes, our platform helps you save on operational costs while improving your document management processes.

-

Can airSlate SignNow integrate with other software for authorization for payoff and title processing?

Absolutely! airSlate SignNow offers integrations with several popular applications to facilitate authorization for payoff and title processing. These integrations enable seamless data transfer, enhancing your overall workflow and making document management more efficient.

-

What types of businesses can benefit from authorization for payoff and title processing using airSlate SignNow?

Any business involved in real estate transactions, such as title companies, mortgage brokers, and real estate agents, can leverage airSlate SignNow for authorization for payoff and title processing. Our solution is adaptable, catering to both small operations and larger enterprises seeking to optimize their documentation processes.

Get more for Authorization For Payoff And Demand For Title

- Parent or guardian agrees to bear any cost connected therewith and shall pay promptly form

- Whose address is hereinafter referred to as vendors do hereby form

- Bargain sell convey deliver and warrant with full guarantee of actions of warranty against all former

- Rs 9954 statutory form 2014 louisiana laws us codes

- Under louisiana law a farm animal activity sponsor or farm animal professional is not form

- Section 2a44a 8 lien claim form 2013 new jersey

- Louisiana mechanics lien law nascla form

- Parelli level 3 4 camp 2012 application form nelson

Find out other Authorization For Payoff And Demand For Title

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document