Personalandtaxdatachangeform 2018-2026

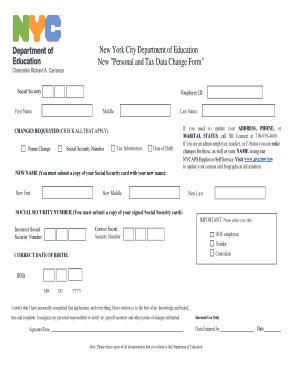

What is the personal tax data change form?

The personal tax data change form is an official document used by individuals to update their personal tax information with the Internal Revenue Service (IRS) or relevant state tax authorities. This form is essential for ensuring that tax records accurately reflect an individual's current status, including changes in name, address, or other personal details that may affect tax filings. Keeping this information up to date helps prevent issues with tax returns and ensures that taxpayers receive any benefits or correspondence from tax agencies in a timely manner.

Steps to complete the personal tax data change form

Completing the personal tax data change form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your Social Security number, previous and new personal details, and any supporting documentation. Next, fill out the form carefully, ensuring that all fields are completed accurately. After reviewing the form for any errors, sign and date it. Finally, submit the form according to the instructions provided, which may include online submission, mailing it to the appropriate address, or delivering it in person.

Legal use of the personal tax data change form

The personal tax data change form is legally binding when completed and submitted according to IRS regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or delays in processing. The form must be signed by the individual making the changes, and in some cases, additional documentation may be required to support the changes being made. Compliance with legal requirements helps maintain the integrity of tax records and protects the taxpayer's rights.

Required documents

When submitting the personal tax data change form, certain documents may be required to verify the changes being requested. Commonly required documents include:

- Proof of identity, such as a driver's license or passport.

- Documentation supporting the change, such as a marriage certificate for a name change or a utility bill for an address change.

- Any previous tax documents that may need to be amended due to the changes.

Having these documents ready can streamline the process and ensure that the form is processed without unnecessary delays.

Form submission methods

The personal tax data change form can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online: Many tax authorities allow for electronic submission of the form through their official websites.

- Mail: The form can be printed and mailed to the appropriate tax office, following the address provided in the form instructions.

- In-person: Taxpayers may also have the option to deliver the form in person at designated tax offices.

Choosing the right submission method can help ensure that the changes are processed efficiently and securely.

IRS guidelines

The IRS provides specific guidelines for completing and submitting the personal tax data change form. Taxpayers should refer to the IRS website or the form instructions for detailed information on:

- Eligibility criteria for making changes.

- Deadlines for submitting the form, especially if changes affect tax filings for the current year.

- Potential impacts on tax benefits or obligations resulting from the changes.

Following these guidelines helps ensure compliance and reduces the risk of complications with tax records.

Quick guide on how to complete personalandtaxdatachangeform

Effortlessly Prepare Personalandtaxdatachangeform on Any Device

Online document handling has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Personalandtaxdatachangeform on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

The easiest way to modify and electronically sign Personalandtaxdatachangeform effortlessly

- Locate Personalandtaxdatachangeform and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to保存 your modifications.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Personalandtaxdatachangeform and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personalandtaxdatachangeform

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is airSlate SignNow's role in personal tax data change?

airSlate SignNow facilitates a streamlined process for managing personal tax data change by enabling users to securely send and eSign necessary documents. Our platform ensures compliance and accuracy in your tax data submissions, helping you navigate any modifications seamlessly.

-

How does airSlate SignNow ensure the security of personal tax data change?

We prioritize your security by offering industry-standard encryption and secure storage for all your documents, including those involving personal tax data change. Our platform features strict access controls, ensuring that only authorized individuals can view or edit sensitive information.

-

What are the pricing options for airSlate SignNow when managing personal tax data change?

airSlate SignNow offers flexible pricing plans designed to accommodate various business sizes and needs for personal tax data change. Our tiered options provide essential tools for both individual users and larger organizations, ensuring you only pay for what you need.

-

Can I integrate airSlate SignNow with other applications for personal tax data change?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications to enhance your personal tax data change processes. This allows for a more connected workflow, enabling you to manage all aspects of your tax data efficiently across different platforms.

-

What are the benefits of using airSlate SignNow for personal tax data change?

Using airSlate SignNow for personal tax data change offers signNow benefits, including increased efficiency and reduced processing times. Our user-friendly interface allows you to quickly generate, send, and sign documents electronically, saving time and minimizing errors.

-

Is airSlate SignNow suitable for freelancers managing personal tax data change?

Absolutely! airSlate SignNow is an excellent choice for freelancers dealing with personal tax data change due to its affordability and ease of use. Our platform streamlines the signing process, making it simple for freelancers to manage their tax documents efficiently.

-

How quickly can I complete a personal tax data change using airSlate SignNow?

With airSlate SignNow, personal tax data change can be completed in just a few minutes. Our electronic signing process accelerates the document workflow, eliminating the delays associated with traditional paper methods.

Get more for Personalandtaxdatachangeform

- Justia lien request missouri court forms

- Information statement to the circuit court for missouri courts

- Mo form cs95 fill online printable fillable blankpdffiller

- Cs 97 answer objecting to termination of child supportdot form

- Cv100 income and expense statement ofdot form

- Address of submitting party form

- Petition to contest drivers license suspension packet 8 form

- Fillable online circuit7 order to establish record of form

Find out other Personalandtaxdatachangeform

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast