Compensation Accrual Fund 2010-2026

What is the Compensation Accrual Fund

The Compensation Accrual Fund is a financial mechanism designed to set aside funds for future compensation obligations. This fund is particularly relevant for businesses that need to account for employee benefits, such as retirement plans and severance pay, ensuring that they have the necessary resources available when these obligations arise. By establishing a Compensation Accrual Fund, organizations can manage their cash flow more effectively and comply with accounting standards that require the recognition of these liabilities on their financial statements.

How to use the Compensation Accrual Fund

Using the Compensation Accrual Fund involves several steps to ensure proper allocation and management of resources. First, businesses should assess their future compensation liabilities based on employee contracts and benefits policies. Next, they can determine the amount to contribute to the fund periodically, which may align with payroll cycles. Once the fund is established, organizations should regularly review and adjust contributions based on changes in employee status or benefits, ensuring that the fund remains adequately funded to meet future obligations.

Steps to complete the Compensation Accrual Fund

Completing the Compensation Accrual Fund requires a systematic approach:

- Identify obligations: Review employee contracts and benefits to determine future compensation liabilities.

- Calculate contributions: Estimate the total amount needed for the fund based on projected liabilities.

- Establish the fund: Open a dedicated account or set up a financial mechanism to hold the funds.

- Make periodic contributions: Allocate funds regularly, aligning with financial planning and payroll cycles.

- Monitor and adjust: Regularly review the fund's status and adjust contributions as necessary to meet changing obligations.

Legal use of the Compensation Accrual Fund

The legal use of the Compensation Accrual Fund is governed by various accounting principles and regulations. Organizations must ensure compliance with the Generally Accepted Accounting Principles (GAAP) and relevant tax laws. Proper documentation and reporting are essential to demonstrate that the fund is being used for its intended purpose. Failure to adhere to these legal requirements may result in penalties or issues during audits, making it crucial for businesses to maintain accurate records and follow established guidelines.

Eligibility Criteria

Eligibility for establishing a Compensation Accrual Fund typically depends on the nature of the business and its compensation policies. Generally, organizations that offer employee benefits, such as retirement plans, health insurance, or severance packages, can set up this fund. Additionally, businesses must comply with federal and state regulations regarding employee compensation and benefits to ensure that they are eligible to utilize the fund effectively. Consulting with a financial advisor or legal expert can help clarify specific eligibility requirements based on the organization's structure and employee agreements.

Required Documents

To establish and manage a Compensation Accrual Fund, certain documents are necessary:

- Employee contracts: These outline the compensation obligations and benefits offered to employees.

- Financial statements: Recent statements help assess the organization's financial health and ability to contribute to the fund.

- Tax documentation: Relevant tax forms and records ensure compliance with federal and state regulations.

- Fund management policies: Internal policies detailing how the fund will be managed, including contribution schedules and withdrawal processes.

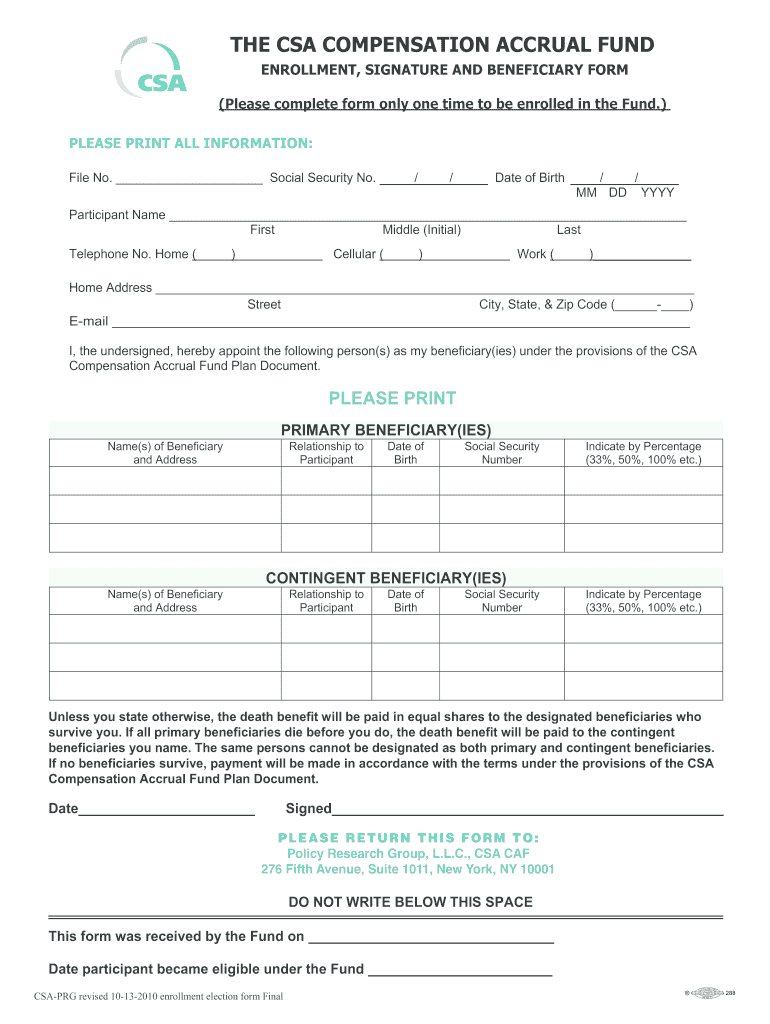

Quick guide on how to complete compensation accrual fund

Complete Compensation Accrual Fund seamlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents promptly without delays. Manage Compensation Accrual Fund on any platform with airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

How to modify and eSign Compensation Accrual Fund effortlessly

- Locate Compensation Accrual Fund and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Compensation Accrual Fund to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the compensation accrual fund

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

The way to make an eSignature for a PDF file on Android OS

People also ask

-

What is a CSA compensation accrual fund?

A CSA compensation accrual fund is a financial reserve set aside to cover anticipated compensation costs for employees. It's designed to ensure that businesses can meet their obligations without cash flow issues related to employee compensation, helping you manage expenses more effectively.

-

How does airSlate SignNow support CSA compensation accrual fund management?

airSlate SignNow offers tools that streamline documentation processes related to compensation funds. With our eSignature capabilities, businesses can quickly approve and manage the agreements tied to the CSA compensation accrual fund, enhancing efficiency and compliance.

-

What are the benefits of using airSlate SignNow for CSA compensation accrual fund documentation?

Using airSlate SignNow for your CSA compensation accrual fund documentation simplifies workflow management by enabling fast and secure electronic signatures. This not only reduces processing time but also ensures that all necessary documents are organized and easily accessible.

-

Are there any integration options available with airSlate SignNow for CSA compensation accrual fund management?

Yes, airSlate SignNow integrates with various accounting and HR systems, allowing for seamless management of your CSA compensation accrual fund processes. This interoperability ensures that your financial data stays synchronized, facilitating accurate tracking and reporting.

-

Is airSlate SignNow a cost-effective solution for managing CSA compensation accrual funds?

Absolutely! airSlate SignNow provides an affordable solution for documentation and eSigning needs, especially for managing CSA compensation accrual funds. Our competitive pricing allows businesses of all sizes to stay compliant without overspending on complex solutions.

-

What features does airSlate SignNow offer for CSA compensation accrual fund management?

airSlate SignNow includes robust features such as customizable templates, bulk sending, and advanced signing workflows, all designed to streamline the management of CSA compensation accrual funds. These features help you automate routine tasks and reduce administrative burdens.

-

Can airSlate SignNow help ensure compliance with regulations regarding CSA compensation accrual funds?

Yes, airSlate SignNow is built to help businesses maintain compliance with regulatory requirements associated with CSA compensation accrual funds. Our platform captures audit trails and maintains document integrity, ensuring that you have the necessary records for compliance audits.

Get more for Compensation Accrual Fund

- So if you only have one adult child form

- Influence in executing this agreement and that execution of same is form

- Nd 599ppdf form

- Late fees or penalties form

- Summons formdivorce or separation actions north

- State of north dakota in district court county of ward form

- State of north dakota in district court plaintiff defendant form

- A guide to understanding south dakota unified judicial form

Find out other Compensation Accrual Fund

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF