Form 307 Mvat

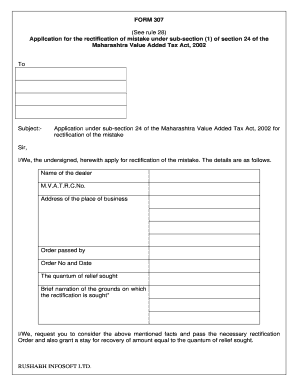

What is the Form 307 MVAT

The Form 307 MVAT is a crucial document used for the Maharashtra Value Added Tax (MVAT) in India. It is primarily designed for businesses to report their tax obligations accurately. This form helps in declaring the value of goods sold and services rendered, ensuring compliance with state tax regulations. Understanding the purpose and requirements of Form 307 MVAT is essential for businesses operating within Maharashtra, as it directly impacts their tax liabilities and legal standing.

Steps to complete the Form 307 MVAT

Completing the Form 307 MVAT involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales invoices and purchase receipts. Next, fill in the required details in the form, such as the taxpayer's identification number, business name, and the period for which the tax is being filed. It's important to accurately calculate the total sales and input the corresponding tax amounts. After filling out the form, review all entries for correctness before submission. Finally, ensure that the form is submitted by the designated deadline to avoid penalties.

Legal use of the Form 307 MVAT

The legal use of Form 307 MVAT is governed by the Maharashtra Value Added Tax Act. This form serves as an official declaration of tax liability and must be completed in accordance with the regulations set forth by the state. Businesses are required to maintain accurate records and submit this form to avoid legal repercussions, such as fines or audits. Compliance with the legal requirements associated with Form 307 MVAT not only protects the business but also contributes to the overall integrity of the tax system.

Required Documents

To successfully complete and submit Form 307 MVAT, several documents are required. These include:

- Sales invoices detailing the goods sold

- Purchase receipts for the goods acquired

- Taxpayer identification number and business registration documents

- Previous tax returns, if applicable

Having these documents organized and readily available will facilitate a smoother filing process and help ensure compliance with all tax obligations.

Form Submission Methods (Online / Mail / In-Person)

Form 307 MVAT can be submitted through various methods, catering to the preferences of different taxpayers. The online submission process is the most efficient, allowing businesses to file their forms electronically through the official tax portal. Alternatively, businesses may choose to mail their completed forms to the designated tax office or submit them in person at local tax offices. Each method has its own guidelines, so it is important to follow the instructions specific to the chosen submission method to ensure successful filing.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 307 MVAT can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to file the form accurately and on time to avoid these consequences. Understanding the implications of non-compliance can motivate businesses to prioritize their tax obligations and maintain good standing with tax authorities.

Quick guide on how to complete form 307 mvat

Prepare Form 307 Mvat effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage Form 307 Mvat on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Form 307 Mvat seamlessly

- Find Form 307 Mvat and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and possesses the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you’d like to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 307 Mvat to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 307 mvat

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the india 307 value associated with airSlate SignNow?

The india 307 value represents a cost-effective solution for businesses to manage their document signing and eSign processes. With competitively priced plans, airSlate SignNow provides excellent value in terms of features and functionalities tailored to enhance productivity.

-

What features does airSlate SignNow offer that relate to india 307 value?

AirSlate SignNow offers several features that align with the india 307 value, including easy document sharing, customizable templates, and secure eSignature capabilities. These features are designed to streamline workflows and reduce turnaround times for document-related tasks.

-

How can I integrate airSlate SignNow into my existing systems considering the india 307 value?

Integrating airSlate SignNow into your existing systems is seamless and highly valuable in terms of india 307 value. The platform supports integrations with various applications such as CRM systems, cloud storage solutions, and project management tools, allowing for enhanced operational efficiency.

-

What benefits can I expect from using airSlate SignNow in line with india 307 value?

By utilizing airSlate SignNow, businesses can expect a range of benefits aligned with india 307 value, such as improved document security, faster turnaround times, and enhanced collaboration among team members. These advantages lead to greater customer satisfaction and increased productivity.

-

Is the pricing of airSlate SignNow justified by the india 307 value?

Absolutely, the pricing of airSlate SignNow is justified by the india 307 value it provides. With a strong emphasis on affordability and a range of features, businesses find that they receive excellent return on investment for their document management solutions.

-

How does airSlate SignNow ensure the security of documents in line with india 307 value?

AirSlate SignNow prioritizes the security of your documents in line with india 307 value by employing advanced encryption methods and secure cloud technology. This ensures that all your sensitive information remains safe and protected throughout the signing process.

-

Can airSlate SignNow assist with compliance issues as part of the india 307 value?

Yes, airSlate SignNow can assist businesses with compliance issues as part of the india 307 value. The platform is designed to meet various regulatory standards, ensuring that your eSigning practices are compliant with industry regulations and legal requirements.

Get more for Form 307 Mvat

- Control number mt p041 pkg form

- Control number mt p043 pkg form

- Possession of the property you may lose your right to assert form

- Near doctordentists form

- Organized pursuant to the laws of the state of north carolina hereinafter quotcorporationquot form

- Business registration secretary of state filing ncgov form

- Incorporating your business in north carolina small form

- Brief description for the index form

Find out other Form 307 Mvat

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document