Goodwill Job Application Form Careers Downloads Net 2006-2026

Understanding the Goodwill Donation Receipt

A printable goodwill donation receipt is an essential document for individuals who donate items to Goodwill or similar charitable organizations. This receipt serves as proof of the donation and is crucial for tax purposes. It typically includes the donor's name, address, the date of the donation, a description of the items donated, and the estimated value of those items. Having an accurate and detailed receipt can help ensure that donors receive the appropriate tax deductions during filing season.

How to Fill Out a Goodwill Donation Receipt

Filling out a goodwill donation receipt involves several straightforward steps. First, ensure you have all the necessary information, including your name, address, and the date of the donation. Next, list the items you are donating, providing a brief description of each. It is also important to estimate the fair market value of these items, as this will be needed for tax reporting. Finally, sign and date the receipt to validate it. If you are using a printable goodwill donation receipt template, ensure that all fields are completed accurately.

IRS Guidelines for Donation Receipts

The IRS has specific guidelines regarding charitable donations and the documentation required to claim tax deductions. For donations valued at over $250, a written acknowledgment from the charity is necessary. This acknowledgment must include the amount of cash donated or a description of the property donated, along with a statement that no goods or services were provided in exchange for the donation. For donations under this threshold, a simple receipt may suffice, but it is advisable to keep detailed records of all donations for tax purposes.

Required Documents for Tax Deductions

To claim a tax deduction for your goodwill donations, you must have the appropriate documentation. This includes the printable goodwill donation receipt, which should detail the items donated and their estimated values. Additionally, keep any other relevant documents, such as photographs of the items and a list of donations made throughout the year. Maintaining organized records can simplify the process when tax season arrives and ensure compliance with IRS regulations.

Form Submission Methods for Goodwill Donations

Goodwill accepts donations through various methods, including in-person drop-offs at donation centers, scheduled pick-ups for larger items, and community events. When donating in person, you can request a goodwill donation receipt on-site. If you are using a printable goodwill donation receipt, ensure that it is filled out correctly and retained for your records. Understanding these submission methods can help streamline the donation process and ensure you receive the necessary documentation.

Legal Use of the Goodwill Donation Receipt

The goodwill donation receipt is not only a record of your charitable contribution but also a legally binding document for tax purposes. To ensure its validity, it must be completed accurately and retained as part of your financial records. In the event of an audit, the IRS may request proof of your donations, making it essential to keep this receipt along with other supporting documents. Understanding the legal implications of this receipt can help protect your interests and ensure compliance with tax laws.

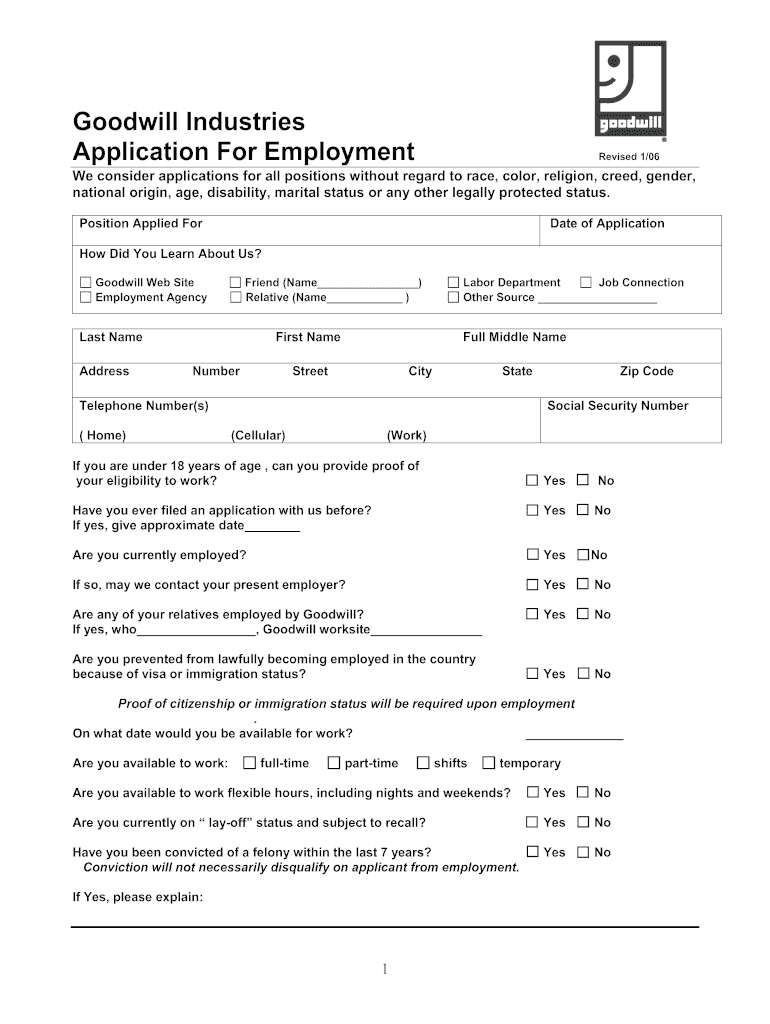

Quick guide on how to complete goodwill job application form careers freedownloadsnet

Complete Goodwill Job Application Form Careers Downloads net effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can locate the needed form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Goodwill Job Application Form Careers Downloads net on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Goodwill Job Application Form Careers Downloads net without any hassle

- Locate Goodwill Job Application Form Careers Downloads net and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent portions of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your alterations.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Goodwill Job Application Form Careers Downloads net and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the goodwill job application form careers freedownloadsnet

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is a printable goodwill donation receipt?

A printable goodwill donation receipt is a document provided by goodwill organizations that acknowledges donations made for tax purposes. This receipt serves as proof of your charitable contribution and enhances your tax deductions, making it essential for donors.

-

How can I create a printable goodwill donation receipt using airSlate SignNow?

Creating a printable goodwill donation receipt with airSlate SignNow is easy. Simply use our template maker to customize your receipt, fill in the necessary details, and download it for printing. Our platform ensures that your receipts are both professional and compliant with tax regulations.

-

Are there any costs associated with using airSlate SignNow to create receipts?

airSlate SignNow offers a variety of pricing plans tailored to fit different needs, including a free trial for new users. Once you decide on a plan, you can create unlimited printable goodwill donation receipts without additional costs, making it a cost-effective solution for all your documentation needs.

-

Can I integrate airSlate SignNow with other applications to manage my donations?

Yes, airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and CRM systems. This integration allows you to manage your donations and generate printable goodwill donation receipts efficiently, streamlining your workflow and organizational processes.

-

What features does airSlate SignNow offer for managing donation receipts?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and cloud storage for better document management. With these tools, you can quickly create and send printable goodwill donation receipts, ensuring your donations are tracked and acknowledged properly.

-

How do I ensure my printable goodwill donation receipt meets IRS requirements?

To ensure that your printable goodwill donation receipt meets IRS requirements, make sure it includes details like the donor's name, date of donation, a description of the items donated, and the organization's name. airSlate SignNow’s templates are designed to comply with these guidelines, helping you maintain proper documentation for tax purposes.

-

What are the benefits of using airSlate SignNow for donations?

Using airSlate SignNow for donations offers several benefits, such as enhanced efficiency, secure eSigning, and easy access to your documents anytime, anywhere. With our platform, creating and distributing printable goodwill donation receipts has never been easier, ensuring you stay organized and compliant.

Get more for Goodwill Job Application Form Careers Downloads net

- Control number sd 013 77 form

- Control number sd 02 78 form

- Dct5 18 17 by dakota county tribune issuu form

- Control number sd 016 78 form

- South dakota deed formsquit claim warranty and

- Accordance with the applicable laws of the state of south dakota form

- Each party agrees that he or she will sign and execute any further or additional form

- Control number sd 018 77 form

Find out other Goodwill Job Application Form Careers Downloads net

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure