Fannie Mae Loan Workout Hierarchy Form

What is the Fannie Mae Loan Workout Hierarchy Form

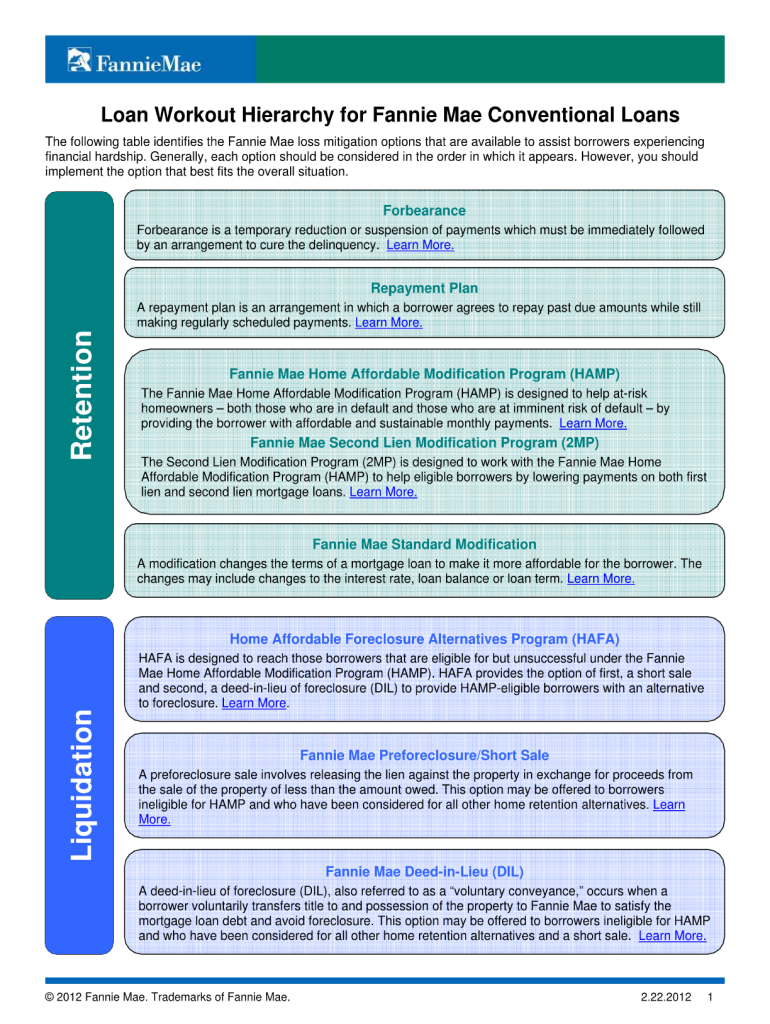

The Fannie Mae Loan Workout Hierarchy Form, commonly referred to as the FNMA 1076, is a critical document used in the loan modification process. It serves as a guideline for lenders to assess the financial situation of borrowers who are facing difficulties in making their mortgage payments. This form outlines the various workout options available to borrowers, helping them to understand their choices and the implications of each option. It is essential for lenders and borrowers alike to be familiar with this form to facilitate effective communication and decision-making during the loan workout process.

How to use the Fannie Mae Loan Workout Hierarchy Form

Using the Fannie Mae Loan Workout Hierarchy Form involves several steps. First, lenders must gather relevant financial information from the borrower, including income, expenses, and any other debts. Once this information is collected, the lender can complete the form by selecting the appropriate workout option based on the borrower’s financial situation. The form helps to categorize the borrower’s options, such as repayment plans, loan modifications, or short sales. Proper use of this form ensures that both parties are aligned on the available solutions and can work together towards a resolution.

Steps to complete the Fannie Mae Loan Workout Hierarchy Form

Completing the FNMA 1076 requires attention to detail and accuracy. Here are the steps involved:

- Gather necessary financial documentation from the borrower, including income statements and expense reports.

- Review the borrower’s financial situation to determine eligibility for various workout options.

- Fill out the form by selecting the appropriate workout option that aligns with the borrower’s circumstances.

- Ensure all required signatures are obtained to validate the form.

- Submit the completed form to the relevant parties for processing.

Legal use of the Fannie Mae Loan Workout Hierarchy Form

The FNMA 1076 is legally binding when completed correctly and used in accordance with applicable laws and regulations. It is essential for lenders to ensure compliance with federal and state laws regarding loan modifications and workouts. The form must be filled out accurately, and all parties involved should retain copies for their records. Proper legal use of the form protects both the lender and the borrower, ensuring that the workout process adheres to established guidelines and maintains transparency.

Key elements of the Fannie Mae Loan Workout Hierarchy Form

The FNMA 1076 contains several key elements that are crucial for its effective use. These include:

- Borrower information: Details about the borrower, including contact information and loan details.

- Financial assessment: A section that outlines the borrower’s current financial status, including income and expenses.

- Workout options: A clear list of available options for the borrower, such as loan modifications or repayment plans.

- Signatures: Required signatures from both the borrower and lender to validate the form.

Examples of using the Fannie Mae Loan Workout Hierarchy Form

Examples of using the FNMA 1076 can illustrate its practical applications. For instance, if a borrower is struggling to make monthly payments due to job loss, the lender may use the form to explore options like a temporary forbearance or a loan modification. Another example could involve a borrower who has experienced a significant decrease in income, prompting the lender to consider a repayment plan that adjusts the monthly payment based on the borrower’s new financial reality. These examples highlight the form's flexibility and its role in facilitating meaningful solutions for borrowers in distress.

Quick guide on how to complete fannie mae loan workout hierarchy form

Complete Fannie Mae Loan Workout Hierarchy Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Manage Fannie Mae Loan Workout Hierarchy Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Fannie Mae Loan Workout Hierarchy Form with ease

- Locate Fannie Mae Loan Workout Hierarchy Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you want to send your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, and errors that necessitate printing new copies. airSlate SignNow addresses your document management needs within a few clicks from any device you prefer. Modify and eSign Fannie Mae Loan Workout Hierarchy Form and guarantee outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How much did we pay to bail out Freddie Mac and Fannie Mae?

Fannie Mae and Freddie Mac were put into conservatorship by the Federal Housing Finance Agency (FHFA) on September 17, 2008. This meant that the two government-sponsored enterprises (GSEs) have been managed by the government since then. The U.S. Treasury Department was authorized to purchase up to $100 billion in the GSEs' preferred stock and mortgage-backed securities (MBS). It was supposed to be temporary, but economic conditions have not improved enough to allow the government to sell the shares it owned and return Fannie and Freddie to private ownership.This was the direct cost. There were also a lot other indirect costs like -$3.9 billion in CDBG grants to help homeowners in poor neighborhoods.Approval for the Treasury Department to buy shares of Fannie's and Freddie's stock to support stock price levels and allow the two to continue to raise capital on the private market.Approval for the Federal Housing Administration (FHA) to guarantee $300 billion in new loans to keep 400,000 homeowners out of foreclosure.About $15 billion in housing tax breaks, including a credit of up to $7,500 for first-time buyers.An increase in the statutory limit on the national debt by $800 billion, to $10.6 trillion.A new regulatory agency to oversee Fannie and Freddie, including executive pay levels.Found this at - What Was the Fannie Mae and Freddie Mac Bailout?

-

How can I apply for an education loan from SBI online?

Step 1: Go to GyanDhan’s website. Check your loan eligibility here.Step 2: Apply for loan with collateral at GyanDhanStep3: Fill the Complete Application form.Done ! You will get a mail from SBI that they have received your application along with a mail from GyanDhan which will contain the details of the branch manger and the documents required.GyanDhan is in partnership with SBI for education loan abroad. GyanDhan team has technically integrated their systems so that customer can fill the GyanDhan’s form and it automatically get applied to SBI. The idea is to make education loan process so simple via GyanDhan that students don’t have to worry finances when they think of higher education abroad.GyanDhan is a marketplace for an education loan abroad and are in partnership with banks like SBI, BOB, Axis and many more.PS: I work at GyanDhan

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

It is my dream to work for Fannie Mae/Freddie Mac doing loan securitization, does anyone know someone that works for them that I could signNow out to?

I worked for Fannie Mae for 5 1/2 years The pay was good and the benefits were great but there is typically no way to advance unless you make good good friends with your boss and the other thing pretty much the only way to get in with Fannie Mae is to have a headhunter .

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the fannie mae loan workout hierarchy form

How to create an eSignature for your Fannie Mae Loan Workout Hierarchy Form online

How to generate an electronic signature for your Fannie Mae Loan Workout Hierarchy Form in Chrome

How to create an electronic signature for putting it on the Fannie Mae Loan Workout Hierarchy Form in Gmail

How to make an electronic signature for the Fannie Mae Loan Workout Hierarchy Form straight from your smartphone

How to create an electronic signature for the Fannie Mae Loan Workout Hierarchy Form on iOS devices

How to make an electronic signature for the Fannie Mae Loan Workout Hierarchy Form on Android devices

People also ask

-

What is the FNMA 1076 form and why is it important?

The FNMA 1076 form is a critical document required by Fannie Mae for mortgage loan processing. It provides essential information about borrower creditworthiness and property eligibility. Understanding this form can streamline the mortgage application process and improve efficiency for lenders.

-

How can airSlate SignNow assist with FNMA 1076 document management?

airSlate SignNow offers a user-friendly platform for managing, signing, and sending the FNMA 1076 form efficiently. Our eSigning solution ensures that all signatures are legally binding and securely stored, making the management of mortgage documents more seamless for financial institutions.

-

What are the pricing options for airSlate SignNow when handling FNMA 1076 forms?

airSlate SignNow provides competitive pricing plans designed to accommodate various business needs, including those that regularly process FNMA 1076 forms. Our plans include options for businesses of all sizes, ensuring you only pay for what you need without compromising on features or support.

-

What features does airSlate SignNow offer for FNMA 1076 eSigning?

airSlate SignNow includes a range of features specifically beneficial for FNMA 1076 eSigning, such as customizable templates, document sharing, secure cloud storage, and real-time tracking. These tools enhance collaboration and streamline the signature process, ensuring timely and accurate completion of essential documents.

-

Why should I choose airSlate SignNow for electronic signatures on FNMA 1076 forms?

Choosing airSlate SignNow for eSigning your FNMA 1076 forms means opting for a solution that is not only cost-effective but also highly reliable. With strong compliance with federal laws regarding electronic signatures and documents, you can trust that your transactions are secure and valid.

-

Does airSlate SignNow integrate with other software for FNMA 1076 processing?

Yes, airSlate SignNow seamlessly integrates with various CRM and document management systems that are commonly used in the mortgage industry. This allows users to incorporate FNMA 1076 forms into their existing workflows without any disruptions, enhancing productivity and operational efficiency.

-

Can I track the status of my FNMA 1076 documents in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including FNMA 1076 forms. You can easily monitor who has signed the document, view completion statuses, and receive instant notifications, ensuring you stay informed throughout the entire process.

Get more for Fannie Mae Loan Workout Hierarchy Form

Find out other Fannie Mae Loan Workout Hierarchy Form

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy