IDOC Non Tax Filer S Statement Form

What is the IDOC Non Tax Filer Statement?

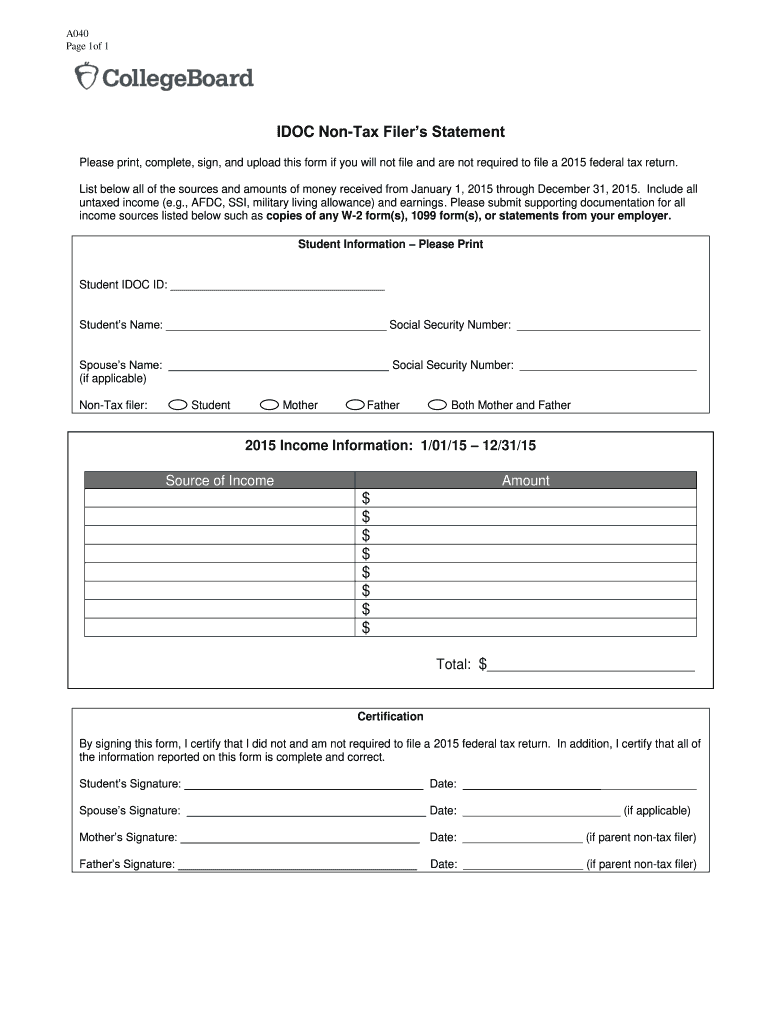

The IDOC Non Tax Filer Statement is a document used primarily by students and individuals who do not have any taxable income. This form is often required by educational institutions to determine eligibility for financial aid. It serves as an official declaration that the individual has not filed a tax return due to a lack of income. Understanding this form is essential for those navigating the financial aid process, as it helps institutions assess the financial situation of applicants accurately.

How to Use the IDOC Non Tax Filer Statement

Using the IDOC Non Tax Filer Statement involves several key steps. First, ensure that you have the correct version of the form, as there may be specific requirements based on the academic year. Next, complete the form by providing accurate personal information, including your name, address, and Social Security number. It's important to include any relevant details that support your non-filing status. After filling out the form, submit it as directed by your educational institution, whether online or through traditional mail.

Steps to Complete the IDOC Non Tax Filer Statement

Completing the IDOC Non Tax Filer Statement requires careful attention to detail. Follow these steps:

- Obtain the correct form for the relevant academic year.

- Fill in your personal information accurately.

- Indicate your non-filing status clearly.

- Provide any additional documentation that may be required, such as proof of income or lack thereof.

- Review the completed form for accuracy before submission.

- Submit the form according to your institution's guidelines.

Legal Use of the IDOC Non Tax Filer Statement

The IDOC Non Tax Filer Statement is legally recognized as a valid document for financial aid purposes. It must be completed truthfully, as providing false information can lead to penalties, including loss of financial aid eligibility. Institutions rely on this statement to verify that applicants meet the necessary criteria for aid, making its accurate completion crucial for compliance with federal regulations.

Key Elements of the IDOC Non Tax Filer Statement

Several key elements must be included in the IDOC Non Tax Filer Statement to ensure its validity:

- Personal Information: Full name, address, and Social Security number.

- Non-Filing Status: A clear statement indicating that you have not filed a tax return.

- Signature: The form must be signed and dated to confirm authenticity.

- Supporting Documentation: Any additional paperwork that supports your claim of non-filing.

Examples of Using the IDOC Non Tax Filer Statement

Common scenarios for using the IDOC Non Tax Filer Statement include:

- Students applying for federal financial aid who did not earn enough income to require filing a tax return.

- Individuals seeking financial assistance from state programs that require proof of income status.

- Applicants for scholarships that necessitate a declaration of income status for eligibility assessment.

Quick guide on how to complete idoc non tax filer s statement

Complete IDOC Non Tax Filer S Statement effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly without any delays. Handle IDOC Non Tax Filer S Statement on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign IDOC Non Tax Filer S Statement without hassle

- Find IDOC Non Tax Filer S Statement and click on Get Form to begin.

- Make use of the tools provided to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any preferred device. Edit and electronically sign IDOC Non Tax Filer S Statement to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idoc non tax filer s statement

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is a non tax filer statement idoc?

A non tax filer statement idoc is a document used to declare that an individual or entity has not filed a tax return. This statement can be critical for various financial processes, such as applying for loans or public assistance. With airSlate SignNow, you can easily create, send, and eSign non tax filer statement idocs securely.

-

How does airSlate SignNow help with non tax filer statement idocs?

airSlate SignNow simplifies the process of managing non tax filer statement idocs by providing a user-friendly platform for document creation and eSigning. The solution allows users to customize templates for non tax filer statements and ensures secure transmission. This efficiency helps businesses save time and streamline their documentation needs.

-

Is there a cost associated with creating a non tax filer statement idoc using airSlate SignNow?

Yes, there is a pricing structure for using airSlate SignNow, which varies based on the plan you choose. The service offers cost-effective options that cater to different business sizes and needs. This includes access to features specifically designed for non tax filer statement idocs, ensuring great value for users.

-

Can I integrate airSlate SignNow with other software for handling non tax filer statement idocs?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for non tax filer statement idocs. This includes integration with CRM tools, cloud storage solutions, and more, ensuring that you can manage your documents smoothly across different platforms.

-

What security measures are in place for non tax filer statement idocs on airSlate SignNow?

Security is a top priority for airSlate SignNow when handling non tax filer statement idocs. The platform employs encryption, secure access controls, and compliance with industry standards to ensure that your documents are protected throughout the eSigning process. You can have peace of mind knowing your sensitive information is safe.

-

How can airSlate SignNow expedite the process of sending non tax filer statement idocs?

With airSlate SignNow, sending non tax filer statement idocs is a quick and efficient process. Users can easily populate templates and send documents for signature in just a few clicks. The automated reminders integrated into the platform help ensure that documents are signed without unnecessary delays.

-

What features are included in airSlate SignNow for managing non tax filer statement idocs?

airSlate SignNow includes a variety of features for managing non tax filer statement idocs, such as template customization, bulk sending, and real-time tracking of document status. These tools make managing and organizing your documents straightforward, enhancing your productivity and accuracy during the signing process.

Get more for IDOC Non Tax Filer S Statement

- Full text of ampquota treatment of the fundamental principles of the form

- Tailor services contract form

- Technician services contract form

- Chief engineer ram ganga kanpur agreement no form

- Travel agent employment contract form

- This agreement is subject to arbitration rewa form

- Exhibit a county of sacramento sample contract waste form

- Speed dating clapham jam tree besides being a homophobe form

Find out other IDOC Non Tax Filer S Statement

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney