Expense Form for Non US Residents American College of 2018-2026

What is the Expense Form For Non US Residents American College Of

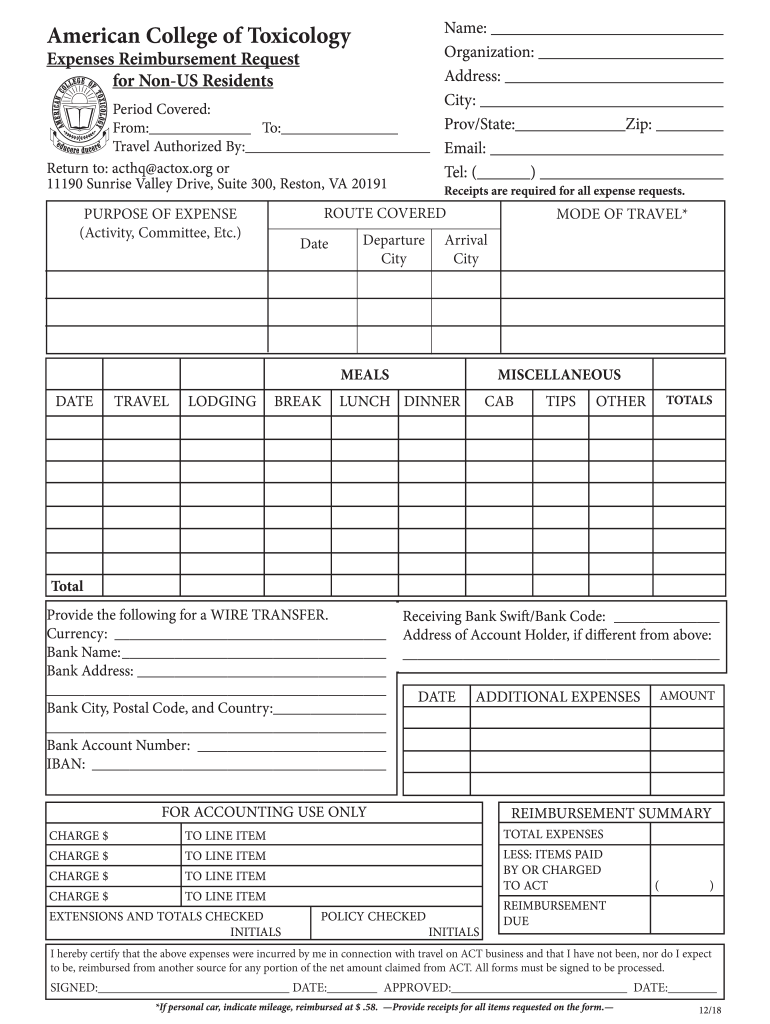

The Expense Form for Non US Residents American College Of is a document designed to facilitate the reimbursement of expenses incurred by individuals who are not U.S. residents but are associated with the American College. This form is essential for ensuring that non-resident individuals can claim eligible expenses while complying with U.S. tax regulations. The form typically requires detailed information regarding the nature of the expenses, the amount incurred, and supporting documentation to substantiate the claims.

Steps to Complete the Expense Form For Non US Residents American College Of

Completing the Expense Form for Non US Residents involves several key steps to ensure accuracy and compliance:

- Gather necessary documents: Collect all receipts and documentation related to the expenses you wish to claim.

- Fill out personal information: Provide your name, address, and any identification numbers required by the American College.

- Detail the expenses: Clearly list each expense, including the date, description, and amount for each item.

- Attach supporting documents: Include copies of receipts or invoices that validate your claims.

- Review the form: Carefully check all entries for accuracy before submission.

- Submit the form: Follow the specified submission method, whether online, by mail, or in person.

Legal Use of the Expense Form For Non US Residents American College Of

The legal use of the Expense Form for Non US Residents is governed by U.S. tax laws and regulations. It is crucial that the form is filled out accurately and submitted in accordance with IRS guidelines to ensure that non-residents can receive reimbursements without facing penalties. The form must include all required information and documentation to be considered valid. Additionally, it is important to keep copies of submitted forms and receipts for record-keeping and potential audits.

Key Elements of the Expense Form For Non US Residents American College Of

Several key elements are essential for the proper completion of the Expense Form for Non US Residents:

- Personal Information: This includes the claimant's name, contact details, and any relevant identification numbers.

- Expense Details: Each expense must be itemized with descriptions, dates, and amounts.

- Supporting Documentation: Attach all necessary receipts and invoices to substantiate claims.

- Signature: The form typically requires a signature to certify the accuracy of the information provided.

How to Obtain the Expense Form For Non US Residents American College Of

The Expense Form for Non US Residents can typically be obtained through the official website of the American College or by contacting their administrative office directly. It may also be available in downloadable format for convenience. Ensure that you are using the most current version of the form to avoid any discrepancies during the reimbursement process.

Form Submission Methods

The Expense Form for Non US Residents can be submitted through various methods, depending on the preferences of the American College. Common submission methods include:

- Online Submission: Many institutions allow forms to be submitted electronically through their secure portal.

- Mail: Forms can often be printed and mailed to the designated office.

- In-Person: Some individuals may prefer to deliver the form directly to the administrative office.

Quick guide on how to complete expense form for non us residents american college of

Prepare Expense Form For Non US Residents American College Of effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Handle Expense Form For Non US Residents American College Of on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Expense Form For Non US Residents American College Of with ease

- Locate Expense Form For Non US Residents American College Of and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share the form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you choose. Edit and electronically sign Expense Form For Non US Residents American College Of and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the expense form for non us residents american college of

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Expense Form For Non US Residents American College Of?

The Expense Form For Non US Residents American College Of is a specialized document designed to manage and process expenses for individuals not residing in the U.S. This form streamlines reporting and reimbursement processes, ensuring compliance with institutional policies and regulations.

-

How can I access the Expense Form For Non US Residents American College Of?

You can easily access the Expense Form For Non US Residents American College Of through our user-friendly platform at airSlate SignNow. Simply create an account, navigate to the document templates section, and select the appropriate form for your needs.

-

What are the benefits of using the Expense Form For Non US Residents American College Of?

Using the Expense Form For Non US Residents American College Of provides a streamlined process for submitting and approving expenses. It enhances accuracy and compliance while saving time for both employees and administrators by reducing paperwork and manual processing.

-

Is there a cost associated with the Expense Form For Non US Residents American College Of?

Yes, using the Expense Form For Non US Residents American College Of comes with a subscription fee that varies based on your organization’s needs. However, this cost is often outweighed by the time savings and efficiency gained through our eSignature solution.

-

What features does the Expense Form For Non US Residents American College Of include?

The Expense Form For Non US Residents American College Of includes features like customizable templates, built-in compliance checks, and electronic signatures for fast approvals. These features ensure that the expense reporting process is both efficient and user-friendly.

-

How does the Expense Form For Non US Residents American College Of integrate with other tools?

The Expense Form For Non US Residents American College Of integrates seamlessly with various accounting and management systems. This ensures that all submitted expenses are automatically captured and synced with your existing workflows, enhancing overall productivity.

-

Can multiple users collaborate on the Expense Form For Non US Residents American College Of?

Absolutely! The Expense Form For Non US Residents American College Of allows multiple users to collaborate in real-time. This feature facilitates easy communication and ensures that all necessary parties can provide input and approvals as needed.

Get more for Expense Form For Non US Residents American College Of

- Washington state courts court forms emancipation

- Judgment of acquittal and order of form

- Superior court of washington county of state of washington form

- Application for writ form

- Fillable online writ of garnishment washington state courts form

- Court of washington county of writ of garnishment for form

- Notice to federal government form

- You have the following exemption rights washington form

Find out other Expense Form For Non US Residents American College Of

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy