Mortgage Pre Approval Application Crescent Mortgage Corp Crescentmortgage Form

What is the mortgage pre approval application for Crescent Mortgage?

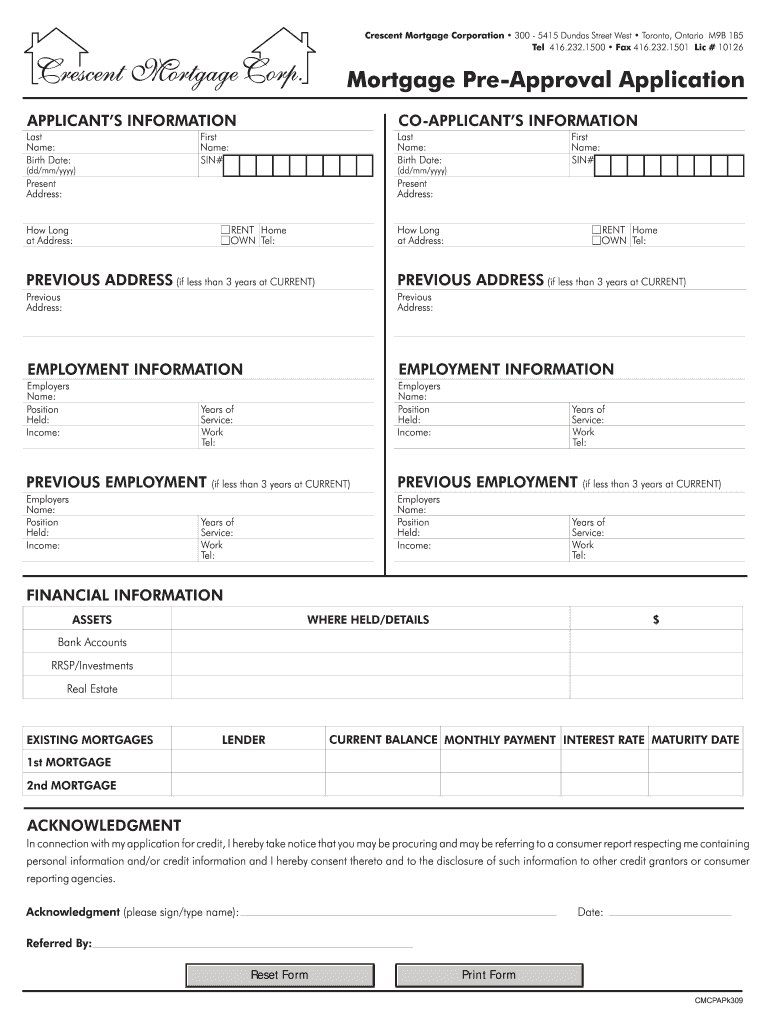

The mortgage pre approval application for Crescent Mortgage is a crucial document that potential homebuyers submit to determine their eligibility for a mortgage loan. This application assesses the financial background of the applicant, including income, credit history, and debt-to-income ratio. By completing this form, buyers gain insights into how much they can borrow, which helps streamline the home buying process. A pre approval not only signifies that a lender has evaluated the applicant's financial situation but also strengthens their position when making offers on properties.

Steps to complete the mortgage pre approval application for Crescent Mortgage

Completing the mortgage pre approval application involves several key steps. First, gather necessary financial documents, such as pay stubs, tax returns, and bank statements. Next, fill out the application form accurately, providing detailed information about your financial status. After submitting the application, the lender will review your information and may request additional documentation. Once the review is complete, you will receive a pre approval letter indicating the loan amount you qualify for. This letter is essential when negotiating with sellers.

Key elements of the mortgage pre approval application for Crescent Mortgage

The mortgage pre approval application includes several key elements that are essential for a thorough evaluation. These elements typically encompass personal information, employment details, income verification, and asset disclosures. Additionally, it may require information about existing debts and any other financial obligations. Understanding these components can help applicants prepare adequately and improve their chances of receiving a favorable pre approval outcome.

Legal use of the mortgage pre approval application for Crescent Mortgage

The legal use of the mortgage pre approval application is governed by various regulations that ensure the process is transparent and fair. In the United States, eSignature laws such as the ESIGN Act and UETA validate electronic signatures, making them legally binding. This means that applicants can complete and submit their applications electronically, provided they comply with these legal frameworks. Ensuring that the application is filled out accurately and submitted through a secure platform is vital for its legal standing.

Eligibility criteria for the mortgage pre approval application for Crescent Mortgage

Eligibility criteria for the mortgage pre approval application typically include factors such as credit score, income level, employment stability, and existing debt. Lenders assess these criteria to determine the risk associated with lending to an applicant. Generally, a higher credit score and lower debt-to-income ratio improve the chances of approval. It is advisable for applicants to review their financial situation and address any potential issues before applying to enhance their eligibility.

Required documents for the mortgage pre approval application for Crescent Mortgage

To complete the mortgage pre approval application, applicants must provide several required documents. Commonly requested items include recent pay stubs, W-2 forms, tax returns from the past two years, bank statements, and details regarding any other income sources. Additionally, documentation related to existing debts, such as credit card statements and loan agreements, may also be necessary. Having these documents ready can expedite the application process and ensure a smooth experience.

Application process and approval time for Crescent Mortgage

The application process for the mortgage pre approval application involves submitting the completed form along with all required documents. Once submitted, the lender will review the application, which typically takes a few days to a week. During this time, the lender may reach out for additional information or clarification. After the review, applicants will receive a decision regarding their pre approval status. Being prepared with accurate information can help speed up this process and reduce approval times.

Quick guide on how to complete mortgage pre approval application crescent mortgage corp crescentmortgage

Effortlessly prepare Mortgage Pre Approval Application Crescent Mortgage Corp Crescentmortgage on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed files, enabling you to acquire the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Mortgage Pre Approval Application Crescent Mortgage Corp Crescentmortgage on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Mortgage Pre Approval Application Crescent Mortgage Corp Crescentmortgage with ease

- Find Mortgage Pre Approval Application Crescent Mortgage Corp Crescentmortgage and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which requires just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, exhausting form searches, or mistakes that require resending new document copies. airSlate SignNow satisfies your document management needs with just a few clicks from any device you choose. Edit and eSign Mortgage Pre Approval Application Crescent Mortgage Corp Crescentmortgage and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage pre approval application crescent mortgage corp crescentmortgage

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is Crescent Mortgage?

Crescent Mortgage is a specialized lending service that offers personalized mortgage solutions for homebuyers and real estate investors. With competitive rates and various loan options, Crescent Mortgage ensures customers find the right financing to suit their needs.

-

How can airSlate SignNow help with Crescent Mortgage documentation?

airSlate SignNow streamlines the documentation process for Crescent Mortgage by enabling users to easily send and eSign crucial documents online. This enhances efficiency and ensures that all paperwork related to mortgage applications is handled promptly and securely.

-

What are the pricing options for Crescent Mortgage?

Crescent Mortgage offers a range of pricing options depending on the type of loan and the applicant's financial profile. It’s essential for potential borrowers to assess their options to find the most cost-effective solution for their mortgage needs.

-

What features does Crescent Mortgage offer?

Crescent Mortgage provides features such as flexible loan terms, competitive interest rates, and quick pre-approval processes. These features are designed to make the mortgage application process as smooth as possible for customers.

-

What are the benefits of choosing Crescent Mortgage?

Choosing Crescent Mortgage offers benefits like personalized support throughout the loan process and access to a variety of mortgage products. Customers appreciate the tailored solutions that fit their specific financial circumstances.

-

Are there any integrations with airSlate SignNow for Crescent Mortgage?

Yes, airSlate SignNow can integrate seamlessly with Crescent Mortgage by allowing users to manage and eSign documents directly within the platform. This makes the overall mortgage experience more efficient and user-friendly.

-

What types of mortgages does Crescent Mortgage provide?

Crescent Mortgage provides various types of mortgages, including fixed-rate, adjustable-rate, and FHA loans. This diversity helps meet the needs of different customers, from first-time homebuyers to seasoned real estate investors.

Get more for Mortgage Pre Approval Application Crescent Mortgage Corp Crescentmortgage

Find out other Mortgage Pre Approval Application Crescent Mortgage Corp Crescentmortgage

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF