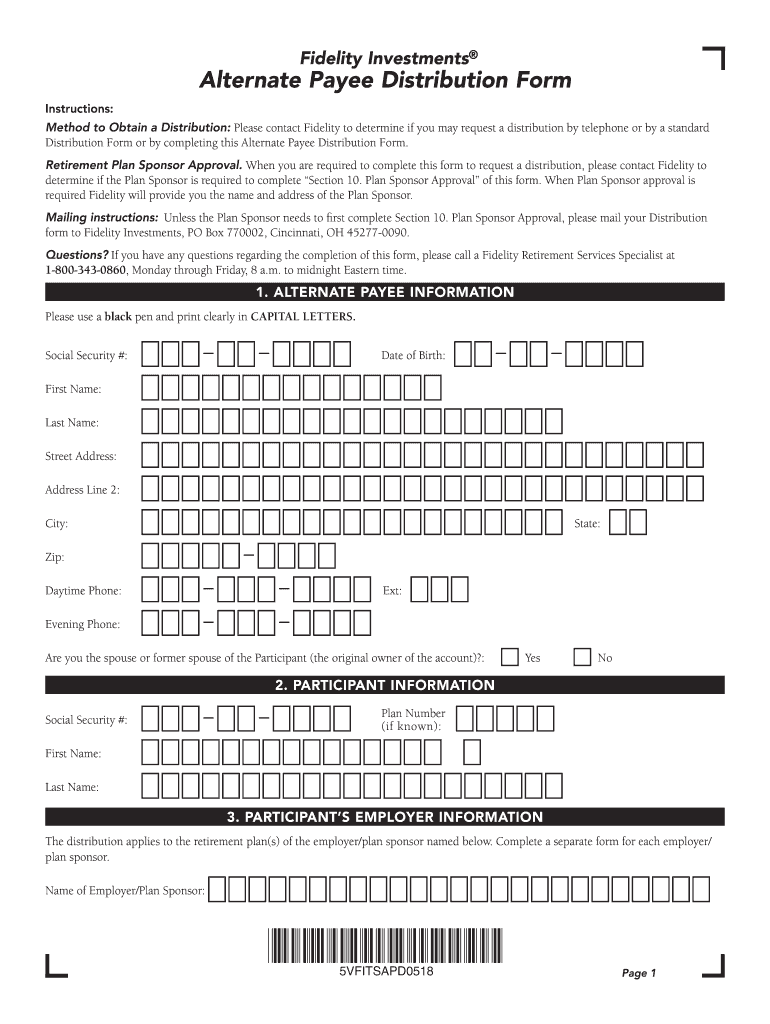

Method to Obtain a Distribution Please Contact Fidelity to Determine If You May Request a Distribution by Telephone or by a Stan Form

IRS Guidelines for Form 1099

The IRS provides specific guidelines for the completion and submission of Form 1099. This form is essential for reporting various types of income other than wages, salaries, and tips. It is crucial to understand the different variants of Form 1099, such as 1099-MISC and 1099-NEC, which cater to different reporting needs. Each variant has unique requirements regarding what income to report and the deadlines for submission. Familiarizing yourself with these guidelines can help ensure compliance and avoid potential penalties.

Filing Deadlines and Important Dates

Timely filing of Form 1099 is critical to avoid penalties. Generally, the deadline for submitting Form 1099 to the IRS is January thirty-first for forms reporting non-employee compensation. For other types of income, the deadline may vary. It is advisable to mark your calendar with these important dates to ensure that you meet the necessary filing requirements. Additionally, if you are filing electronically, the deadline may extend to March thirty-first.

Required Documents for Form 1099

To accurately complete Form 1099, you will need specific documents and information. This includes the recipient's name, address, and taxpayer identification number (TIN). If you are reporting payments made to a business, you will also need the business's legal name and TIN. Gathering these documents in advance can streamline the process and help prevent errors that could lead to compliance issues.

Form Submission Methods

Form 1099 can be submitted through various methods, including online, by mail, or in person. Electronic filing is often recommended for its efficiency and speed. If you choose to file by mail, ensure that you send the form to the correct IRS address based on your location. For those who prefer in-person submission, check with your local IRS office for their policies and procedures regarding form submission.

Penalties for Non-Compliance

Failure to file Form 1099 correctly or on time can result in significant penalties. The IRS imposes fines based on how late the form is filed and the size of the business. Understanding these penalties is essential for businesses to avoid unnecessary financial burdens. Additionally, incorrect information on the form can lead to further complications, including audits and additional fines.

Eligibility Criteria for Filing Form 1099

Not all payments require the issuance of Form 1099. Understanding the eligibility criteria is essential for compliance. Generally, if you have paid an independent contractor or other non-employee $600 or more in a calendar year, you are required to issue a Form 1099. However, there are exceptions, such as payments made to corporations, which typically do not require a 1099. Familiarizing yourself with these criteria can help ensure that you fulfill your reporting obligations correctly.

Quick guide on how to complete method to obtain a distribution please contact fidelity to determine if you may request a distribution by telephone or by a

Effortlessly Prepare Method To Obtain A Distribution Please Contact Fidelity To Determine If You May Request A Distribution By Telephone Or By A Stan on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed forms, allowing you to access the necessary documentation and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly and without interruptions. Manage Method To Obtain A Distribution Please Contact Fidelity To Determine If You May Request A Distribution By Telephone Or By A Stan on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Edit and Electronically Sign Method To Obtain A Distribution Please Contact Fidelity To Determine If You May Request A Distribution By Telephone Or By A Stan

- Obtain Method To Obtain A Distribution Please Contact Fidelity To Determine If You May Request A Distribution By Telephone Or By A Stan and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools specifically designed for such tasks by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal authority as a conventional ink signature.

- Review the information and click on the Done button to save your alterations.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Edit and electronically sign Method To Obtain A Distribution Please Contact Fidelity To Determine If You May Request A Distribution By Telephone Or By A Stan to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the method to obtain a distribution please contact fidelity to determine if you may request a distribution by telephone or by a

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is a 'form 1099 need' and why is it important?

A 'form 1099 need' arises when a business pays an independent contractor or freelancer $600 or more in a year. This form is crucial for reporting income to the IRS and ensures compliance with tax regulations. Businesses should understand their 'form 1099 need' to avoid penalties and maintain accurate financial records.

-

How can airSlate SignNow help with my form 1099 need?

airSlate SignNow simplifies the process of collecting signatures for form 1099 needs. Our platform allows you to rapidly send, eSign, and store forms securely, making it easier to manage documents and meet your reporting requirements. Efficiently addressing your 'form 1099 need' helps streamline your tax preparation.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to meet various business needs, starting from a basic plan to comprehensive solutions for larger enterprises. Each plan is designed to ensure that you can effectively manage your 'form 1099 need' and other document requirements at a cost that fits your budget. You can choose a plan based on your usage and features needed.

-

Does airSlate SignNow provide templates for form 1099?

Yes, airSlate SignNow offers customizable templates for form 1099, which can be quickly edited and sent out for signatures. This feature is designed to address your 'form 1099 need' effectively, ensuring that you can draft and manage the form accurately. Our templates simplify the document process, allowing you to focus on other important tasks.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, which can help in automating your 'form 1099 need'. This integration streamlines your workflow, allowing for easy transfer of data between platforms, enhancing efficiency in managing your financial documentation.

-

What security measures does airSlate SignNow implement for sensitive forms?

airSlate SignNow prioritizes security by employing advanced encryption and compliance protocols to protect your documents. When dealing with sensitive information related to your 'form 1099 need', you can trust that your data is secure. Our platform ensures that all eSigned documents are stored safely, providing peace of mind for your business.

-

Is there a mobile app for airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to manage your 'form 1099 need' on the go. You can easily send, sign, and track documents from your mobile device without being tied to a computer. This flexibility enhances productivity, making it easier to handle your document needs anytime, anywhere.

Get more for Method To Obtain A Distribution Please Contact Fidelity To Determine If You May Request A Distribution By Telephone Or By A Stan

- Alaska general 497294131 form

- Revocation of general durable power of attorney alaska form

- Essential legal life documents for newlyweds alaska form

- Alaska legal life form

- Essential legal life documents for new parents alaska form

- General power of attorney for care and custody of child or children alaska form

- Small business accounting package alaska form

- Company employment policies and procedures package alaska form

Find out other Method To Obtain A Distribution Please Contact Fidelity To Determine If You May Request A Distribution By Telephone Or By A Stan

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application