Election or Revocation of an Election to Have Certain Taxable Supplies Made between Specified Members Deemed Made for No Conside 2015-2026

Understanding the Election or Revocation of an Election for Taxable Supplies

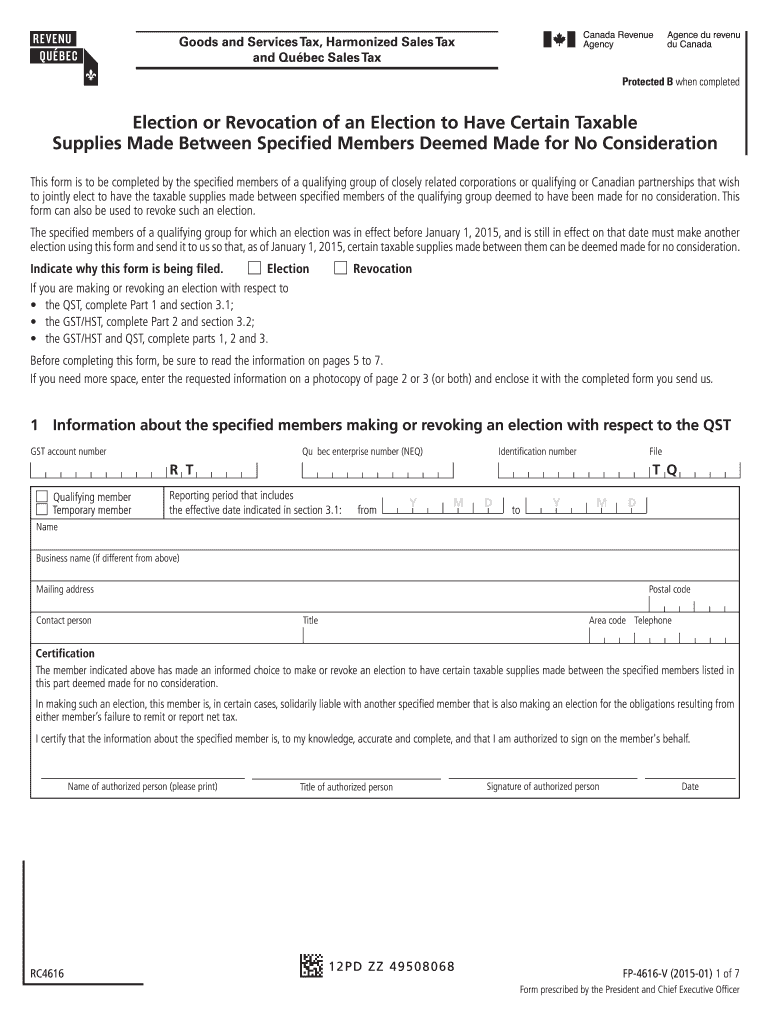

The Election or Revocation of an Election to have certain taxable supplies made between specified members deemed made for no consideration is a critical process for businesses. This form allows organizations to manage their tax obligations effectively by electing to treat certain transactions as non-taxable. Understanding this process ensures compliance with tax regulations and helps avoid unnecessary penalties.

Steps to Complete the Election or Revocation of an Election

Completing the Election or Revocation of an Election requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including business identification and transaction details.

- Review the eligibility criteria to ensure compliance.

- Fill out the form accurately, paying close attention to each section.

- Submit the completed form electronically or via mail, depending on your preference.

Key Elements of the Election or Revocation Process

Several key elements are crucial for the success of the Election or Revocation process. These include:

- Eligibility Criteria: Ensure that your organization meets the specific criteria outlined by the IRS.

- Required Documentation: Collect all necessary documents to support your election or revocation.

- Submission Method: Choose the appropriate method for submitting your form, whether online or by mail.

Legal Considerations for the Election or Revocation

Understanding the legal implications of the Election or Revocation is essential for compliance. The IRS has specific guidelines that govern how these elections are treated. Compliance with these guidelines not only ensures the legality of your transactions but also protects your organization from potential audits or penalties.

IRS Guidelines for the Election or Revocation

The IRS provides comprehensive guidelines regarding the Election or Revocation of an Election for taxable supplies. Familiarizing yourself with these guidelines will help ensure that your submission meets all necessary requirements. This includes understanding the definitions of taxable supplies and the implications of making such elections.

Filing Deadlines and Important Dates

Timeliness is crucial when dealing with the Election or Revocation process. Be aware of the filing deadlines to avoid penalties. The IRS typically sets specific dates for submissions, and missing these deadlines can result in complications for your organization’s tax status.

Quick guide on how to complete election or revocation of an election to have certain taxable supplies made between specified members deemed made for no

Access Election Or Revocation Of An Election To Have Certain Taxable Supplies Made Between Specified Members Deemed Made For No Conside effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Manage Election Or Revocation Of An Election To Have Certain Taxable Supplies Made Between Specified Members Deemed Made For No Conside on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Election Or Revocation Of An Election To Have Certain Taxable Supplies Made Between Specified Members Deemed Made For No Conside effortlessly

- Obtain Election Or Revocation Of An Election To Have Certain Taxable Supplies Made Between Specified Members Deemed Made For No Conside and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or redact confidential information using tools specifically offered by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information thoroughly and then click on the Done button to finalize your changes.

- Select how you would prefer to share your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Election Or Revocation Of An Election To Have Certain Taxable Supplies Made Between Specified Members Deemed Made For No Conside and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the election or revocation of an election to have certain taxable supplies made between specified members deemed made for no

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is rc4616 and how does it relate to airSlate SignNow?

The rc4616 is a unique identifier for a specific feature set within airSlate SignNow, which enables businesses to efficiently send and electronically sign documents. This functionality enhances workflow productivity and ensures security for your important documents.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs. With the rc4616 identifier, you can access special promotions that provide cost-effective solutions for document management and eSigning.

-

What features does airSlate SignNow offer that include rc4616?

With rc4616, airSlate SignNow offers a variety of features including customizable templates, real-time tracking, and advanced security options. These features are designed to simplify the document signing process and improve user experience.

-

How does airSlate SignNow enhance document security under rc4616?

airSlate SignNow prioritizes document security under the rc4616 guidelines by using encryption, secure access controls, and compliance with industry standards. This ensures that your sensitive information remains protected throughout the signing process.

-

Can I integrate airSlate SignNow with other applications using rc4616?

Yes, airSlate SignNow is designed to integrate seamlessly with various applications through the rc4616 framework. This allows for a more streamlined workflow, giving you the ability to connect with popular platforms like Google Drive and Salesforce.

-

What are the benefits of using airSlate SignNow with the rc4616 feature set?

Using airSlate SignNow with rc4616 offers numerous benefits including time savings, enhanced collaboration, and improved accuracy in document transactions. These advantages make it an ideal choice for businesses looking to optimize their eSigning processes.

-

How can airSlate SignNow improve my team's efficiency with rc4616?

airSlate SignNow improves team efficiency under the rc4616 guidelines by automating document workflows and reducing turnaround time for signatures. This leads to quicker decision-making and a faster pace of business.

Get more for Election Or Revocation Of An Election To Have Certain Taxable Supplies Made Between Specified Members Deemed Made For No Conside

Find out other Election Or Revocation Of An Election To Have Certain Taxable Supplies Made Between Specified Members Deemed Made For No Conside

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple