Loan Form

What is the Loan Form

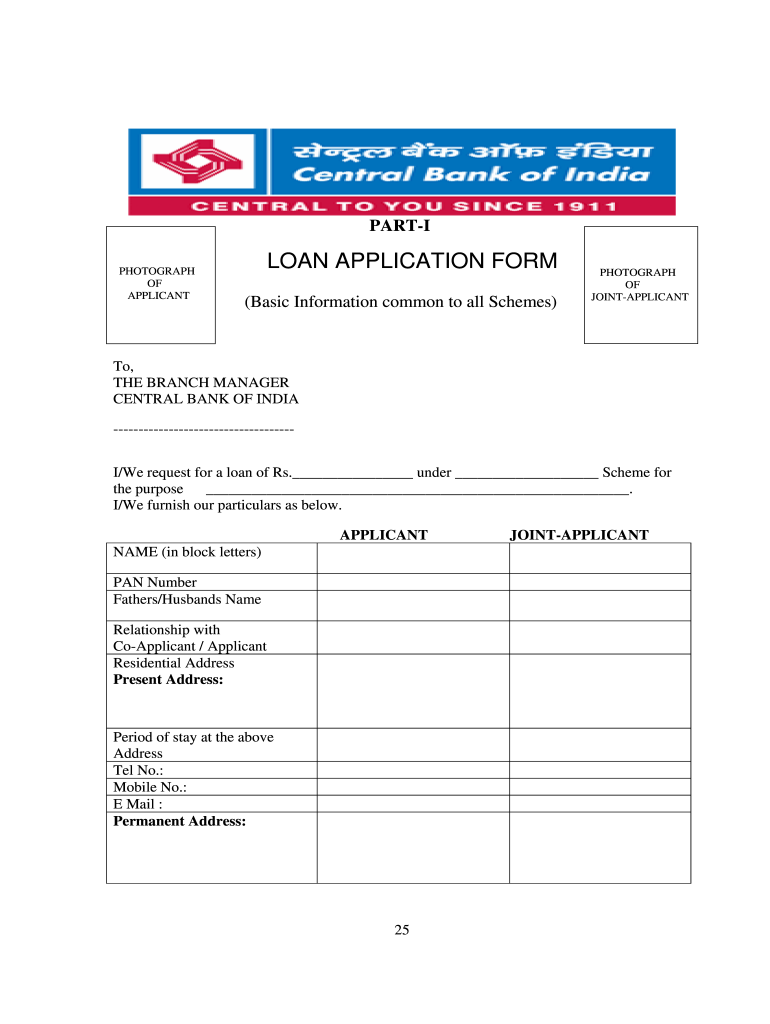

The india loan application form is a crucial document used by individuals seeking financial assistance from banks or financial institutions. This form collects essential information about the applicant's financial status, employment details, and the purpose of the loan. It serves as the initial step in the loan approval process, allowing lenders to assess the applicant's eligibility and creditworthiness. Understanding the components of this form is vital for a smooth application process.

Steps to Complete the Loan Form

Filling out the india bank loan application form involves several key steps to ensure accuracy and completeness. First, gather all necessary documents, such as proof of income, identification, and credit history. Next, carefully fill in personal details, including your name, address, and social security number. Be sure to provide accurate information regarding your employment and financial obligations. After completing the form, review it thoroughly for any errors before submission. This attention to detail can significantly impact the approval process.

Required Documents

When applying for a loan using the india central bank loan application form, specific documents are typically required to support your application. Commonly requested items include:

- Proof of identity (e.g., driver's license, passport)

- Proof of income (e.g., pay stubs, tax returns)

- Bank statements for the last few months

- Details of existing debts and financial obligations

- Any additional documentation requested by the lender

Having these documents ready can expedite the application process and improve the chances of approval.

Legal Use of the Loan Form

The india loan application form must adhere to specific legal standards to be considered valid. This includes compliance with regulations set forth by financial authorities and ensuring that all provided information is truthful and accurate. Misrepresentation or falsification of information can lead to severe penalties, including loan denial or legal repercussions. It is essential to understand these legal implications when completing the form.

Form Submission Methods

Applicants can submit the india bank loan application form through various methods, depending on the lender's requirements. Common submission options include:

- Online submission via the lender's secure portal

- Mailing a printed copy of the completed form

- In-person submission at the lender's branch office

Each method has its advantages, and choosing the right one can facilitate a smoother application experience.

Eligibility Criteria

Eligibility for a loan through the india loan application form typically depends on several factors, including credit score, income level, and employment history. Lenders assess these criteria to determine whether the applicant can repay the loan. Understanding these requirements beforehand can help applicants better prepare their applications and improve their chances of approval.

Quick guide on how to complete loan form

Complete Loan Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Loan Form on any device with airSlate SignNow's Android or iOS applications, simplifying any document-related process today.

The easiest way to modify and eSign Loan Form without stress

- Find Loan Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Loan Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan form

How to generate an eSignature for a PDF document online

How to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the india loan application form, and how does it work?

The india loan application form is a structured document that collects essential information from applicants seeking a loan. Using airSlate SignNow, you can easily create, send, and eSign this form to streamline the application process. Our solution ensures that you can manage applications efficiently, saving time and reducing the chances of errors.

-

What features does airSlate SignNow provide for the india loan application form?

airSlate SignNow offers a variety of features specifically designed for the india loan application form, including customizable templates, automated reminders, and simple electronic signatures. These features enable you to create a user-friendly experience for your applicants and improve the speed of processing loans. Additionally, our platform supports integration with other tools to enhance your workflow.

-

How can I ensure the security of the india loan application form?

Security is a top priority when handling sensitive information on the india loan application form. airSlate SignNow uses advanced encryption technologies to protect your data during transmission and storage. We also provide user authentication options to ensure that only authorized parties can access the application forms.

-

What are the benefits of using airSlate SignNow for the india loan application form?

By utilizing airSlate SignNow for the india loan application form, businesses can enhance operational efficiency and create a more streamlined process. Our solution reduces paperwork, minimizes manual errors, and accelerates the turnaround time for loan approvals. This ultimately leads to improved customer satisfaction and better business outcomes.

-

Is airSlate SignNow suitable for all types of loan applications in India?

Yes, airSlate SignNow can cater to various types of loan applications in India, including personal loans, business loans, and mortgage applications. The platform allows for customization, enabling businesses to adapt the india loan application form to meet their specific needs. This versatility ensures that you can process any loan application seamlessly.

-

What are the pricing options for using airSlate SignNow for the india loan application form?

airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes. Whether you are a small startup or a large financial institution, you can find a plan that suits your budget and needs for managing the india loan application form. Additionally, we provide a free trial to help you assess our features before committing.

-

Can I integrate airSlate SignNow with other software for the india loan application form?

Absolutely! airSlate SignNow supports integrations with various business tools and applications, making it easy to connect your existing systems with the india loan application form. This ensures that you can automate workflows and manage loan applications efficiently in conjunction with your other software solutions.

Get more for Loan Form

- Bill of sale for watercraft or boat massachusetts form

- Bill of sale of automobile and odometer statement for as is sale massachusetts form

- Construction contract cost plus or fixed fee massachusetts form

- Painting contract for contractor massachusetts form

- Trim carpenter contract for contractor massachusetts form

- Fencing contract for contractor massachusetts form

- Hvac contract for contractor massachusetts form

- Landscape contract for contractor massachusetts form

Find out other Loan Form

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe