Request for Name & Address Change Total Community Credit 2016-2026

Understanding monoline liquor liability

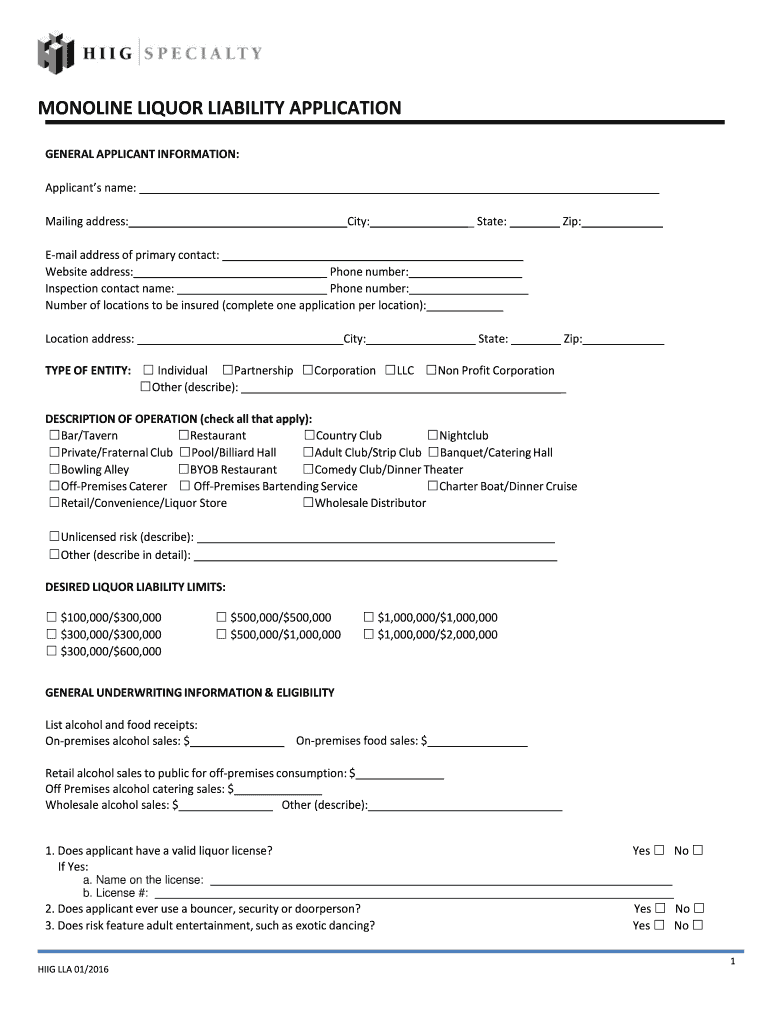

Monoline liquor liability insurance provides coverage specifically for businesses that sell or serve alcoholic beverages. This type of insurance protects against claims resulting from alcohol-related incidents, such as injuries or damages caused by intoxicated patrons. It is essential for bars, restaurants, and other establishments that serve alcohol to have this coverage to mitigate financial risks associated with potential lawsuits.

Key elements of monoline liquor liability

Several critical components define monoline liquor liability insurance. These include:

- Coverage Limits: The policy outlines the maximum amount the insurer will pay for claims, which can vary based on the specific needs of the business.

- Exclusions: Common exclusions may include incidents that occur outside the premises or those involving illegal activities.

- Legal Defense: The policy typically covers legal fees associated with defending against claims, which can be substantial.

- Claims Process: Understanding how to file a claim and what documentation is required is crucial for timely resolution.

Steps to obtain monoline liquor liability insurance

Acquiring monoline liquor liability insurance involves several steps:

- Assess Your Needs: Determine the level of coverage required based on your business size, alcohol sales volume, and local regulations.

- Research Providers: Look for insurance companies that specialize in liquor liability coverage and compare their offerings.

- Request Quotes: Obtain quotes from multiple insurers to understand pricing and coverage options.

- Review Policy Terms: Carefully examine the terms and conditions of the policies, focusing on coverage limits and exclusions.

- Finalize the Purchase: Once you choose a provider, complete the necessary paperwork and make your first premium payment.

Legal use of monoline liquor liability insurance

Monoline liquor liability insurance is legally recognized and often required by state laws for establishments serving alcohol. It serves to protect businesses from financial losses due to lawsuits stemming from alcohol-related incidents. Compliance with local regulations regarding alcohol service is crucial, as failure to maintain adequate insurance can result in penalties or loss of licensing.

Examples of claims covered by monoline liquor liability

Common scenarios that may lead to claims under a monoline liquor liability policy include:

- A patron injures another individual in a bar fight after being overserved.

- A customer drives under the influence after leaving a restaurant, resulting in an accident.

- A guest suffers an injury due to a fall caused by intoxication while on the premises.

State-specific rules for monoline liquor liability

Each state in the U.S. has its own regulations regarding liquor liability insurance. Some states mandate minimum coverage limits, while others may require proof of insurance for licensing. It is essential for business owners to familiarize themselves with their state's specific requirements to ensure compliance and adequate protection.

Quick guide on how to complete request for name ampamp address change total community credit

Complete Request For Name & Address Change Total Community Credit effortlessly on any device

Electronic document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without hold-ups. Manage Request For Name & Address Change Total Community Credit on any device with airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

The easiest way to edit and eSign Request For Name & Address Change Total Community Credit with ease

- Find Request For Name & Address Change Total Community Credit and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Request For Name & Address Change Total Community Credit and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request for name ampamp address change total community credit

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is monoline liquor liability insurance?

Monoline liquor liability insurance provides coverage specifically for businesses that serve or sell alcohol. This type of policy protects against claims arising from incidents related to the consumption of alcohol, such as injuries or property damage. It's crucial for establishments like bars or restaurants to have this protection to mitigate financial risk.

-

Why do I need monoline liquor liability insurance for my business?

Having monoline liquor liability insurance is essential for any business that serves alcohol, as it safeguards against costly lawsuits and claims. This insurance ensures that your business can operate smoothly without the fear of financial liabilities resulting from alcohol-related incidents. Additionally, many states require this coverage for alcohol-serving licenses.

-

How much does monoline liquor liability insurance cost?

The cost of monoline liquor liability insurance varies based on several factors, including the type of business, location, and coverage limits. Generally, businesses can expect to pay a premium that reflects their risk exposure, which can range from hundreds to thousands of dollars annually. It's advisable to get quotes from multiple providers to find the best coverage at a competitive rate.

-

What are the key features of monoline liquor liability insurance?

Key features of monoline liquor liability insurance include coverage for bodily injury and property damage claims related to alcohol consumption. It may also offer legal defense costs for lawsuits that arise from alcohol-related incidents. This specialized coverage ensures that business owners are protected in a variety of scenarios when alcohol is being served.

-

Can monoline liquor liability insurance be bundled with other policies?

Yes, monoline liquor liability insurance can often be bundled with other insurance policies, such as general liability or property insurance. Bundling can lead to cost savings and simplified management of your insurance portfolio. However, it’s important to ensure that all necessary coverages are included to address your business's unique risks.

-

What benefits does monoline liquor liability insurance provide?

Monoline liquor liability insurance offers protection against legal claims arising from alcohol-related incidents, which can be financially devastating without insurance. It provides peace of mind for business owners, allowing them to operate confidently, knowing they have a safety net. Additionally, it helps maintain a professional reputation and compliance with legal requirements.

-

Does monoline liquor liability insurance cover events outside of my business premises?

In most cases, monoline liquor liability insurance covers incidents that occur on your business premises. However, some policies may provide limited coverage for events held offsite, such as catering or special events. It is essential to review policy specifics or speak with an insurance representative to understand the scope of your coverage.

Get more for Request For Name & Address Change Total Community Credit

- Non foreign affidavit under irc 1445 missouri form

- Owners or sellers affidavit of no liens missouri form

- Affidavit of occupancy and financial status missouri form

- Complex will with credit shelter marital trust for large estates missouri form

- Missouri affidavit support form

- Affidavit search warrant form

- Mo search warrant form

- Missouri support form

Find out other Request For Name & Address Change Total Community Credit

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy