Voluntary Disclosure Agreement for Use Tax and 2018-2026

What is the Voluntary Disclosure Agreement for Use Tax?

The Voluntary Disclosure Agreement for Use Tax is a legal document that allows taxpayers to voluntarily disclose their use tax liabilities to the state of Colorado. This agreement provides a means for individuals and businesses to come forward and report unpaid use taxes without facing penalties or interest, provided they meet specific criteria. By entering into this agreement, taxpayers can resolve past tax obligations while minimizing the financial impact of non-compliance.

Steps to Complete the Voluntary Disclosure Agreement for Use Tax

Completing the Voluntary Disclosure Agreement involves several key steps:

- Gather necessary information, including details about your business and any unpaid use tax liabilities.

- Complete the Voluntary Disclosure Agreement form accurately, ensuring all required fields are filled out.

- Submit the completed form to the appropriate state tax authority, either online or via mail.

- Await confirmation from the tax authority regarding the acceptance of your agreement.

- Pay any agreed-upon use tax liabilities as outlined in the agreement.

Required Documents for the Voluntary Disclosure Agreement

To successfully file the Voluntary Disclosure Agreement for Use Tax, you will need to prepare and submit several documents:

- A completed Voluntary Disclosure Agreement form.

- Documentation supporting the calculation of your use tax liabilities.

- Any prior correspondence with the tax authority regarding your use tax obligations.

- Proof of payment for any outstanding liabilities, if applicable.

Eligibility Criteria for the Voluntary Disclosure Agreement

To qualify for the Voluntary Disclosure Agreement, taxpayers must meet specific eligibility criteria:

- The taxpayer must not be currently under audit by the Colorado Department of Revenue.

- The taxpayer must voluntarily disclose all use tax liabilities for the previous years.

- The taxpayer must agree to pay the calculated use tax liabilities within the stipulated time frame.

Form Submission Methods for the Voluntary Disclosure Agreement

The Voluntary Disclosure Agreement can be submitted through various methods, depending on the taxpayer's preference:

- Online submission via the Colorado Department of Revenue's official website.

- Mailing the completed form to the designated address provided by the state tax authority.

- In-person submission at a local tax office, if applicable.

Penalties for Non-Compliance with Use Tax Obligations

Failure to comply with use tax obligations can result in significant penalties, including:

- Interest charges on unpaid taxes, which can accumulate over time.

- Fines imposed by the state for failure to report or pay use taxes.

- Potential legal action taken by the state to recover unpaid tax liabilities.

Quick guide on how to complete voluntary disclosure agreement for use tax and

Complete Voluntary Disclosure Agreement For Use Tax And effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage Voluntary Disclosure Agreement For Use Tax And on any platform with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Voluntary Disclosure Agreement For Use Tax And effortlessly

- Find Voluntary Disclosure Agreement For Use Tax And and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow has specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all information and click on the Done button to save your alterations.

- Decide how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Voluntary Disclosure Agreement For Use Tax And and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the voluntary disclosure agreement for use tax and

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

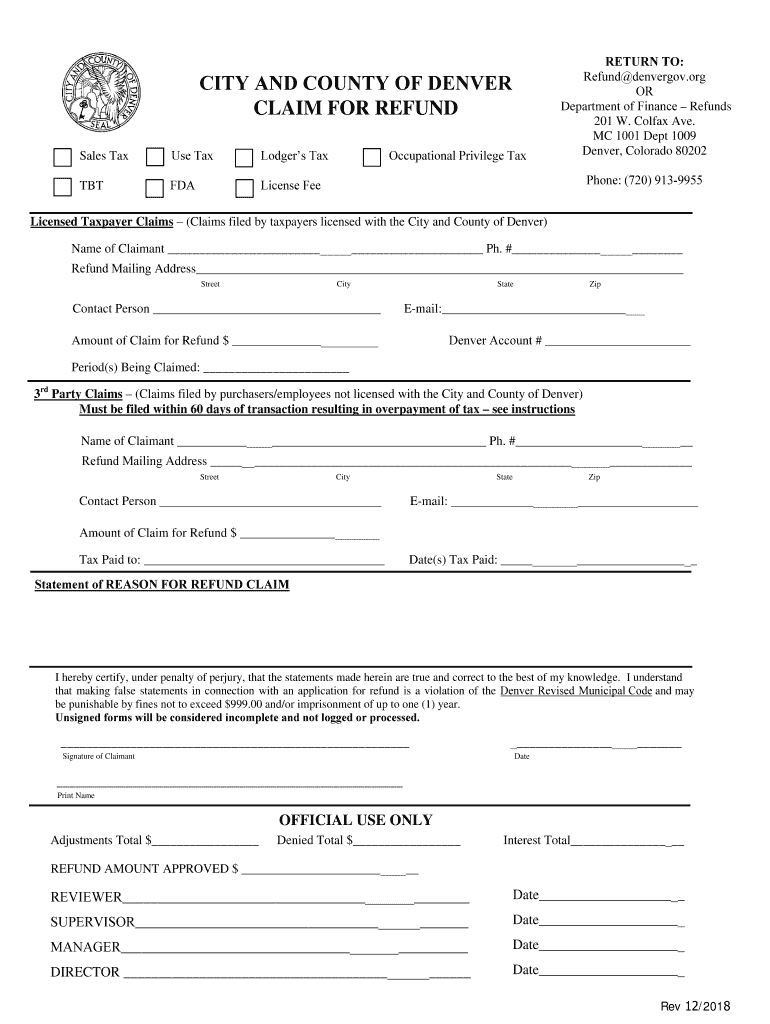

What is the county claim refund form, and how does it work?

The county claim refund form is a document used to request a refund from county services. With airSlate SignNow, you can easily create, send, and eSign this form electronically, streamlining the process and ensuring that all necessary information is included.

-

How can I fill out the county claim refund form using airSlate SignNow?

Filling out the county claim refund form with airSlate SignNow is simple. You can upload the form, customize it as needed, and use our user-friendly interface to add your information. Once completed, you can share it for eSignature, ensuring a quick turnaround.

-

Is there a cost associated with using airSlate SignNow for the county claim refund form?

Yes, there is a pricing plan associated with airSlate SignNow, which offers various tiers to suit your needs. The cost includes access to features that simplify managing documents like the county claim refund form, with options for individuals and businesses.

-

What features does airSlate SignNow offer for the county claim refund form?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and secure storage for your county claim refund form. Additionally, you can track the status of your forms in real-time and automate reminders for signers.

-

How can airSlate SignNow benefit me when using the county claim refund form?

Using airSlate SignNow for your county claim refund form can signNowly reduce processing time and improve organization. By digitizing the process, you can minimize paperwork and ensure that your requests are submitted promptly and accurately.

-

Can I integrate airSlate SignNow with other software for managing the county claim refund form?

Absolutely! airSlate SignNow offers integration with various third-party applications, making it easy to manage your county claim refund form alongside other business tools. This allows for a seamless workflow, saving you time and improving efficiency.

-

Is my information secure when using airSlate SignNow for the county claim refund form?

Yes, airSlate SignNow prioritizes your data security. When using the county claim refund form, your information is encrypted and compliant with various regulations, ensuring that it remains confidential and protected from unauthorized access.

Get more for Voluntary Disclosure Agreement For Use Tax And

- Name change notification form new jersey

- Commercial building or space lease new jersey form

- Nj legal documents 497319364 form

- New jersey standby temporary guardian legal documents package new jersey form

- New jersey bankruptcy guide and forms package for chapters 7 or 13 new jersey

- Bill of sale with warranty by individual seller new jersey form

- Bill of sale with warranty for corporate seller new jersey form

- Bill of sale without warranty by individual seller new jersey form

Find out other Voluntary Disclosure Agreement For Use Tax And

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later