Certificate of Taxes Due for Business Personal Property and 2015-2026

What is the Certificate of Taxes Due for Business Personal Property?

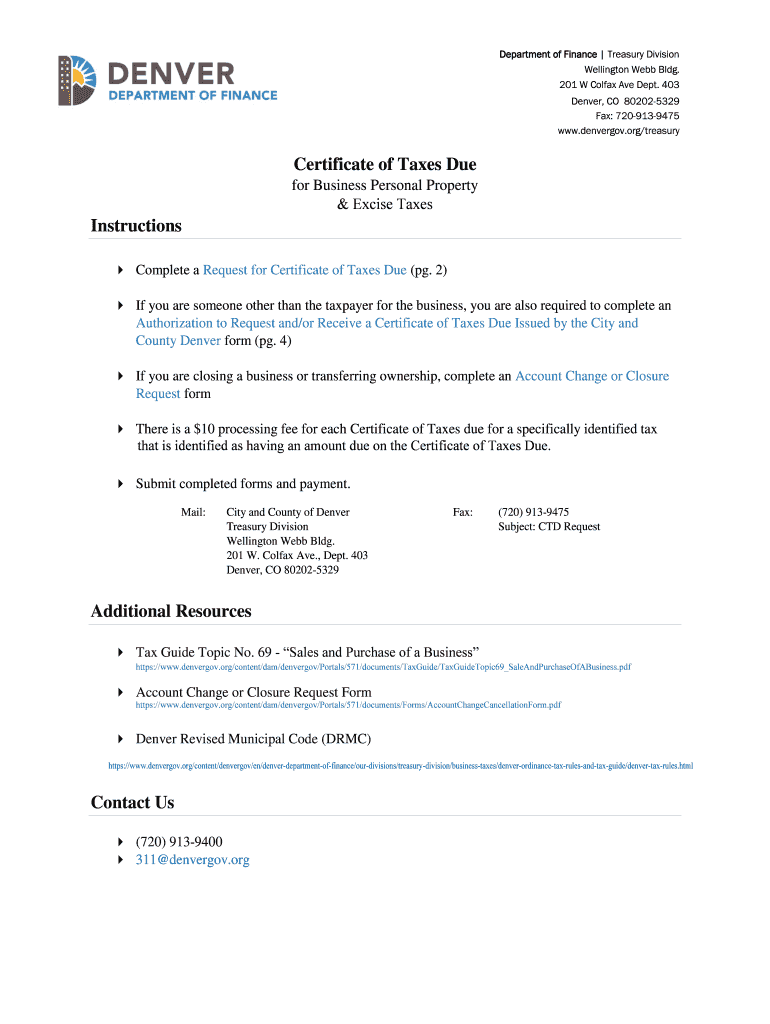

The Certificate of Taxes Due for Business Personal Property is an official document that indicates the amount of taxes owed on personal property used for business purposes. This certificate is essential for businesses operating in Denver, as it verifies that all tax obligations have been met. It serves as proof of compliance with local tax regulations and is often required for various business transactions, such as securing loans or renewing licenses.

How to Use the Certificate of Taxes Due for Business Personal Property

This certificate can be used in several ways to facilitate business operations. Primarily, it acts as verification for lenders or investors that a business is in good standing regarding its tax obligations. Additionally, it may be required when applying for certain permits or licenses, ensuring that the business complies with local regulations. Properly utilizing this certificate can help maintain a positive reputation and avoid potential legal issues.

Steps to Complete the Certificate of Taxes Due for Business Personal Property

Completing the Certificate of Taxes Due involves several key steps:

- Gather necessary documentation, including previous tax returns and property records.

- Fill out the certificate form accurately, ensuring all business details are correct.

- Calculate the total amount of taxes due based on the assessed value of the personal property.

- Submit the completed form to the appropriate Denver tax authority, either online or via mail.

Following these steps ensures that the certificate is completed correctly and submitted on time, helping to avoid penalties.

Legal Use of the Certificate of Taxes Due for Business Personal Property

This certificate holds legal significance, as it confirms that a business has fulfilled its tax obligations. It can be presented in legal proceedings or audits as proof of compliance. Additionally, the certificate may be required when transferring ownership of business assets or during mergers and acquisitions, making it a critical document for maintaining legal and financial integrity.

Required Documents for the Certificate of Taxes Due for Business Personal Property

To obtain the Certificate of Taxes Due, businesses typically need to provide several documents:

- Previous tax returns related to business personal property.

- Records of property assessments and valuations.

- Identification documents for the business owner or authorized representative.

Having these documents ready can streamline the application process and ensure accuracy in reporting tax obligations.

Filing Deadlines for the Certificate of Taxes Due for Business Personal Property

It is crucial for businesses to be aware of filing deadlines to avoid penalties. In Denver, the deadline for submitting the Certificate of Taxes Due typically aligns with the annual tax filing period. Businesses should check local regulations for specific dates and ensure timely submission to maintain compliance and avoid any late fees.

Quick guide on how to complete certificate of taxes due for business personal property and

Complete Certificate Of Taxes Due For Business Personal Property And effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It presents an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly and without delays. Handle Certificate Of Taxes Due For Business Personal Property And on any device with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to alter and eSign Certificate Of Taxes Due For Business Personal Property And effortlessly

- Obtain Certificate Of Taxes Due For Business Personal Property And and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Certificate Of Taxes Due For Business Personal Property And and guarantee exceptional communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certificate of taxes due for business personal property and

How to make an eSignature for a PDF in the online mode

How to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What are the benefits of using airSlate SignNow for Denver taxes?

Using airSlate SignNow for Denver taxes allows businesses to efficiently manage tax documents with electronic signatures. This solution streamlines the signing process, reduces paper usage, and ensures secure storage of important tax documents. Additionally, it helps to maintain compliance with local tax regulations, making it easier for businesses to stay organized.

-

How does airSlate SignNow integrate with other platforms for handling Denver taxes?

airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to manage Denver taxes. With integrations like QuickBooks and Salesforce, users can automate workflows, save time, and improve overall efficiency. This connectivity ensures tax-related documents are accessible and well-organized across multiple platforms.

-

Is airSlate SignNow cost-effective for handling Denver taxes?

Yes, airSlate SignNow offers a cost-effective solution for handling Denver taxes. The pricing plans are designed to suit businesses of all sizes, providing essential features without breaking the bank. This affordability ensures that even small businesses can manage their tax documents efficiently.

-

What features does airSlate SignNow offer for Denver taxes?

airSlate SignNow provides a range of features essential for managing Denver taxes, including electronic signatures, document templates, and real-time tracking. These features allow users to quickly prepare, send, and sign tax documents, ensuring a smooth workflow. Additionally, users benefit from advanced security measures to protect sensitive tax information.

-

How can airSlate SignNow help with tax document compliance in Denver?

AirSlate SignNow helps ensure compliance with Denver taxes by providing legally binding electronic signatures and an audit trail for all transactions. This transparency allows businesses to demonstrate compliance with state and federal regulations. Furthermore, the platform keeps all tax-related documents securely stored and easily accessible for audits or reviews.

-

Can airSlate SignNow assist businesses unfamiliar with Denver taxes?

Absolutely! airSlate SignNow offers user-friendly tools that simplify the process of managing Denver taxes, making it ideal for businesses unfamiliar with tax procedures. The intuitive interface and readily available templates guide users to efficiently create and manage their tax documents. Plus, customer support is always available for further assistance.

-

What types of documents can airSlate SignNow handle for Denver taxes?

airSlate SignNow can manage a variety of documents related to Denver taxes, including W-2 forms, 1099s, and business tax returns. This versatility allows businesses to handle all their tax documentation needs within a single platform. By centralizing document management, airSlate SignNow helps ensure that all tax records are organized and easily accessible.

Get more for Certificate Of Taxes Due For Business Personal Property And

Find out other Certificate Of Taxes Due For Business Personal Property And

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word