Election on Disposition of Property by a Taxpayer to a Canada Ca Form

Understanding the Election on Disposition of Property

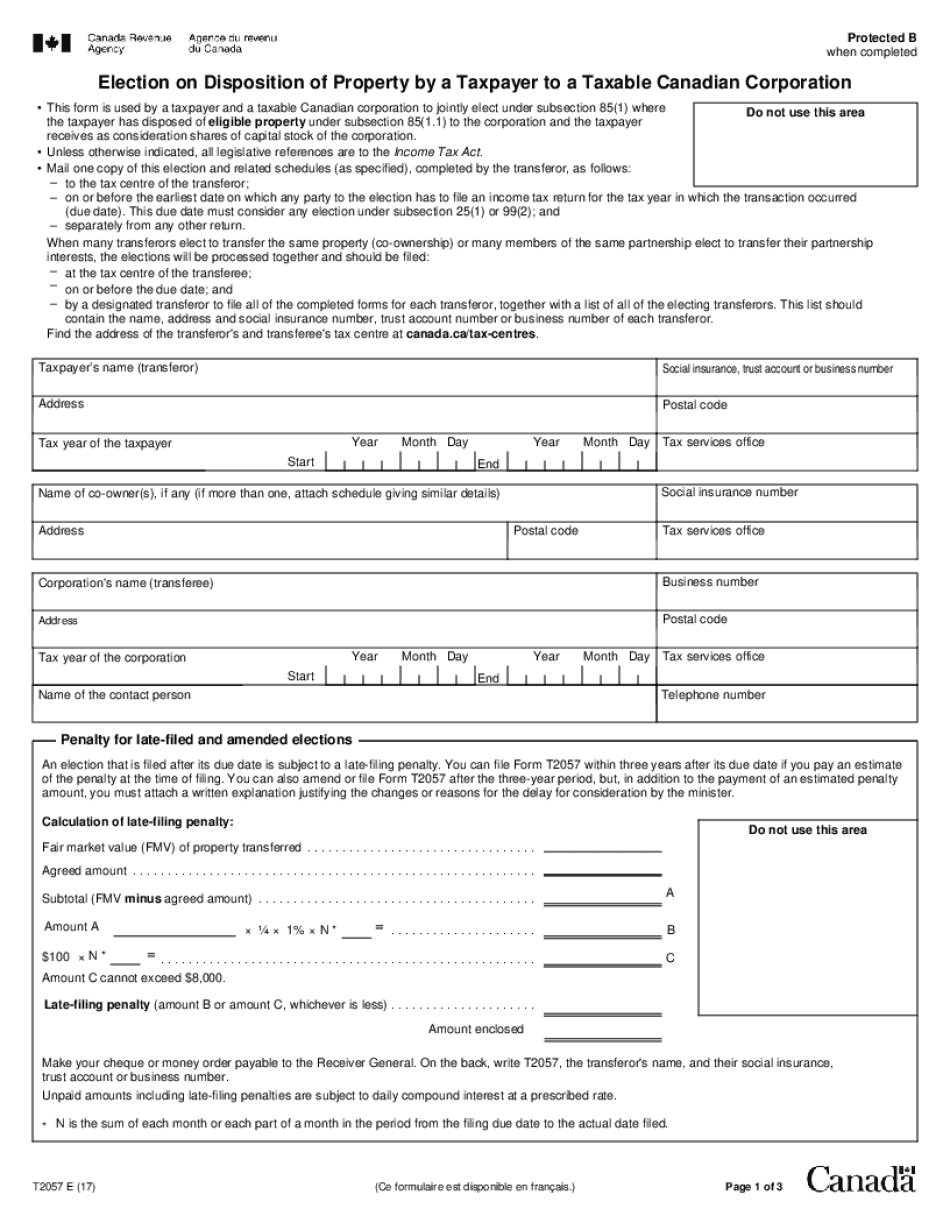

The Election on Disposition of Property by a Taxpayer to Canada (form T2057) is a crucial document for taxpayers who wish to elect to defer capital gains tax on the disposition of certain properties. This election allows taxpayers to report the sale of a property without immediate tax implications, enabling them to manage their tax liabilities more effectively. It is particularly relevant for individuals who are selling properties that may appreciate in value over time, allowing for strategic financial planning.

Steps to Complete the T2057 Form

Completing the T2057 form involves several key steps to ensure accuracy and compliance with tax regulations. Begin by gathering necessary information about the property being disposed of, including its fair market value and acquisition details. Next, fill out the form by providing your personal information, details of the property, and the election choice. It is essential to double-check all entries for accuracy before submission. Finally, submit the form to the appropriate tax authority by the specified deadline to ensure the election is valid.

Eligibility Criteria for the T2057 Election

To be eligible for the T2057 election, taxpayers must meet specific criteria. The property in question must qualify under Canadian tax law, typically involving real estate or other capital assets. Additionally, the taxpayer must be the legal owner of the property and must not have previously made a similar election for the same property. Understanding these criteria helps taxpayers determine if they can benefit from this election and avoid potential penalties for ineligibility.

Required Documents for Filing the T2057

When filing the T2057 form, taxpayers must prepare certain documents to support their election. This includes proof of ownership, such as property deeds or purchase agreements, and documentation that verifies the property's fair market value. Taxpayers may also need to provide financial statements or tax returns that reflect the property's income-generating potential. Having these documents ready ensures a smoother filing process and strengthens the validity of the election.

Submission Methods for the T2057 Form

The T2057 form can be submitted through various methods, including online, by mail, or in person, depending on the preferences of the taxpayer and the requirements of the tax authority. Online submissions may offer quicker processing times, while mailing the form allows for physical documentation. It is important to follow the guidelines provided by the tax authority regarding submission methods to ensure timely and proper processing of the election.

Penalties for Non-Compliance with T2057 Regulations

Failure to comply with the regulations surrounding the T2057 election can result in significant penalties. Taxpayers who do not submit the form by the deadline or who provide inaccurate information may face fines or additional taxes owed. Understanding these potential consequences emphasizes the importance of careful preparation and timely filing. Taxpayers should stay informed about compliance requirements to avoid any unexpected financial burdens.

Quick guide on how to complete election on disposition of property by a taxpayer to a canadaca

Complete Election On Disposition Of Property By A Taxpayer To A Canada ca effortlessly on any device

Digital document management has gained traction among enterprises and individuals. It offers a fantastic eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the resources needed to generate, modify, and electronically sign your documents efficiently without delays. Manage Election On Disposition Of Property By A Taxpayer To A Canada ca on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Election On Disposition Of Property By A Taxpayer To A Canada ca with ease

- Obtain Election On Disposition Of Property By A Taxpayer To A Canada ca and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to store your changes.

- Select how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow meets all your needs in document management with a few clicks from any device you prefer. Modify and electronically sign Election On Disposition Of Property By A Taxpayer To A Canada ca to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the election on disposition of property by a taxpayer to a canadaca

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is t2057 in relation to airSlate SignNow?

The t2057 designation refers to a specific document type supported by airSlate SignNow, facilitating the electronic signing process. By using t2057 compliant solutions, businesses can ensure that their document signing practices meet legal standards and regulatory requirements.

-

How does airSlate SignNow handle pricing for t2057 signing features?

airSlate SignNow offers competitive pricing plans that include features necessary for handling t2057 documents. Various subscription levels ensure that businesses of all sizes can access t2057 signing capabilities without overspending.

-

What are the key features of airSlate SignNow for t2057 documentation?

airSlate SignNow provides intuitive features specifically designed for managing t2057 documents, including customizable templates and advanced signature tracking. These features streamline workflows and enhance the usability of t2057 for both senders and signers.

-

What benefits does using airSlate SignNow with t2057 offer?

Utilizing airSlate SignNow for t2057 documents enhances efficiency and reduces turnaround times. The electronic signature process for t2057 is faster and more secure compared to traditional methods, leading to improved customer satisfaction.

-

Can airSlate SignNow integrate with other tools for processing t2057 forms?

Yes, airSlate SignNow supports integrations with various platforms, allowing businesses to manage t2057 forms seamlessly within their established workflows. This compatibility enhances productivity and supports diverse business applications.

-

Is airSlate SignNow compliant with t2057 signing regulations?

Absolutely. airSlate SignNow ensures that all t2057 document signing processes adhere to legal requirements and electronic signature laws. This compliance provides peace of mind for businesses relying on t2057 for their documentation needs.

-

How secure is airSlate SignNow when signing t2057 documents?

airSlate SignNow prioritizes security and employs advanced encryption protocols to protect t2057 documents. This ensures that sensitive information remains confidential throughout the entire signing process.

Get more for Election On Disposition Of Property By A Taxpayer To A Canada ca

- Virginia guardian 497428426 form

- New state resident package virginia form

- Health care directive advance medical directive includes living will and health care decisions virginia form

- Commercial property sales package virginia form

- Virginia revocation 497428430 form

- General partnership package virginia form

- Contract for deed package virginia form

- Virginia poa form

Find out other Election On Disposition Of Property By A Taxpayer To A Canada ca

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later