Form 945 Annual Return of Withheld Federal Income Tax

What is the Form 945 Annual Return Of Withheld Federal Income Tax

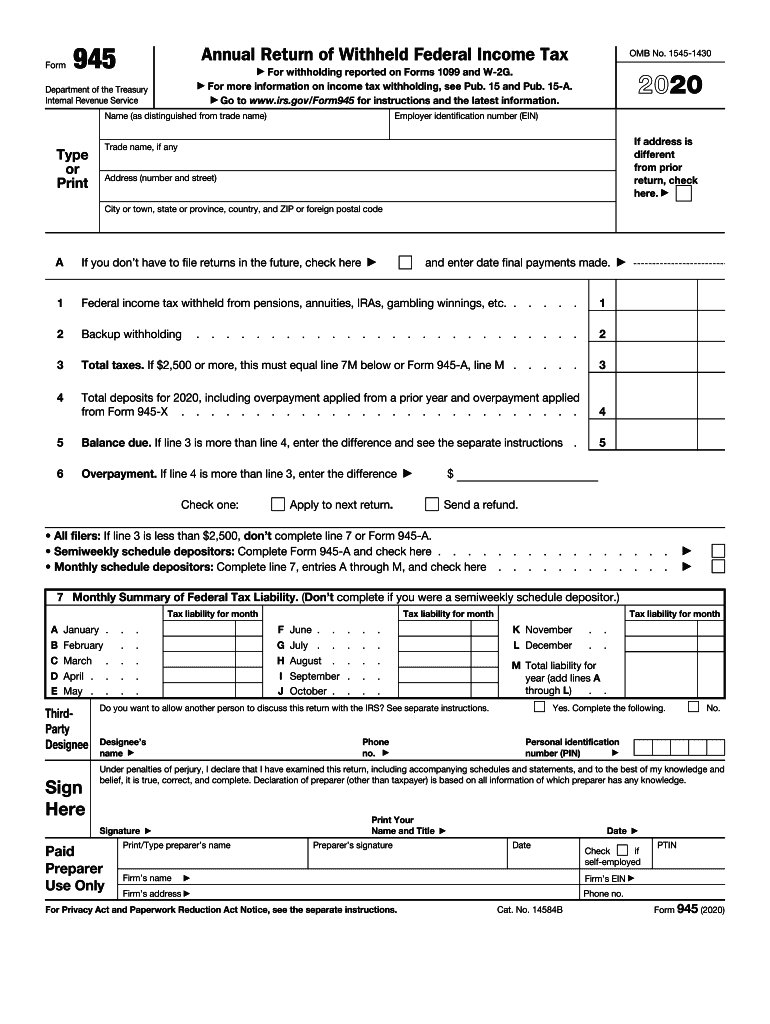

The Form 945 is the Annual Return of Withheld Federal Income Tax, used by businesses to report federal income tax withheld from nonpayroll payments. This form is essential for employers who have withheld federal income tax from payments such as pensions, annuities, and other non-wage compensation. It ensures compliance with IRS regulations and helps maintain accurate tax records.

Steps to complete the Form 945 Annual Return Of Withheld Federal Income Tax

Completing the Form 945 involves several key steps:

- Gather necessary information, including the total amount of federal income tax withheld and the payer's details.

- Fill out the form accurately, ensuring that all required fields are completed, such as the payer's name, address, and Employer Identification Number (EIN).

- Calculate the total federal income tax withheld for the year, which will be reported on the form.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the specified deadline.

Filing Deadlines / Important Dates

It is vital to adhere to filing deadlines to avoid penalties. The Form 945 is typically due by January 31 of the year following the tax year being reported. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Employers should also be aware of any additional requirements for electronic filing, which may have different deadlines.

Legal use of the Form 945 Annual Return Of Withheld Federal Income Tax

The legal use of the Form 945 is crucial for compliance with federal tax laws. Employers must accurately report the amount of federal income tax withheld to avoid penalties and ensure that the IRS has the correct information for tax purposes. Failure to file or inaccuracies can lead to legal repercussions, including fines and audits.

How to obtain the Form 945 Annual Return Of Withheld Federal Income Tax

The Form 945 can be easily obtained from the IRS website or through tax preparation software. It is available in both PDF format for manual completion and as an electronic form for digital submission. Employers can also request a paper copy by contacting the IRS directly if needed.

Key elements of the Form 945 Annual Return Of Withheld Federal Income Tax

Key elements of the Form 945 include the payer's information, the total amount of federal income tax withheld, and the signature of the authorized person. Additionally, the form requires the reporting of any adjustments made during the year, ensuring that all withholding amounts are accurate and up-to-date. Understanding these elements is essential for proper completion and compliance.

Quick guide on how to complete 2020 form 945 annual return of withheld federal income tax

Complete Form 945 Annual Return Of Withheld Federal Income Tax effortlessly on any device

Digital document management has gained increased traction among businesses and individuals. It serves as a suitable eco-friendly alternative to traditional printed and signed paperwork, enabling you to locate the appropriate form and securely save it online. airSlate SignNow offers you all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Form 945 Annual Return Of Withheld Federal Income Tax on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form 945 Annual Return Of Withheld Federal Income Tax with ease

- Find Form 945 Annual Return Of Withheld Federal Income Tax and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the document or hide sensitive information using the tools that airSlate SignNow offers specifically for such tasks.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign Form 945 Annual Return Of Withheld Federal Income Tax and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 945 annual return of withheld federal income tax

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What are the key features of airSlate SignNow for managing form 945 instructions 2020?

airSlate SignNow offers a comprehensive set of features that simplify the management of documentation such as form 945 instructions 2020. With eSignature capabilities, cloud storage, and customizable workflows, users can efficiently handle their forms and ensure compliance. This helps streamline the filing process and improve overall productivity.

-

How does airSlate SignNow ensure the security of my form 945 instructions 2020?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like form 945 instructions 2020. Our platform employs advanced encryption and secure access controls to protect your data. Additionally, every signed document is stored securely in compliance with regulatory standards.

-

Is airSlate SignNow suitable for small businesses filing form 945 instructions 2020?

Absolutely! airSlate SignNow is designed to be a cost-effective solution, making it ideal for small businesses managing form 945 instructions 2020. With affordable pricing plans and user-friendly features, it empowers small businesses to streamline their documentation processes without breaking the bank.

-

What integrations does airSlate SignNow provide for those using form 945 instructions 2020?

airSlate SignNow offers a variety of integrations with popular platforms, which can greatly benefit users handling form 945 instructions 2020. Compatible tools include Google Drive, Salesforce, and various CRM systems, allowing you to efficiently manage your forms and enhance workflow. These integrations make it easier to incorporate eSigning into your existing processes.

-

Can I customize my forms for form 945 instructions 2020 within airSlate SignNow?

Yes, airSlate SignNow allows users to customize their forms, including form 945 instructions 2020, to meet their specific needs. You can add fields, change the layout, and tailor the content to align with your company’s requirements. This flexibility helps ensure that your forms serve their intended purpose effectively.

-

How can airSlate SignNow improve the speed of processing form 945 instructions 2020?

By utilizing airSlate SignNow, businesses can drastically improve the speed of processing form 945 instructions 2020. The platform allows users to send, sign, and manage documents electronically, eliminating the need for physical paperwork. The intuitive interface ensures quick navigation and faster turnaround times, enhancing overall efficiency.

-

What support options are available for users handling form 945 instructions 2020 with airSlate SignNow?

airSlate SignNow provides a range of support options to assist users with form 945 instructions 2020. Customers can access a comprehensive help center, and live chat support is also available. Our dedicated customer service team is ready to help you resolve any issues, ensuring that your experience with our platform is seamless.

Get more for Form 945 Annual Return Of Withheld Federal Income Tax

- Letter from tenant to landlord about landlords failure to make repairs wyoming form

- Letter from landlord to tenant as notice that rent was voluntarily lowered in exchange for tenant agreeing to make repairs 497432213 form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession wyoming form

- Letter from tenant to landlord about illegal entry by landlord wyoming form

- Letter from landlord to tenant about time of intent to enter premises wyoming form

- Wyoming tenant landlord 497432217 form

- Letter from tenant to landlord about sexual harassment wyoming form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children wyoming form

Find out other Form 945 Annual Return Of Withheld Federal Income Tax

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT