Form 8853 Archer MSAs and Long Term Care Insurance Contracts

What is the Form 8853 Archer MSAs And Long Term Care Insurance Contracts

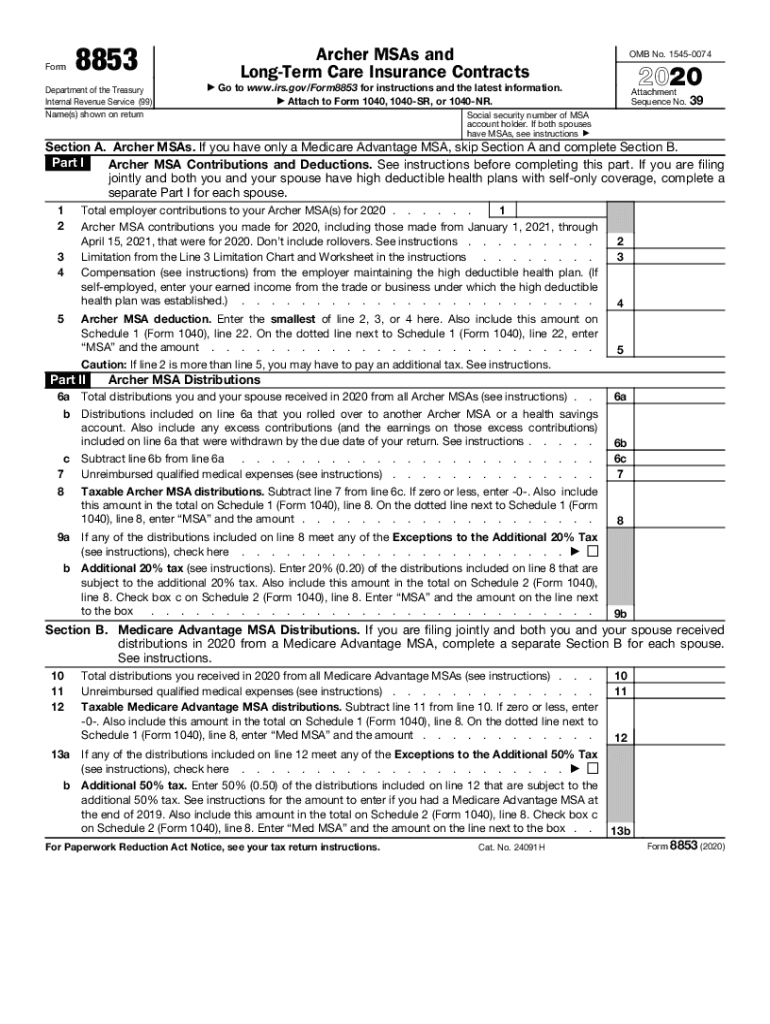

The 2020 Form 8853 is designed for reporting contributions to Archer Medical Savings Accounts (MSAs) and long-term care insurance contracts. Archer MSAs are tax-advantaged accounts that allow individuals to save for medical expenses. This form is essential for taxpayers who wish to claim deductions for contributions made to these accounts. It also provides information on distributions from the accounts, ensuring compliance with IRS regulations.

How to use the Form 8853 Archer MSAs And Long Term Care Insurance Contracts

To effectively use the 2020 Form 8853, taxpayers must first gather all necessary documentation regarding their Archer MSAs and long-term care insurance. This includes details about contributions made during the tax year, distributions received, and any relevant insurance contracts. The form requires accurate reporting of these figures to determine eligibility for tax benefits. Once completed, the form should be submitted along with the taxpayer's annual tax return.

Steps to complete the Form 8853 Archer MSAs And Long Term Care Insurance Contracts

Completing the 2020 Form 8853 involves several key steps:

- Gather all relevant financial documents, including records of contributions and distributions.

- Fill out the form by entering personal information and the details of the Archer MSAs and long-term care contracts.

- Calculate any applicable deductions or credits based on the information provided.

- Review the completed form for accuracy before submission.

- Submit the form with your tax return to the IRS.

Legal use of the Form 8853 Archer MSAs And Long Term Care Insurance Contracts

The legal use of the 2020 Form 8853 is governed by IRS regulations. It must be filled out accurately to ensure compliance with tax laws. Failure to properly report contributions or distributions can result in penalties or disallowed deductions. It is crucial for taxpayers to understand the legal implications of the information reported on this form to avoid potential issues with the IRS.

Filing Deadlines / Important Dates

For the 2020 tax year, the filing deadline for submitting the Form 8853 is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes to deadlines and ensure timely submission to avoid penalties.

Eligibility Criteria

To be eligible to use the 2020 Form 8853, individuals must have established an Archer MSA and made contributions to it during the tax year. Additionally, they must meet specific criteria set forth by the IRS, including being covered under a high-deductible health plan. Understanding these eligibility requirements is essential for taxpayers looking to benefit from the tax advantages associated with Archer MSAs.

Quick guide on how to complete 2020 form 8853 archer msas and long term care insurance contracts

Complete Form 8853 Archer MSAs And Long Term Care Insurance Contracts effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle Form 8853 Archer MSAs And Long Term Care Insurance Contracts on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Form 8853 Archer MSAs And Long Term Care Insurance Contracts with ease

- Acquire Form 8853 Archer MSAs And Long Term Care Insurance Contracts and then click Get Form to initiate.

- Make use of the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your edits.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, monotonous form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs with a few clicks from any device of your preference. Modify and eSign Form 8853 Archer MSAs And Long Term Care Insurance Contracts to guarantee outstanding communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8853 archer msas and long term care insurance contracts

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the 2020 Form 8853 and how do I use it?

The 2020 Form 8853 is used for reporting Health Savings Accounts (HSAs) and Medical Savings Accounts (MSAs). Businesses and individuals can utilize airSlate SignNow to easily fill out, send, and eSign this form, ensuring compliance with IRS requirements.

-

How can airSlate SignNow help me with the 2020 Form 8853?

airSlate SignNow streamlines the process of completing the 2020 Form 8853 by providing an easy-to-use interface and templates that guide you through the required information. You can quickly distribute the form to multiple signers and track its status for added convenience.

-

Is there a cost associated with using airSlate SignNow for 2020 Form 8853?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that simplify the completion and signing of the 2020 Form 8853, making it a cost-effective solution for your document management.

-

What are the key features of airSlate SignNow for handling forms like the 2020 Form 8853?

airSlate SignNow includes features like document templates, in-app eSigning, real-time status tracking, and cloud storage, which make managing the 2020 Form 8853 seamless. These tools enhance productivity and ensure that all necessary documents are easily accessible.

-

Can I integrate airSlate SignNow with other software for processing the 2020 Form 8853?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing you to import data and manage documents efficiently for the 2020 Form 8853. This flexibility enhances your overall workflow and reduces manual data entry errors.

-

How does airSlate SignNow ensure the security of my 2020 Form 8853?

Security is a top priority for airSlate SignNow. All documents, including the 2020 Form 8853, are encrypted and stored securely, ensuring that sensitive health-related information is protected during storage and transmission.

-

What benefits does airSlate SignNow provide for businesses submitting the 2020 Form 8853?

By using airSlate SignNow, businesses can save time and enhance efficiency when submitting the 2020 Form 8853. The platform allows for quick collaboration, easy adjustments, and ensures compliance, allowing you to focus on other important aspects of your business.

Get more for Form 8853 Archer MSAs And Long Term Care Insurance Contracts

- Standard business card layout form

- The craigmore halifax form

- Maintenance request form 244113634

- Odometer disclosure statement atlantic city classic car auction form

- Wwworegongovodotdmvoregon department of transportation vehicle trip permits form

- Daily outdoor safety checklist form

- City of encinitas permits form

- Pdf charity golf tournament flyer the italian catholic federation form

Find out other Form 8853 Archer MSAs And Long Term Care Insurance Contracts

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation