File Circuit Breaker Online Missouri Form

Understanding the Circuit Breaker Application in Missouri

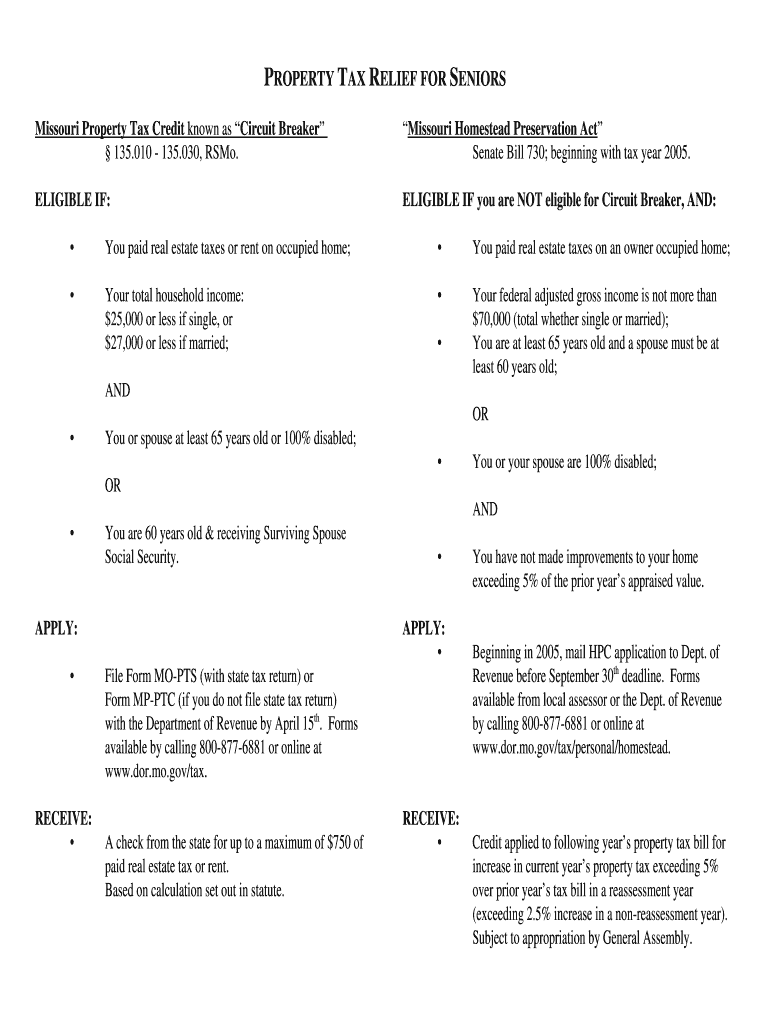

The Circuit Breaker application in Missouri is a property tax relief program designed to assist eligible homeowners and renters. This program provides financial assistance to those who meet specific income and age criteria, primarily aimed at seniors and individuals with disabilities. By reducing the property tax burden, it helps ensure that residents can maintain their homes without facing undue financial strain.

Eligibility Criteria for Missouri Property Tax Relief

To qualify for Missouri property tax relief, applicants must meet certain criteria, including:

- Age: Applicants must be at least sixty-five years old or be a person with a disability.

- Income: There are income limits that vary based on household size, typically requiring a total income below a specified threshold.

- Residency: Applicants must be residents of Missouri and have owned or rented their home for a minimum period.

Meeting these criteria is essential for successful application and approval of the Circuit Breaker tax credit.

Steps to Complete the Circuit Breaker Form in Missouri

Filing the Circuit Breaker form is a straightforward process that can be completed online. Here are the steps to follow:

- Gather necessary documents, including proof of income, residency, and age or disability status.

- Access the online application portal designated for the Circuit Breaker program.

- Fill out the required fields on the form, ensuring all information is accurate and complete.

- Submit the form electronically, ensuring you receive confirmation of submission.

These steps help streamline the application process, making it easier for eligible individuals to apply for tax relief.

Required Documents for the Circuit Breaker Application

When applying for the Circuit Breaker tax relief, applicants must provide specific documents to verify their eligibility. Required documents typically include:

- Proof of income, such as tax returns or pay stubs.

- Identification documents, like a driver's license or state ID.

- Proof of residency, such as utility bills or lease agreements.

Having these documents ready can expedite the application process and improve the chances of approval.

Form Submission Methods for the Circuit Breaker Application

The Circuit Breaker application can be submitted through various methods, allowing flexibility for applicants. The primary submission methods include:

- Online: The most efficient method, allowing for immediate processing and confirmation.

- Mail: Applicants can print the form and send it to the appropriate state office.

- In-Person: Some applicants may prefer to submit their forms directly at local government offices.

Each method has its advantages, and applicants should choose the one that best suits their needs.

Tracking Your Circuit Breaker Refund Status

After submitting the Circuit Breaker application, applicants may want to track their refund status. This can typically be done through the state’s online portal or by contacting the local tax office. Keeping track of the application status ensures that applicants are informed about any additional requirements or the approval timeline.

Quick guide on how to complete file circuit breaker online missouri

Effortlessly Prepare File Circuit Breaker Online Missouri on Any Device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without any delays. Manage File Circuit Breaker Online Missouri on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign File Circuit Breaker Online Missouri Without Stress

- Find File Circuit Breaker Online Missouri and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign File Circuit Breaker Online Missouri and maintain effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the file circuit breaker online missouri

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is Missouri property tax relief?

Missouri property tax relief refers to programs designed to assist eligible homeowners and renters in reducing their property tax burden. These programs can provide financial assistance and exemptions, helping individuals manage tax payments more effectively. Understanding Missouri property tax relief options is essential for homeowners seeking to alleviate their financial responsibilities.

-

How can airSlate SignNow help with Missouri property tax relief applications?

airSlate SignNow simplifies the application process for Missouri property tax relief by allowing users to easily send and eSign necessary documents. This efficient solution saves time and ensures that all paperwork is accurately completed and submitted. With airSlate SignNow, applicants can quickly navigate the requirements for Missouri property tax relief.

-

What features does airSlate SignNow offer for managing property tax relief documents?

airSlate SignNow offers features such as customizable templates, eSigning capabilities, and secure document storage that streamline the management of property tax relief documents. Users can track document status and ensure compliance with state requirements, making the process easier. These robust features are designed to assist those seeking Missouri property tax relief efficiently.

-

Is airSlate SignNow cost-effective for businesses seeking Missouri property tax relief solutions?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to manage property tax relief applications and documents. The pricing structure is designed to fit the budgets of small and large organizations alike. Utilizing airSlate SignNow can ultimately save time and resources while navigating Missouri property tax relief options.

-

Can airSlate SignNow integrate with other tools to help manage property tax relief applications?

Absolutely! airSlate SignNow integrates seamlessly with a variety of tools and software, enhancing the efficiency of managing property tax relief applications. These integrations allow users to connect their existing platforms, ensuring a smooth workflow. This feature is particularly beneficial for businesses engaged in Missouri property tax relief processes.

-

What are the benefits of using airSlate SignNow for property tax relief documentation?

Using airSlate SignNow for property tax relief documentation offers numerous benefits, including expedited processing and enhanced document security. The ability to eSign documents reduces delays caused by mailing physical copies. Furthermore, businesses can maintain compliance with Missouri property tax relief requirements while improving their operational efficiency.

-

How do I get started with airSlate SignNow for Missouri property tax relief?

Getting started with airSlate SignNow is straightforward. Simply create an account, explore the available features, and begin uploading your property tax relief documents. With user-friendly tools, airSlate SignNow caters to both novice and experienced users, making it easier to handle Missouri property tax relief applications.

Get more for File Circuit Breaker Online Missouri

Find out other File Circuit Breaker Online Missouri

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online