Ct Resale Certificate Form

What is the Ct Resale Certificate

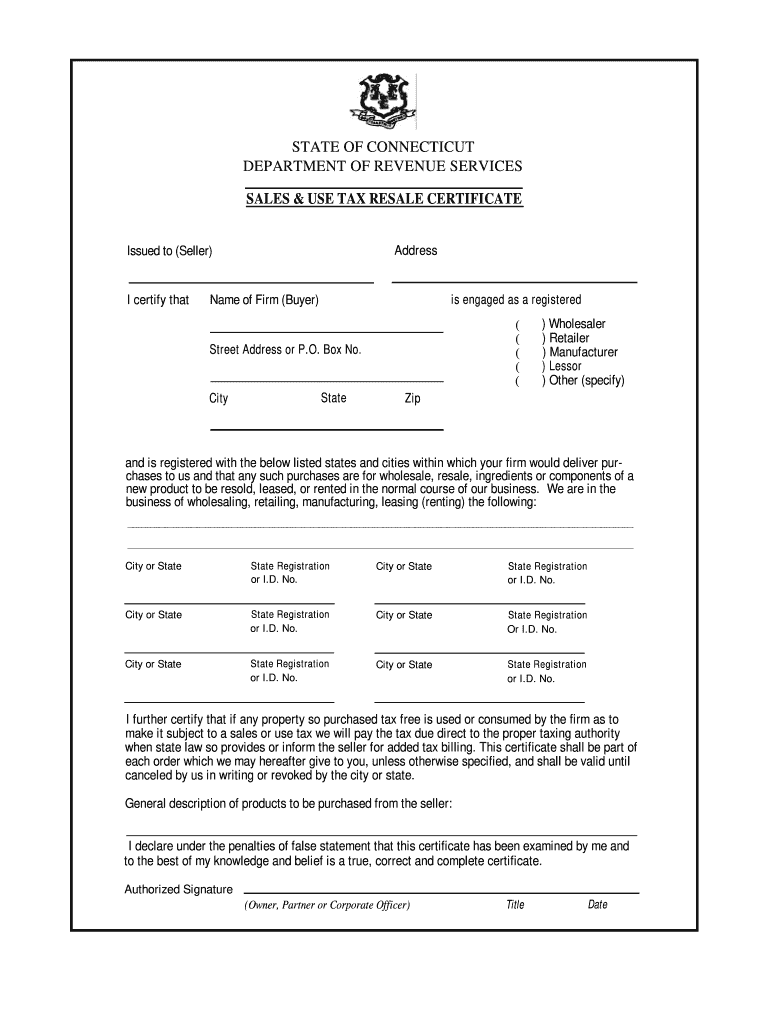

The Ct resale certificate is a legal document that allows businesses in Connecticut to purchase goods without paying sales tax. This certificate is particularly useful for retailers and wholesalers who intend to resell the products they acquire. By providing this certificate to suppliers, businesses can avoid upfront sales tax costs, which can enhance cash flow and streamline purchasing processes. It is essential for the certificate to be filled out accurately to ensure compliance with Connecticut state tax regulations.

How to use the Ct Resale Certificate

To use the Ct resale certificate, a buyer must present it to the seller at the time of purchase. The certificate should include specific information, such as the buyer's name, address, and the seller’s details. Additionally, it must state that the goods purchased are intended for resale. Sellers are required to keep these certificates on file to substantiate their tax-exempt sales. Proper usage of the certificate helps both parties comply with tax laws and avoid penalties.

Steps to complete the Ct Resale Certificate

Completing the Ct resale certificate involves several key steps:

- Obtain the official Ct resale certificate form, which can be found on the Connecticut Department of Revenue Services (DRS) website.

- Fill in your business name, address, and sales tax registration number accurately.

- Provide the seller's name and address.

- Clearly indicate the type of goods being purchased for resale.

- Sign and date the certificate to confirm its validity.

Ensure that all information is accurate to prevent any compliance issues during tax audits.

Legal use of the Ct Resale Certificate

The legal use of the Ct resale certificate is governed by state tax laws. It is crucial for businesses to use the certificate only for purchases intended for resale. Misuse of the certificate, such as using it for personal purchases or non-resale items, can lead to penalties and fines. Businesses should maintain thorough records of all transactions involving the resale certificate to demonstrate compliance during audits by the Connecticut Department of Revenue Services.

Eligibility Criteria

To qualify for a Ct resale certificate, a business must be registered with the Connecticut Department of Revenue Services and possess a valid sales tax permit. This permit confirms that the business is engaged in selling tangible personal property or taxable services. Additionally, the business must be purchasing items specifically for resale in the regular course of its operations. Individuals or businesses not meeting these criteria are not eligible to use the resale certificate.

Required Documents

When applying for a Ct resale certificate, businesses need to prepare specific documents, including:

- A completed application form for the sales tax permit.

- Proof of business registration, such as a business license or incorporation documents.

- Any additional documentation that may be required by the Connecticut Department of Revenue Services.

Having these documents ready can expedite the application process and ensure compliance with state regulations.

Quick guide on how to complete ct resale certificate

Easily prepare Ct Resale Certificate on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and safely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly and efficiently. Handle Ct Resale Certificate on any platform with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The easiest way to modify and electronically sign Ct Resale Certificate effortlessly

- Locate Ct Resale Certificate and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to store your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ct Resale Certificate and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct resale certificate

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the importance of understanding ct sales tax for my business?

Understanding ct sales tax is crucial for businesses operating in Connecticut as it ensures compliance with state regulations. Proper knowledge helps avoid costly penalties and aids in accurate financial planning. Additionally, a clear grasp of ct sales tax can optimize pricing strategies for your products and services.

-

How does airSlate SignNow help with managing ct sales tax documentation?

airSlate SignNow streamlines the management of ct sales tax documentation by allowing businesses to digitally sign and store tax-related documents securely. This eliminates the hassle of paper documents and ensures easy access and organization for tax filing purposes. With eSigning capabilities, necessary documents can be signed quickly, keeping everything in compliance.

-

Are there additional costs associated with handling ct sales tax using airSlate SignNow?

No, airSlate SignNow offers a cost-effective solution for managing ct sales tax without hidden fees. Pricing plans are transparent, and you can choose one that best suits your business size and needs. This means you can efficiently handle ct sales tax regulations without worrying about unexpected expenses.

-

What features does airSlate SignNow offer that can assist with ct sales tax compliance?

AirSlate SignNow offers features such as customizable templates for tax documents, secure eSigning, and audit trails that enhance ct sales tax compliance. You can create, send, and track tax documents effortlessly. This full visibility ensures you never miss a deadline and maintains your compliance with ct sales tax regulations.

-

Can airSlate SignNow integrate with accounting software to assist with ct sales tax?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making it easier to track and file ct sales tax. These integrations allow automatic syncing of financial data, reducing the risk of errors in tax calculations. By leveraging this feature, your business can stay organized and compliant with ct sales tax requirements.

-

What are the benefits of using airSlate SignNow for ct sales tax management?

Using airSlate SignNow for ct sales tax management provides numerous benefits, including improved efficiency and reduced paperwork. The platform enhances collaboration by allowing teams to sign and manage documents from anywhere. Furthermore, the ability to keep everything digital reduces storage costs and logistical challenges associated with physical documents.

-

Is airSlate SignNow suitable for small businesses dealing with ct sales tax?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing ct sales tax. Its user-friendly interface and cost-effective pricing plans make it accessible for startup and growing companies. This way, small businesses can focus on growth while staying compliant with ct sales tax.

Get more for Ct Resale Certificate

Find out other Ct Resale Certificate

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service