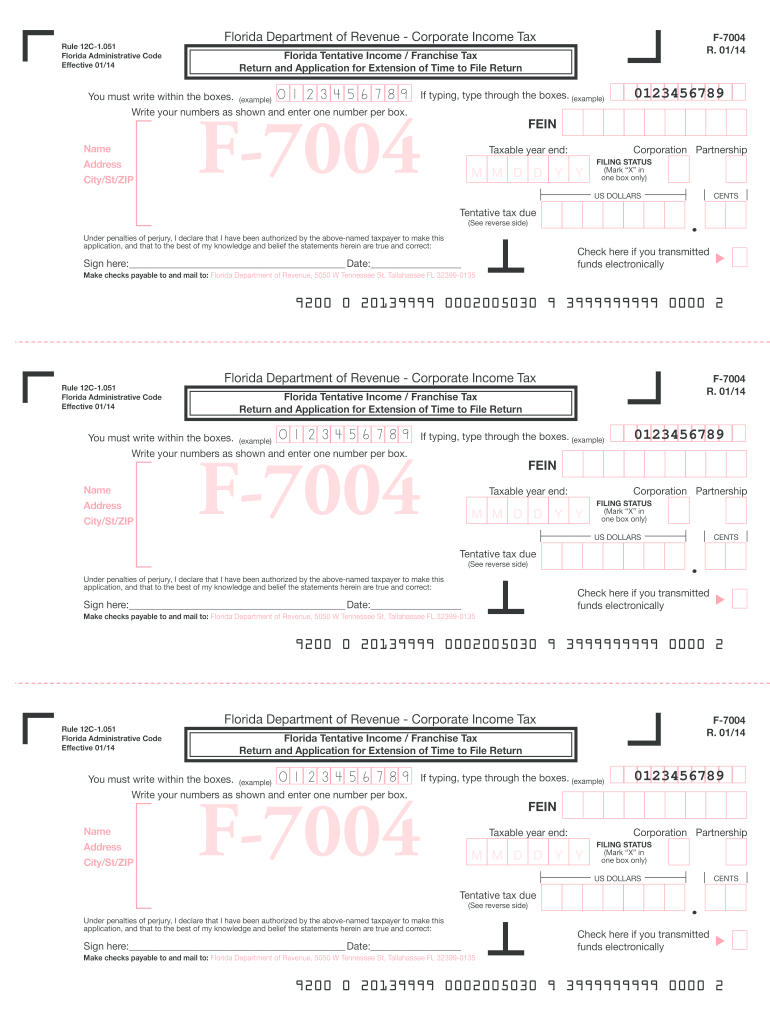

F 7004 Form 2017

What is the F 7004 Form

The F 7004 Form is an application for an automatic extension of time to file certain business tax returns. This form is primarily used by corporations and partnerships to request additional time to submit their tax documents to the Internal Revenue Service (IRS). By filing this form, businesses can extend their filing deadline, allowing them more time to prepare their returns without incurring penalties for late submission.

How to use the F 7004 Form

Using the F 7004 Form involves several key steps. First, ensure you are eligible to file this form based on your business entity type. Next, gather the necessary information, including your business name, address, and Employer Identification Number (EIN). Complete the form accurately, ensuring all required fields are filled in. Once completed, you can submit the form electronically or via mail, depending on your preference and IRS guidelines.

Steps to complete the F 7004 Form

Completing the F 7004 Form requires careful attention to detail. Follow these steps:

- Download the latest version of the F 7004 Form from the IRS website.

- Provide your business information, including the name, address, and EIN.

- Select the type of return for which you are requesting an extension.

- Indicate the tax year for which the extension is being requested.

- Sign and date the form to validate your request.

After filling out the form, review it for accuracy before submission.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the F 7004 Form is crucial for compliance. Generally, the form must be submitted by the original due date of the tax return you are extending. For most corporations, this is typically the fifteenth day of the fourth month following the end of the tax year. For partnerships, the deadline is usually the fifteenth day of the third month after the end of the tax year. Be mindful of these dates to avoid penalties.

Legal use of the F 7004 Form

The F 7004 Form is legally binding when completed and submitted according to IRS regulations. It is essential to ensure that the information provided is accurate and truthful, as any discrepancies can lead to penalties or legal issues. The form serves as a formal request for an extension, and once filed, it provides the taxpayer with additional time to file their complete tax return without incurring late fees.

Who Issues the Form

The F 7004 Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides guidelines and instructions for completing and submitting this form, ensuring that taxpayers understand their responsibilities regarding tax filings and extensions.

Quick guide on how to complete 2014 f 7004 form

Prepare F 7004 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as a superb environmentally friendly substitute for conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents rapidly without delays. Manage F 7004 Form on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

The easiest method to modify and eSign F 7004 Form seamlessly

- Locate F 7004 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow has specifically designed for this purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to secure your updates.

- Choose how you wish to send your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign F 7004 Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 f 7004 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 f 7004 form

The best way to generate an electronic signature for your PDF file online

The best way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the F 7004 Form and why is it important?

The F 7004 Form is an IRS form used to request an extension of time to file certain business tax returns. It is crucial for businesses to understand this form to avoid penalties and ensure compliance with tax regulations. Using airSlate SignNow, you can easily eSign and send the F 7004 Form securely, saving time and ensuring accuracy.

-

How does airSlate SignNow help with F 7004 Form submission?

airSlate SignNow simplifies the process of preparing and submitting the F 7004 Form by providing an easy-to-use interface for document management. You can fill out, eSign, and send the form quickly, ensuring that you meet filing deadlines. This service not only streamlines your workflow but also enhances security and compliance.

-

Is there a cost associated with using airSlate SignNow for the F 7004 Form?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including options for businesses that frequently use the F 7004 Form. The cost is competitive and is designed to provide value through an intuitive eSignature solution. Additionally, the cost savings from avoiding tax penalties make it a worthwhile investment for businesses.

-

What are the key features of airSlate SignNow for managing F 7004 Form?

Key features of airSlate SignNow include real-time collaboration, customizable templates, and secure eSignature capabilities specifically for documents like the F 7004 Form. The platform allows teams to track document status and audit trails, ensuring that the submission process is transparent and efficient. These features signNowly reduce the hassle of paperwork.

-

Can I integrate airSlate SignNow with other software for F 7004 Form processing?

Absolutely, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and many more. This means you can easily pull in data for the F 7004 Form from various sources, streamlining your workflow. Integration capabilities help ensure that all your documents are organized and easily accessible within your existing platforms.

-

What benefits can I expect from using airSlate SignNow for F 7004 Form?

Using airSlate SignNow for your F 7004 Form offers numerous benefits, including time savings, enhanced security against unauthorized changes, and a user-friendly interface. Moreover, the ability to eSign documents from anywhere accelerates your business processes and helps ensure that your tax filings are timely and precise. Overall, it enables better compliance and peace of mind.

-

How secure is the eSigning process for the F 7004 Form with airSlate SignNow?

The eSigning process for the F 7004 Form with airSlate SignNow is highly secure, utilizing advanced encryption and authentication measures. This ensures that your sensitive data and documents are protected throughout the signing process. The platform adheres to industry standards for security and privacy, giving you confidence in the confidentiality of your business information.

Get more for F 7004 Form

- Bre 365 download form

- Transportable building electrical installation certificate form

- Recruitment sla pdf form

- Mini practice set 1 accounting answers pdf form

- Shriver and atkins inorganic chemistry solutions manual pdf download form

- Rental application 275381 form

- Usatestprep answer key form

- Sample request fax form fax to 973 644 2386

Find out other F 7004 Form

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed