Nys Estate Tax Extension Form 2019

What is the Nys Estate Tax Extension Form

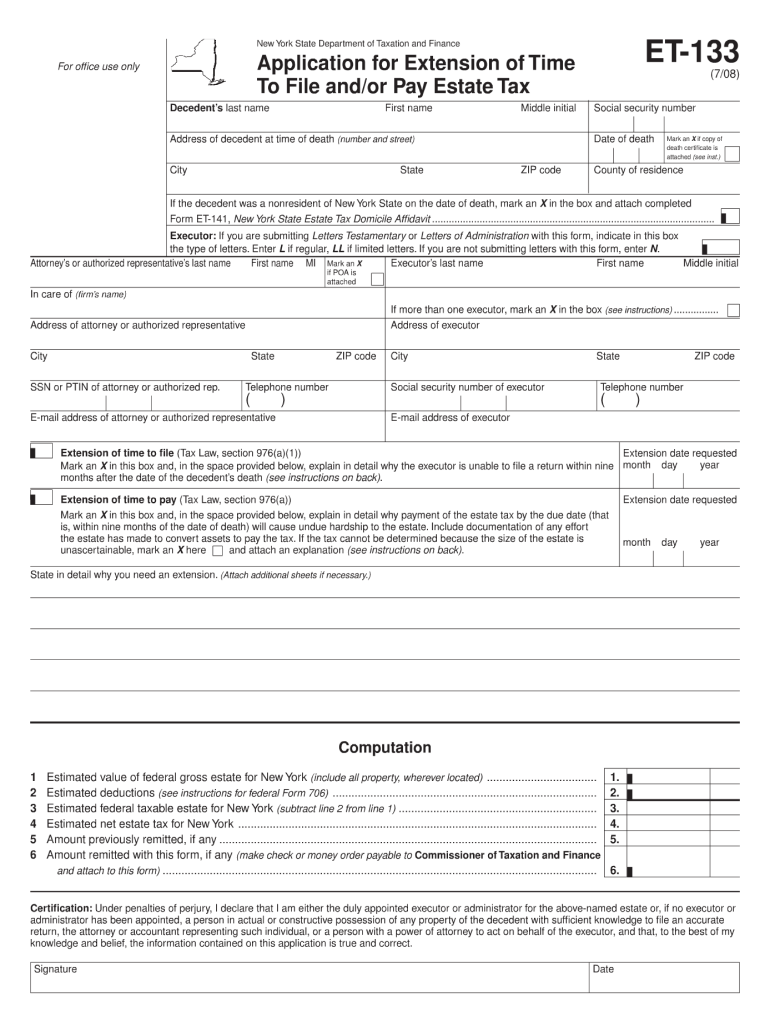

The Nys Estate Tax Extension Form is a document used by individuals in New York State to request an extension for filing their estate tax return. This form allows executors or administrators of estates to gain additional time to gather necessary information and complete the required tax documentation. It is essential for ensuring compliance with state tax regulations while providing the necessary flexibility to manage estate affairs effectively.

How to use the Nys Estate Tax Extension Form

Using the Nys Estate Tax Extension Form involves several straightforward steps. First, obtain the form from the New York State Department of Taxation and Finance website or through authorized channels. Next, fill out the required fields, including details about the estate and the reason for the extension request. After completing the form, submit it by the specified deadline to ensure that the extension is granted. It is crucial to keep a copy of the submitted form for your records.

Steps to complete the Nys Estate Tax Extension Form

Completing the Nys Estate Tax Extension Form requires careful attention to detail. Follow these steps:

- Gather all necessary information about the estate, including the decedent's details and the estimated value of the estate.

- Access the form from the New York State Department of Taxation and Finance website.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form by mail or electronically, adhering to the submission guidelines provided.

Legal use of the Nys Estate Tax Extension Form

The Nys Estate Tax Extension Form is legally recognized when completed and submitted according to state regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal issues. The form serves as a formal request for an extension, and its approval allows the executor additional time to fulfill tax obligations without incurring late fees.

Filing Deadlines / Important Dates

Filing deadlines for the Nys Estate Tax Extension Form are critical to avoid penalties. The form must be submitted by the original due date of the estate tax return. Typically, this is nine months after the date of the decedent's death. It is advisable to check the New York State Department of Taxation and Finance for specific dates, as they may vary based on individual circumstances or changes in legislation.

Required Documents

When completing the Nys Estate Tax Extension Form, certain documents are typically required to support the extension request. These may include:

- A copy of the decedent's death certificate.

- Documentation of the estate's assets and liabilities.

- Any prior tax returns related to the estate.

Having these documents ready can facilitate a smoother application process and ensure that all necessary information is provided.

Quick guide on how to complete nys estate tax extension 2008 form

Effortlessly complete Nys Estate Tax Extension Form on any gadget

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely archive it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage Nys Estate Tax Extension Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Nys Estate Tax Extension Form effortlessly

- Acquire Nys Estate Tax Extension Form and click Get Form to commence.

- Use the tools we provide to complete your form.

- Highlight essential sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method of sharing your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about misplaced or lost files, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Edit and eSign Nys Estate Tax Extension Form while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys estate tax extension 2008 form

Create this form in 5 minutes!

How to create an eSignature for the nys estate tax extension 2008 form

How to generate an eSignature for your PDF document in the online mode

How to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the Nys Estate Tax Extension Form?

The Nys Estate Tax Extension Form is a document that allows you to request an extension for filing estate tax for New York State. It provides taxpayers additional time to prepare their estate tax return without incurring penalties. Understanding this form is crucial for anyone managing an estate.

-

How can airSlate SignNow help with the Nys Estate Tax Extension Form?

airSlate SignNow simplifies the process of completing and signing the Nys Estate Tax Extension Form. Our platform offers a user-friendly interface that allows businesses to eSign documents securely and efficiently, saving time and reducing paperwork. This ensures that your tax extension is filed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for the Nys Estate Tax Extension Form?

Yes, airSlate SignNow offers various pricing plans to suit your needs, which include access to features for completing documents like the Nys Estate Tax Extension Form. Our plans are designed to be cost-effective, making it affordable for businesses of all sizes to manage their documentation. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other systems for the Nys Estate Tax Extension Form?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, allowing you to streamline the process of filling out the Nys Estate Tax Extension Form. Integration with CRM tools, cloud storage, and more enhances your workflow efficiency and keeps your documents organized. This interoperability is key to managing your estate tax documentation.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for your Nys Estate Tax Extension Form not only simplifies the signing process but also enhances the security and accuracy of your documents. The platform provides features like document tracking, reminders, and secure storage. This ensures that you meet deadlines and maintain compliance with state regulations.

-

How secure is airSlate SignNow for handling the Nys Estate Tax Extension Form?

Security is a top priority at airSlate SignNow. When handling the Nys Estate Tax Extension Form, our platform employs strong encryption and compliance with industry standards to protect your data. You can trust that your sensitive tax information remains confidential and secure during the signing process.

-

Can I reuse the Nys Estate Tax Extension Form on airSlate SignNow?

Yes, airSlate SignNow allows you to save templates, including the Nys Estate Tax Extension Form, for future use. This feature enables quick access and modification for subsequent tax years or different estates. By reusing documents, you can save valuable time and maintain consistency in your filings.

Get more for Nys Estate Tax Extension Form

- Unit 6 outcome meiosis coloring worksheet form

- Duct leakage test report form

- Nbcrfli provident fund balance check form

- Angle puzzle worksheet answers pdf form

- Minutes writing format pdf

- Verification of working life residence in australia form

- Certificado de empadronamiento form

- Domiciliary letters 50223486 form

Find out other Nys Estate Tax Extension Form

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed