Ft 949 Form

What is the Ft 949

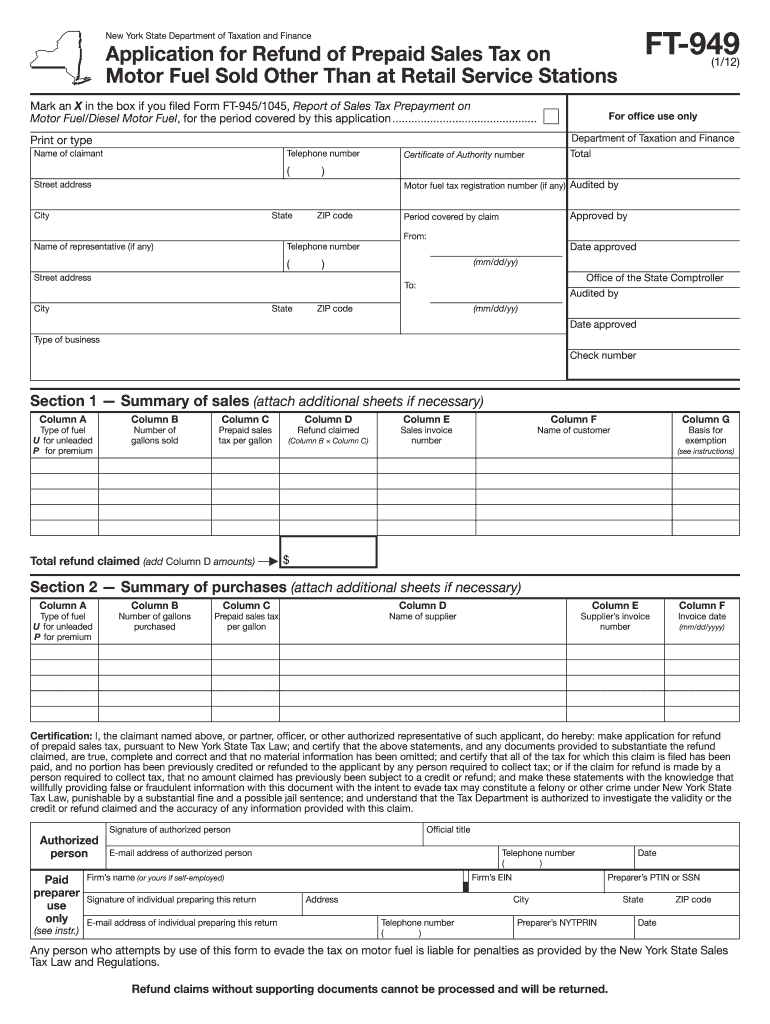

The Ft 949 is a tax form used in New York for claiming a refund of prepaid sales tax. This form is essential for businesses and individuals who have overpaid sales tax on certain purchases. The Ft 949 application tax form serves as a formal request to the state for reimbursement, ensuring that taxpayers can recover excess amounts paid. Understanding the purpose and function of the Ft 949 is crucial for anyone looking to navigate the tax refund process effectively.

How to use the Ft 949

Using the Ft 949 involves several key steps to ensure proper completion and submission. First, gather all necessary documentation that supports your claim, such as receipts and proof of payment. Next, accurately fill out the Ft 949 taxation form, providing detailed information about the purchases for which you are seeking a refund. Ensure that all figures are correct and that you have included any required attachments. Finally, submit the completed form according to the guidelines provided by the New York State Department of Taxation and Finance.

Steps to complete the Ft 949

Completing the Ft 949 requires careful attention to detail. Follow these steps for a successful submission:

- Collect all relevant receipts and documentation related to your prepaid sales tax.

- Download the Ft 949 tax form from the official website or obtain a physical copy.

- Fill in your personal information, including name, address, and taxpayer identification number.

- Detail the items for which you are claiming a refund, including purchase dates and amounts.

- Double-check all entries for accuracy before signing the form.

- Submit the form via the specified method, either online or by mail.

Legal use of the Ft 949

The Ft 949 must be used in compliance with state laws governing tax refunds. It is crucial to ensure that the information provided is truthful and accurate, as any discrepancies may lead to penalties or denial of the refund request. The form must be submitted within the designated time frame to be considered valid. Understanding the legal implications of using the Ft 949 helps taxpayers avoid potential issues with tax authorities.

Required Documents

When filing the Ft 949, certain documents are required to support your claim. These typically include:

- Receipts for purchases made that incurred prepaid sales tax.

- Proof of payment, such as bank statements or credit card statements.

- Any additional documentation requested by the state to substantiate your claim.

Having these documents ready can expedite the process and increase the likelihood of a successful refund.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Ft 949. Generally, taxpayers must submit the form within a specific period following the purchase date to qualify for a refund. Staying informed about these deadlines ensures that your claim is processed in a timely manner, preventing any delays in receiving your refund.

Quick guide on how to complete ft 949

Effortlessly Complete Ft 949 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Ft 949 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Easiest Way to Edit and eSign Ft 949 Seamlessly

- Obtain Ft 949 and then click Get Form to initiate the process.

- Utilize the tools available to fill out your document.

- Highlight important sections of your documents or redact sensitive information with features that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Ft 949 and guarantee outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ft 949

The way to make an eSignature for your PDF in the online mode

The way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the ft 949 and how does it work with airSlate SignNow?

The ft 949 is a powerful feature within airSlate SignNow that streamlines the electronic signing process. It allows users to quickly send documents for eSignature while ensuring compliance and security. This feature integrates seamlessly with various document formats, making the signing experience efficient and user-friendly.

-

How much does it cost to use the ft 949 feature in airSlate SignNow?

The ft 949 feature is part of airSlate SignNow's subscription plans which vary in pricing based on the features included. Users can choose a plan that fits their business needs and budget. Additionally, there are options for monthly or annual subscriptions, providing flexibility for different users.

-

What are the main benefits of using airSlate SignNow's ft 949?

Using the ft 949 with airSlate SignNow offers numerous benefits including enhanced efficiency and reduced turnaround times for contract signing. It helps eliminate paper-based processes, thereby saving time and costs. Moreover, the ft 949 ensures that documents are securely stored and easily accessible.

-

Are there any integrations available for the ft 949 feature in airSlate SignNow?

Yes, the ft 949 integrates with various third-party applications such as CRM systems and document management tools. These integrations help businesses maintain their workflows and enhance productivity. This flexibility makes it easier for teams to adopt airSlate SignNow into their existing processes.

-

Is the ft 949 compliant with eSignature laws?

Absolutely, the ft 949 feature in airSlate SignNow is designed to comply with eSignature laws and regulations, including the E-Sign Act and UETA. This compliance ensures that all electronic signatures collected are legally binding and valid. Users can trust that their documents signed using the ft 949 are secure and enforceable.

-

How can I get started with the ft 949 feature?

Getting started with the ft 949 feature is simple. Create an account on airSlate SignNow and choose a subscription plan that includes this feature. Once set up, you can begin uploading documents and sending them for eSignature using the ft 949 functionality.

-

What types of documents can I sign using the ft 949?

You can sign various types of documents using the ft 949, including contracts, agreements, and forms. The feature supports multiple file formats such as PDFs, Word documents, and more. This versatility makes it suitable for a wide range of business applications.

Get more for Ft 949

- Mses application form

- Equitable third party authorization form

- Southern university dancing dolls tryouts form

- Sc corporation loan application form pdf

- Acura credit application form

- Teaching assistant application form template

- Church employment application first baptist clover form

- Ailes detasseling form

Find out other Ft 949

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document