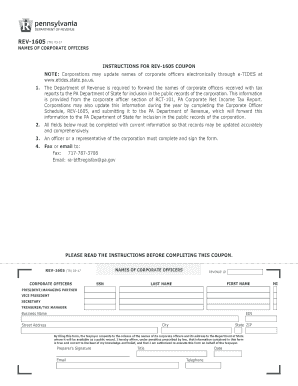

Pa 1605 Form 2017

What is the PA 1605 Form

The PA 1605 form, also known as the Pennsylvania Department of Revenue form 1605, is primarily used for tax purposes. This form is essential for individuals and businesses to report specific financial information to the state of Pennsylvania. It is typically associated with income tax obligations and helps ensure compliance with state tax laws. Understanding the purpose of this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the PA 1605 Form

Using the PA 1605 form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form either online or via mail, depending on your preference and the available options.

Steps to complete the PA 1605 Form

Completing the PA 1605 form requires a systematic approach:

- Gather all relevant financial documentation, including income sources and deductions.

- Download the PA 1605 form from the official Pennsylvania Department of Revenue website.

- Fill out the form, ensuring that all required fields are completed accurately.

- Double-check your entries for accuracy and completeness.

- Submit the completed form through the chosen method (online or mail).

Legal use of the PA 1605 Form

The legal use of the PA 1605 form is governed by Pennsylvania state tax laws. To ensure that the form is legally binding, it must be completed in accordance with the regulations set forth by the Pennsylvania Department of Revenue. This includes providing accurate information, signing the form where required, and adhering to submission deadlines. Failure to comply with these legal requirements can result in penalties or other legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the PA 1605 form are critical for compliance. Typically, the form must be submitted by April 15 of each year for individual taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special cases. It is essential to stay informed about any changes to these deadlines to avoid late fees or penalties.

Required Documents

When completing the PA 1605 form, certain documents are required to support your claims. These may include:

- W-2 forms from employers

- 1099 forms for additional income

- Documentation of deductions and credits

- Previous year’s tax returns for reference

Having these documents ready will streamline the completion of the form and help ensure accuracy.

Form Submission Methods

The PA 1605 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Pennsylvania Department of Revenue’s e-filing system.

- Mailing a printed copy of the completed form to the appropriate address.

- In-person submission at designated Pennsylvania Department of Revenue offices.

Choosing the right submission method can enhance the efficiency of your filing process.

Quick guide on how to complete pa 1605 form

Prepare Pa 1605 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the resources you require to create, amend, and electronically sign your documents swiftly without delays. Manage Pa 1605 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Pa 1605 Form without any hassle

- Locate Pa 1605 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information thoroughly and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Modify and electronically sign Pa 1605 Form and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa 1605 form

Create this form in 5 minutes!

How to create an eSignature for the pa 1605 form

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is rev1605 and how does it relate to airSlate SignNow?

Rev1605 is a designation for our advanced electronic signature capabilities within airSlate SignNow. This feature enhances document security and compliance, making it ideal for businesses looking for a trustworthy eSigning solution.

-

How much does airSlate SignNow cost with rev1605 features?

Pricing for airSlate SignNow varies based on the chosen plan, but all options that include rev1605 features offer competitive rates. We recommend checking our website for the most current pricing and special offers that include these advanced functionalities.

-

What features are included in the rev1605 package of airSlate SignNow?

The rev1605 package of airSlate SignNow includes robust features like custom branding, real-time tracking of documents, and integration with popular applications. This ensures an efficient workflow tailored to the specific needs of your business.

-

How can rev1605 improve my document workflow?

Rev1605 enhances document workflows by streamlining the eSigning process with automation and notifications, allowing for quicker turnaround times. With airSlate SignNow, businesses can easily manage documents, reducing time and improving efficiency.

-

Does airSlate SignNow integrate with other software and applications using rev1605?

Yes, airSlate SignNow, featuring rev1605, integrates seamlessly with a wide range of software applications like Salesforce, Google Drive, and Microsoft Office. These integrations help enhance your existing workflow and improve productivity.

-

What are the security features associated with rev1605 in airSlate SignNow?

When using rev1605 in airSlate SignNow, businesses benefit from encryption, two-factor authentication, and audit trails, ensuring document security and compliance with industry standards. This makes it one of the safest options for eSigning documents.

-

Can I customize my eSigning experience with rev1605?

Absolutely! Rev1605 allows users to customize their eSigning experience with options for branding and personalized messages. Businesses can create a unique and professional appearance that reflects their brand identity.

Get more for Pa 1605 Form

Find out other Pa 1605 Form

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy