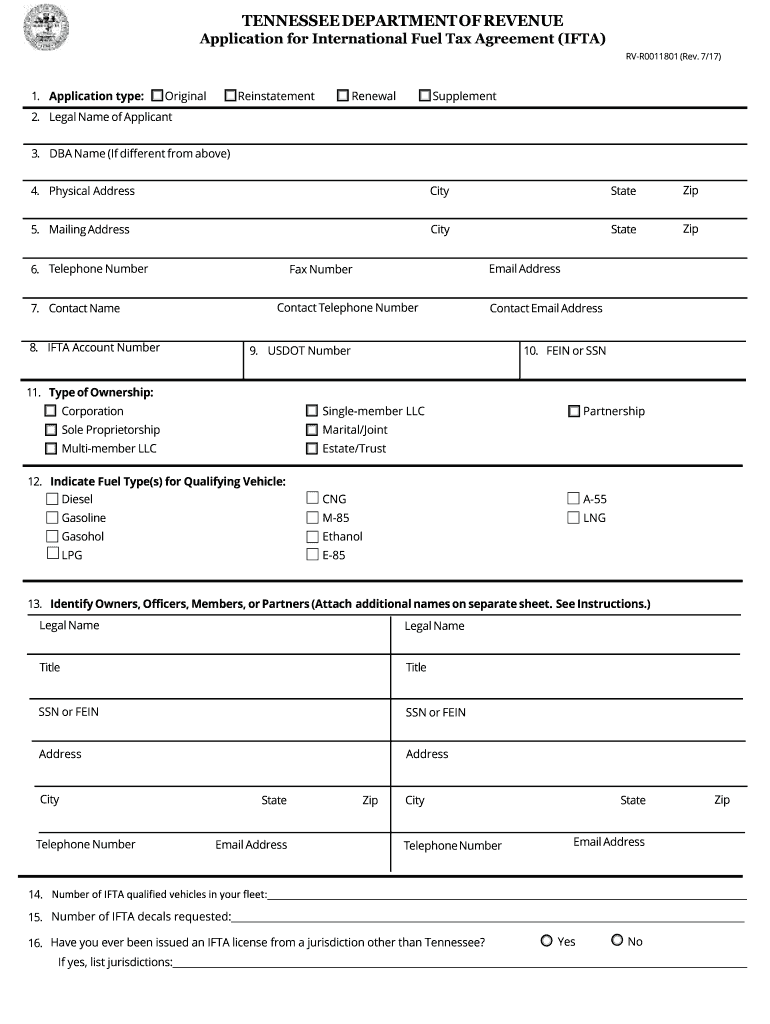

Ifta Application Form

What is the IFTA Application

The IFTA application is a crucial document for motor carriers operating in multiple jurisdictions. It facilitates the reporting and payment of fuel taxes for vehicles that travel across state lines. The International Fuel Tax Agreement (IFTA) simplifies the process by allowing carriers to file a single quarterly fuel tax report instead of separate reports for each state. This application is essential for compliance with state tax regulations and helps ensure that fuel taxes are allocated appropriately among the states involved.

Steps to Complete the IFTA Application

Completing the IFTA application involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including vehicle details, mileage records, and fuel purchases for the reporting period. Next, fill out the application form, ensuring all entries are complete and accurate. It is important to calculate the total miles traveled and the total gallons of fuel purchased in each state. After completing the form, review it for any errors or omissions. Finally, submit the application by the designated deadline to avoid penalties.

Required Documents

When preparing to submit the IFTA application, certain documents are required to support the information provided. These typically include:

- Proof of fuel purchases, such as receipts or invoices.

- Mileage records detailing the distances traveled in each jurisdiction.

- Previous IFTA returns, if applicable, to ensure consistency and accuracy.

Having these documents ready will streamline the application process and help avoid any compliance issues.

Penalties for Non-Compliance

Failure to comply with IFTA regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential audits by state tax authorities. Additionally, non-compliance can lead to the suspension of your IFTA license, which may restrict your ability to operate across state lines. It is important for carriers to stay informed about their filing obligations and ensure timely submissions to avoid these consequences.

Form Submission Methods

The IFTA application can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state’s tax authority website.

- Mailing a physical copy of the application to the appropriate state agency.

- In-person submission at designated offices, if available.

Choosing the right submission method can enhance efficiency and ensure that your application is processed promptly.

Eligibility Criteria

To be eligible for the IFTA application, certain criteria must be met. Primarily, the applicant must operate qualified motor vehicles, which are defined as those weighing over 26,000 pounds or having three or more axles. Additionally, the vehicle must travel in two or more jurisdictions and be used for the transportation of passengers or property for hire. Meeting these eligibility requirements is essential for compliance with IFTA regulations.

Quick guide on how to complete ifta application

Effortlessly Set Up Ifta Application on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage Ifta Application on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and Electronically Sign Ifta Application with Ease

- Obtain Ifta Application and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight key sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Modify and electronically sign Ifta Application and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ifta application

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is the IFTA International Fuel Tax Agreement?

The IFTA International Fuel Tax Agreement is a tax collection agreement in the United States and Canada that simplifies the reporting of fuel use by motor carriers. It allows interstate travelers to pay fuel taxes in a simplified manner, reducing the administrative burden on trucking companies. By participating in the IFTA, businesses can optimize their fuel tax compliance and reduce regulatory hassles.

-

How can airSlate SignNow help with IFTA International Fuel Tax Agreement documentation?

airSlate SignNow offers an efficient platform for electronically signing and sending documents related to the IFTA International Fuel Tax Agreement. Our solution streamlines the process by allowing users to sign forms quickly and manage their documentation seamlessly. This saves time and ensures your IFTA-related documents are always securely digitized.

-

What pricing options does airSlate SignNow offer for IFTA International Fuel Tax Agreement services?

airSlate SignNow provides flexible pricing plans tailored to the needs of businesses managing the IFTA International Fuel Tax Agreement. Our pricing is competitive, and we offer various subscription tiers to suit your specific requirements. By selecting the plan that best matches your business size and document needs, you can find cost-effective solutions for managing your IFTA compliance.

-

Are there any integrations available with airSlate SignNow for IFTA International Fuel Tax Agreement management?

Yes, airSlate SignNow easily integrates with various business applications that can assist in managing the IFTA International Fuel Tax Agreement. Popular platforms such as CRM systems, accounting software, and fleet management tools can be connected to streamline your workflow. These integrations enhance overall efficiency by consolidating data related to your IFTA compliance.

-

What features does airSlate SignNow provide for the IFTA International Fuel Tax Agreement?

airSlate SignNow includes features like electronic signatures, document templates, and automated workflows specifically designed for the IFTA International Fuel Tax Agreement. These tools simplify the preparation and submission of IFTA-related documents, making compliance straightforward. Additionally, version control ensures that you are always using the most up-to-date forms for your tax reporting.

-

What are the benefits of using airSlate SignNow for IFTA International Fuel Tax Agreement?

Using airSlate SignNow for the IFTA International Fuel Tax Agreement offers signNow benefits, including reduced paperwork, increased efficiency, and improved compliance. Our platform allows for faster processing of documents and better organization of your IFTA records. By adopting our solution, businesses can minimize errors and focus more on their core operations.

-

Can airSlate SignNow assist with tracking IFTA International Fuel Tax Agreement submissions?

Absolutely! airSlate SignNow provides tracking capabilities for submissions related to the IFTA International Fuel Tax Agreement. Users can monitor the status of their documents in real-time, ensuring that all necessary filings have been completed accurately. This transparency helps businesses stay compliant with tax regulations and avoid potential penalties.

Get more for Ifta Application

Find out other Ifta Application

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template