Tax Alaska Form

Understanding the 680 fishery tax form

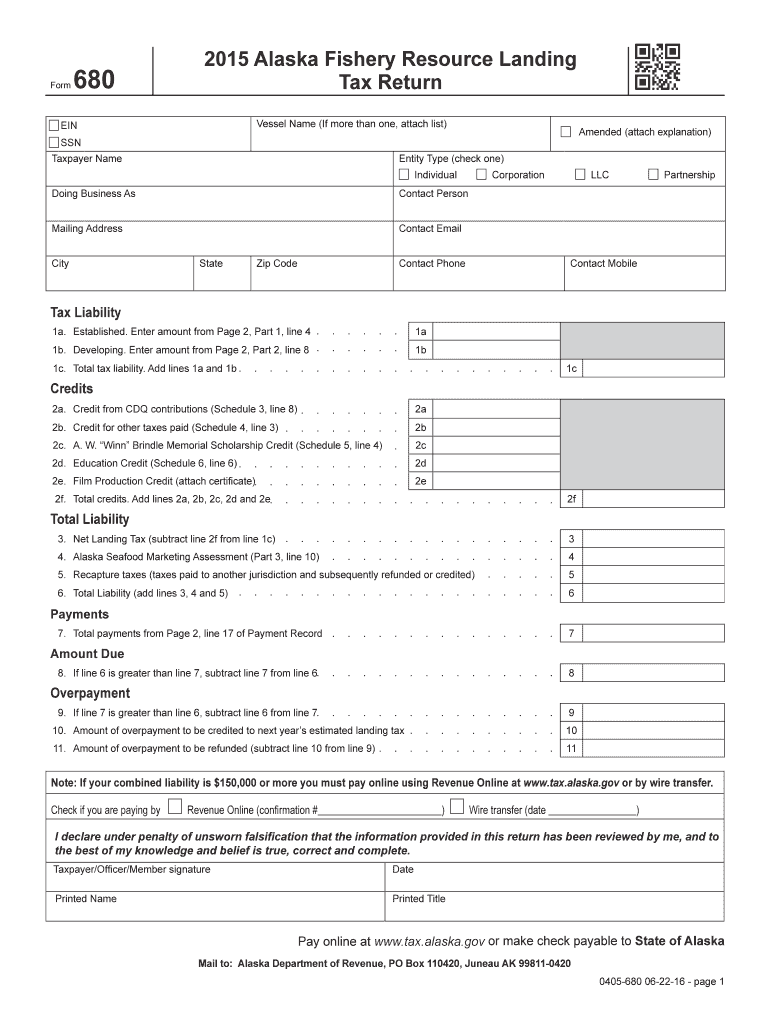

The 680 fishery tax form is a specific document used primarily by individuals and businesses engaged in fishing activities within the United States. This form is essential for reporting income earned from fishing operations and ensuring compliance with federal and state tax regulations. It captures various details, including gross receipts, deductions, and other relevant financial information related to the fishing business.

Steps to complete the 680 fishery tax form

Completing the 680 fishery tax form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including income statements and receipts from fishing activities. Follow these steps:

- Enter your business information, including name, address, and tax identification number.

- Document your gross receipts from fishing activities for the reporting period.

- List any allowable deductions, such as expenses related to equipment, maintenance, and operational costs.

- Calculate your net income by subtracting total deductions from gross receipts.

- Review the completed form for accuracy and ensure all required signatures are included.

Filing deadlines for the 680 fishery tax form

Timely filing of the 680 fishery tax form is crucial to avoid penalties. Generally, the form must be submitted by April 15 of the year following the tax year being reported. However, if you are a business entity, the deadlines may vary based on your specific tax situation. It is advisable to check the IRS guidelines or consult a tax professional for any updates on filing dates.

Legal use of the 680 fishery tax form

The 680 fishery tax form is legally recognized for reporting fishing income and expenses. To ensure its legal validity, it must be completed accurately and submitted within the designated timeframe. Compliance with IRS regulations is essential to avoid potential audits or penalties. Additionally, utilizing electronic filing options can enhance the security and efficiency of the submission process.

Required documents for the 680 fishery tax form

When preparing to fill out the 680 fishery tax form, certain documents are necessary to support your claims. These include:

- Income statements detailing earnings from fishing activities.

- Receipts for expenses related to fishing operations, such as fuel, gear, and maintenance.

- Bank statements that reflect deposits from fishing income.

- Any relevant licenses or permits required for fishing operations.

Who issues the 680 fishery tax form

The 680 fishery tax form is issued by the Internal Revenue Service (IRS). It is designed to assist taxpayers in reporting their fishing-related income accurately. The IRS provides guidelines and resources to help individuals and businesses understand their obligations regarding this form.

Quick guide on how to complete tax alaska 6967153

Easily prepare Tax Alaska on any device

Managing documents online has gained popularity among both businesses and individuals. It serves as an ideal sustainable alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Handle Tax Alaska on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Tax Alaska effortlessly

- Locate Tax Alaska and then click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize important sections of the documents or obscure private information with tools specifically designed for that purpose by airSlate SignNow.

- Form your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tax Alaska and guarantee outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967153

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the 680 fishery tax form?

The 680 fishery tax form is a specific tax document used by individuals and businesses in the fishing industry to report income, expenses, and other relevant financial information. This form helps ensure compliance with tax regulations while providing insight into the profitability of fishing operations. By properly filling out the 680 fishery tax form, businesses can effectively manage their financial obligations.

-

How can airSlate SignNow assist with filing the 680 fishery tax form?

airSlate SignNow simplifies the process of completing and submitting the 680 fishery tax form by allowing you to create, edit, and eSign documents effortlessly. Our user-friendly platform reduces the time spent on paperwork, ensuring that your tax documents are accurate and submitted in a timely manner. Additionally, you can easily store and access your forms digitally.

-

Is there a cost associated with using airSlate SignNow for the 680 fishery tax form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. With our cost-effective solution, you can choose a plan that best fits your budget while gaining access to the tools necessary for efficient document management, including the 680 fishery tax form. We also provide a free trial to explore our features before committing.

-

What features does airSlate SignNow provide for eSigning the 680 fishery tax form?

airSlate SignNow offers several features for eSigning the 680 fishery tax form, including legally binding signatures, customizable templates, and real-time tracking of document status. Our intuitive interface allows you to sign documents quickly and securely, ensuring that you can submit your tax forms without hassle. Moreover, we comply with all legal standards for electronic signatures.

-

Can I integrate airSlate SignNow with other software for my 680 fishery tax form needs?

Yes, airSlate SignNow supports integrations with numerous third-party applications, making it easy to streamline your workflow when dealing with the 680 fishery tax form. You can connect with popular accounting and financial software to automatically pull information needed for your form, improving efficiency and reducing errors in your tax filings.

-

What are the benefits of using airSlate SignNow for the 680 fishery tax form?

Using airSlate SignNow to manage the 680 fishery tax form provides signNow benefits such as increased efficiency, reduced paperwork, and enhanced compliance. The ability to easily eSign documents and track their progress minimizes delays in the filing process. Additionally, our secure platform protects sensitive financial information, giving you peace of mind.

-

Is customer support available if I have questions about the 680 fishery tax form?

Absolutely! airSlate SignNow provides comprehensive customer support to assist with any inquiries regarding the 680 fishery tax form and our services. Our knowledgeable team is available through various channels to ensure you receive timely and effective guidance. Whether it's about features, integrations, or specific tax filing questions, we’re here to help.

Get more for Tax Alaska

Find out other Tax Alaska

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word