Dtf Dtf Income Return Get Form

What is the Dtf Dtf Income Return Get

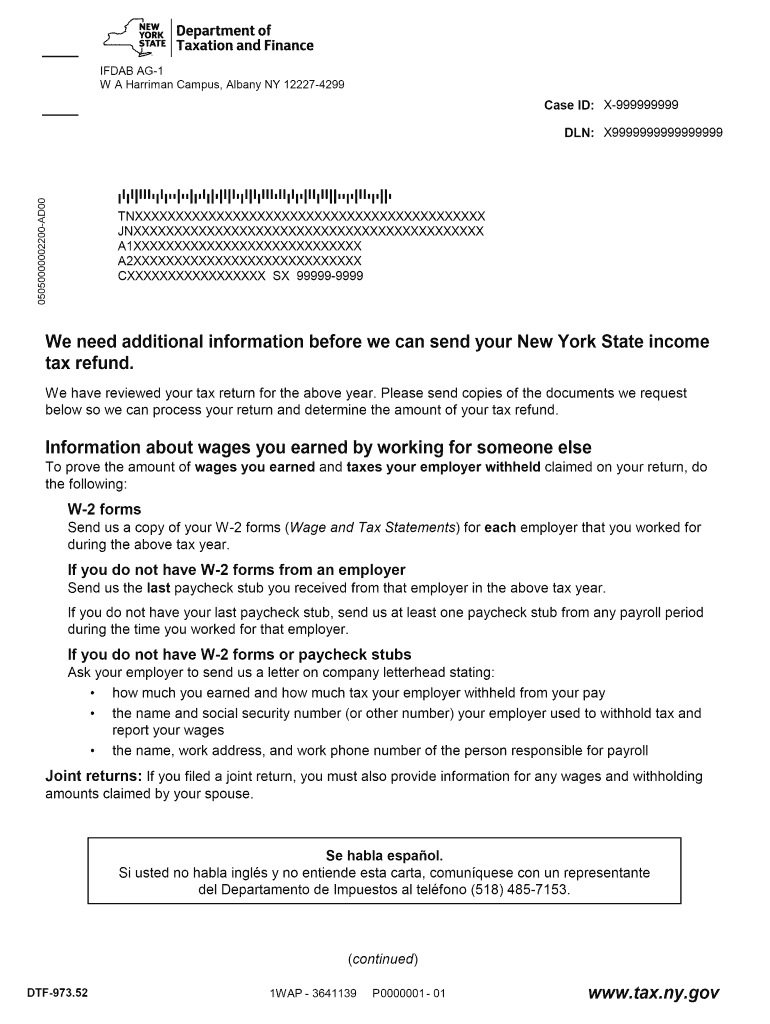

The Dtf Dtf Income Return Get is a specific tax form used in New York State for reporting certain income information. This form is primarily utilized by businesses and individuals who need to disclose income details to the New York State Department of Taxation and Finance. It is essential for ensuring compliance with state tax regulations and for accurate income reporting.

This form is particularly relevant for those who have received income that is subject to withholding, as it provides a comprehensive overview of the income earned and the taxes withheld. Understanding the purpose and requirements of the Dtf Dtf Income Return Get is crucial for accurate tax filing and avoiding potential penalties.

Steps to Complete the Dtf Dtf Income Return Get

Completing the Dtf Dtf Income Return Get involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documentation related to your income for the tax year. This may include W-2 forms, 1099 forms, and any other relevant financial statements.

Next, fill out the form with precise details, including your personal information, income amounts, and any taxes withheld. It is important to double-check all entries for accuracy to prevent errors that could lead to delays or penalties. Once completed, review the form thoroughly and ensure that all required signatures are included before submission.

Legal Use of the Dtf Dtf Income Return Get

The Dtf Dtf Income Return Get is legally recognized as a valid document for reporting income to the state tax authority. To ensure that the form is used correctly, it must be completed in accordance with the guidelines set forth by the New York State Department of Taxation and Finance.

When submitted correctly, this form serves as a legal declaration of income, which can be used in various legal contexts, including audits and tax assessments. It is essential to retain a copy of the submitted form for your records, as it may be required for future reference or verification.

Required Documents for the Dtf Dtf Income Return Get

To successfully complete and submit the Dtf Dtf Income Return Get, several documents are required. These typically include:

- W-2 forms from employers, detailing wages and taxes withheld

- 1099 forms for any freelance or contract work

- Records of any additional income sources, such as rental income or dividends

- Documentation of any deductions or credits you plan to claim

Having these documents ready will streamline the process of filling out the form and ensure that all necessary information is accurately reported.

Form Submission Methods

The Dtf Dtf Income Return Get can be submitted through various methods to accommodate different preferences. Taxpayers can choose to submit the form online through the New York State Department of Taxation and Finance website, which offers a secure and efficient process.

Alternatively, the form can be mailed to the appropriate tax office, or submitted in person at designated locations. Each method has its own advantages, and taxpayers should select the one that best fits their needs and circumstances.

Quick guide on how to complete dtf dtf income return get

Complete Dtf Dtf Income Return Get effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Dtf Dtf Income Return Get on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Dtf Dtf Income Return Get with ease

- Obtain Dtf Dtf Income Return Get and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Dtf Dtf Income Return Get to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf dtf income return get

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the dtf 973 52 att feature in airSlate SignNow?

The dtf 973 52 att feature is designed to streamline document management and eSigning processes, making it easier for users to handle their paperwork efficiently. This feature allows for customizable templates, enhancing flexibility in document creation. Additionally, it provides secure storage solutions for signed documents.

-

How much does the dtf 973 52 att service cost?

Pricing for the dtf 973 52 att service varies based on the plan you choose. airSlate SignNow offers competitive pricing tailored to businesses of all sizes, allowing you to select a plan that meets your specific needs. Many users find the cost-effective nature of this solution helps in reducing overall operational expenses.

-

What are the key benefits of using dtf 973 52 att?

Using dtf 973 52 att enhances collaboration by allowing team members to access documents from anywhere. This feature improves turnaround times by enabling real-time eSigning and document sharing. Moreover, it ensures compliance with industry regulations, providing peace of mind for businesses concerned about legality.

-

Are there any integrations available for dtf 973 52 att?

Yes, dtf 973 52 att seamlessly integrates with a variety of popular tools and software applications. This includes CRM systems, project management tools, and cloud storage services, ensuring a cohesive workflow. These integrations simplify the document handling process, allowing for a more efficient business operation.

-

How does dtf 973 52 att ensure document security?

The dtf 973 52 att feature prioritizes document security through advanced encryption protocols and secure cloud storage. This ensures that your sensitive information remains protected against unauthorized access. Additionally, airSlate SignNow complies with industry standards, offering an extra layer of assurance for users.

-

Is there a trial available for testing dtf 973 52 att?

Yes, airSlate SignNow offers a trial period for the dtf 973 52 att service, allowing prospective customers to explore its features before committing. This trial gives users a firsthand experience of the platform’s functionalities and benefits. It’s an excellent opportunity to assess how well it meets your business needs.

-

Can dtf 973 52 att be used for international transactions?

Absolutely, dtf 973 52 att is designed to cater to international transactions, making it a versatile tool for global businesses. It supports multiple languages and complies with international eSignature laws, enhancing its usability. This feature enables organizations to streamline their operations across borders effectively.

Get more for Dtf Dtf Income Return Get

- Ameriprise forms

- Printable medication reconciliation form template

- Guarantor letter sample for rental form

- Florida probation community service form 31746362

- Apreasal form

- Sample of bylaws for an association form

- Alaska death certificate request form

- Wisconsin dot application for bonded certificate of title for a vehicle form

Find out other Dtf Dtf Income Return Get

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast