Agreement to Pay Individual or 1099 Reportable Entity Departments Weber Form

Understanding the Agreement to Pay Individual or 1099 Reportable Entity Departments Weber

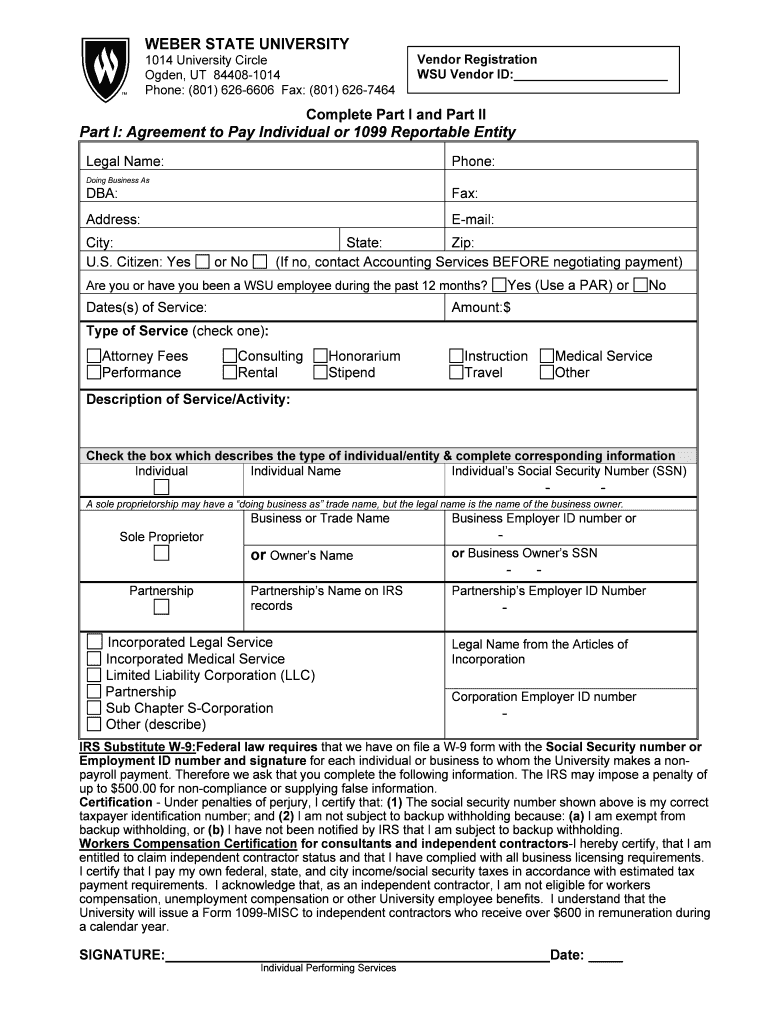

The Agreement to Pay Individual or 1099 reportable entity departments Weber is a legal document that outlines the terms under which payments are made to independent contractors or entities that are required to report income to the IRS. This agreement is crucial for ensuring compliance with tax regulations, as it provides a clear record of the services rendered and the payment terms agreed upon by both parties. It is particularly important for businesses that engage freelancers or contractors, as it helps in maintaining accurate financial records for tax reporting purposes.

Steps to Complete the Agreement to Pay Individual or 1099 Reportable Entity Departments Weber

Completing the Agreement to Pay Individual or 1099 reportable entity departments Weber involves several key steps:

- Gather Information: Collect all necessary information about the contractor or entity, including their legal name, address, and taxpayer identification number (TIN).

- Define Payment Terms: Clearly outline the payment terms, including the amount, payment schedule, and method of payment.

- Detail Services Provided: Specify the services that will be performed under the agreement to avoid any ambiguity.

- Include Signatures: Ensure that both parties sign the agreement to make it legally binding. Digital signatures can be used to streamline this process.

Legal Use of the Agreement to Pay Individual or 1099 Reportable Entity Departments Weber

The legal use of the Agreement to Pay Individual or 1099 reportable entity departments Weber is governed by IRS regulations. It is essential for businesses to use this agreement to document payments made to contractors who meet the criteria for 1099 reporting. By doing so, businesses can protect themselves from potential audits and penalties associated with improper reporting. This agreement serves as a formal acknowledgment of the relationship between the business and the contractor, ensuring that both parties understand their rights and responsibilities.

IRS Guidelines for 1099 Reportable Payments

The IRS has specific guidelines regarding which payments are reportable on a 1099 form. Generally, payments made to non-corporate entities for services rendered that total $600 or more in a calendar year must be reported. It is important for businesses to familiarize themselves with these guidelines to ensure compliance and avoid penalties. Additionally, businesses should maintain accurate records of all payments made, as this information is critical when filing taxes.

Filing Deadlines for 1099 Forms

Filing deadlines for 1099 forms are crucial for compliance with IRS regulations. Typically, businesses must provide a copy of the 1099 form to the contractor by January thirty-first of the following year. The form must also be submitted to the IRS by the end of February if filed by paper, or by March thirty-first if filed electronically. Adhering to these deadlines helps avoid penalties and ensures that both the business and the contractor are in good standing with the IRS.

Examples of Using the Agreement to Pay Individual or 1099 Reportable Entity Departments Weber

There are various scenarios in which the Agreement to Pay Individual or 1099 reportable entity departments Weber can be utilized:

- Freelance Services: A graphic designer providing services to a marketing agency.

- Consulting Work: A business consultant hired to improve operational efficiency.

- Contractor Work: A construction contractor hired for a specific project.

In each of these cases, the agreement serves to clarify the terms of engagement and ensure compliance with tax reporting requirements.

Quick guide on how to complete agreement to pay individual or 1099 reportable entity departments weber

Complete Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly and without delays. Manage Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-based process today.

The simplest way to edit and electronically sign Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber without hassle

- Obtain Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and electronically sign Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber and ensure exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the agreement to pay individual or 1099 reportable entity departments weber

How to make an eSignature for the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber in the online mode

How to generate an electronic signature for the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber in Chrome

How to create an eSignature for signing the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber in Gmail

How to generate an eSignature for the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber straight from your smart phone

How to generate an electronic signature for the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber on iOS

How to make an electronic signature for the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber on Android devices

People also ask

-

What is the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber?

The Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber is a crucial document that outlines payment terms for individuals or entities that need to report income. This agreement ensures compliance with tax regulations and simplifies the reporting process for businesses and individuals alike. Using airSlate SignNow, you can easily create, send, and eSign this agreement securely.

-

How does airSlate SignNow facilitate the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber?

airSlate SignNow streamlines the process of creating and managing the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber by providing customizable templates. Users can fill in details, send for signatures, and store completed documents all in one platform. This efficiency saves time and minimizes paperwork errors.

-

What are the pricing options for using airSlate SignNow for the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber?

airSlate SignNow offers various pricing plans designed to meet the needs of different businesses. Each plan includes features that support the creation and management of the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber, ensuring you have the tools necessary for compliance and efficiency. Explore our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for managing the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber?

Yes, airSlate SignNow provides seamless integration with various software applications, allowing you to manage the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber alongside your existing systems. This integration enhances workflow efficiency, enabling you to synchronize data and documents for better collaboration.

-

What benefits does airSlate SignNow offer for managing the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber?

By using airSlate SignNow for the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber, businesses benefit from an easy-to-use interface, reduced turnaround times, and enhanced document security. The platform's eSigning capabilities ensure that agreements are executed quickly and are legally binding, helping you maintain compliance effortlessly.

-

Is it easy to customize the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber in airSlate SignNow?

Absolutely! airSlate SignNow allows users to easily customize the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber with specific terms, conditions, and branding elements. This customization ensures that the agreement meets your unique business requirements while maintaining a professional appearance.

-

How secure is airSlate SignNow when handling the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber?

airSlate SignNow prioritizes security, using advanced encryption and compliance measures to protect the Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber. All documents are stored securely, and user access can be managed to ensure that only authorized personnel can view or edit sensitive information.

Get more for Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber

Find out other Agreement To Pay Individual Or 1099 Reportable Entity Departments Weber

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form