Form 593 E 2019

What is the Form 593 E

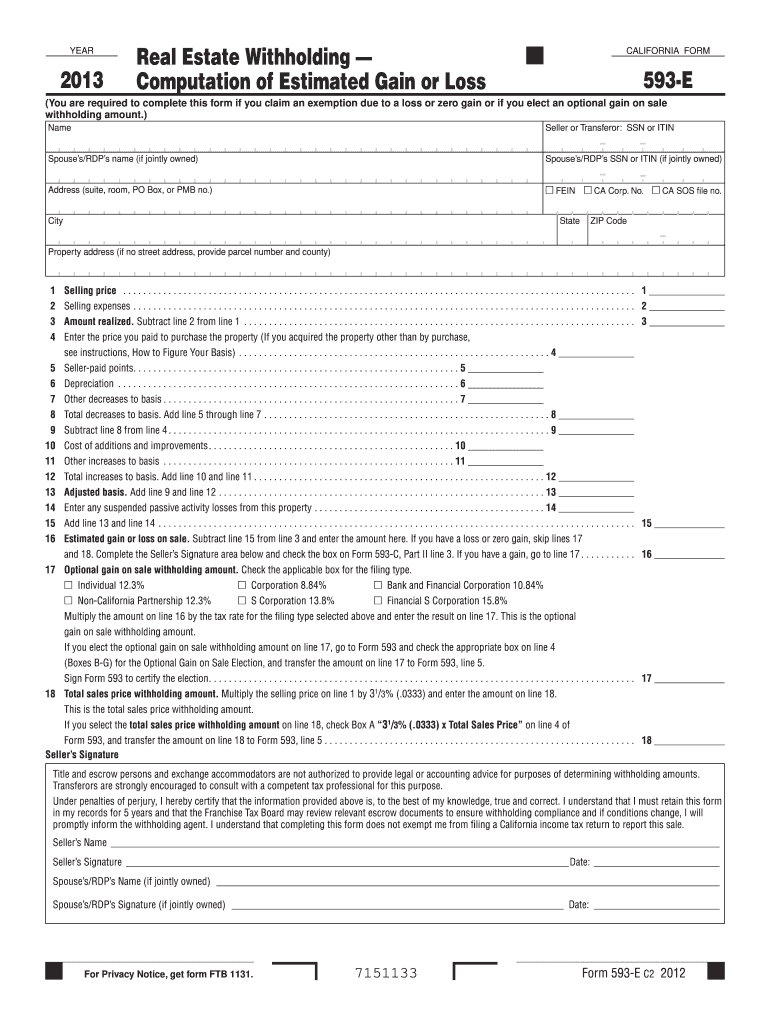

The Form 593 E is a tax document used in the United States, specifically for reporting the sale or transfer of California real estate. This form is essential for withholding tax obligations related to the transfer of property. It is typically required when a buyer or transferee acquires real estate from a seller who is a non-resident of California. The form ensures that the appropriate taxes are collected and reported to the California Franchise Tax Board.

How to use the Form 593 E

Using the Form 593 E involves several steps to ensure compliance with California tax regulations. First, the seller must provide accurate information regarding the property being sold, including the address and the sale price. The buyer must complete the form by including their details and confirming their residency status. Once completed, the form is submitted to the California Franchise Tax Board along with any required payment for withholding taxes. It is crucial to follow the instructions carefully to avoid penalties.

Steps to complete the Form 593 E

Completing the Form 593 E requires careful attention to detail. Here are the key steps:

- Gather necessary information, including the property address, sale price, and both parties' details.

- Indicate whether the seller is a resident or non-resident of California.

- Calculate the withholding amount based on the sale price and applicable tax rates.

- Complete all sections of the form accurately, ensuring there are no errors.

- Sign and date the form to validate its authenticity.

- Submit the completed form to the California Franchise Tax Board by the required deadline.

Legal use of the Form 593 E

The legal use of the Form 593 E is governed by California tax laws, which mandate that non-residents must comply with withholding requirements during real estate transactions. Failure to use the form correctly can lead to significant penalties and legal repercussions. It is essential for both buyers and sellers to understand their obligations under California law to ensure that the transaction is legally binding and that all tax liabilities are met.

Filing Deadlines / Important Dates

Filing deadlines for the Form 593 E are critical to avoid penalties. Typically, the form must be submitted at the time of the property transfer, along with any required tax payments. It is advisable to check the California Franchise Tax Board's official guidelines for specific deadlines, as they may vary based on the transaction date. Being aware of these dates ensures compliance and helps avoid unnecessary complications.

Required Documents

When completing the Form 593 E, certain documents are required to support the information provided. These may include:

- Proof of the property's sale price, such as a purchase agreement.

- Identification documents for both the buyer and seller.

- Any previous tax documents related to the property, if applicable.

Having these documents ready can streamline the completion process and ensure that all necessary information is accurately reported.

Quick guide on how to complete 2013 form 593 e

Complete Form 593 E effortlessly on any device

Web-based document management has gained immense popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Form 593 E on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Form 593 E seamlessly

- Find Form 593 E and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for such tasks.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to finalize your changes.

- Select your preferred method of delivering the form, whether by email, SMS, or invitation link, or download it to your computer.

Leave behind lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Modify and eSign Form 593 E and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 593 e

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 593 e

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the Form 593 E and how is it used?

The Form 593 E is a tax form used for reporting the sale of real property in California. It is essential for residents involved in real estate transactions, as it ensures compliance with state tax regulations. By using airSlate SignNow, businesses can easily create and eSign the Form 593 E to facilitate smooth transaction processes.

-

How can airSlate SignNow help with filling out the Form 593 E?

airSlate SignNow streamlines the process of filling out the Form 593 E with its user-friendly interface. You can quickly input required details, ensuring your form is completed accurately and efficiently. Plus, the ability to eSign documents saves time and reduces paperwork burden.

-

What are the pricing options for using airSlate SignNow to manage Form 593 E?

airSlate SignNow offers flexible pricing plans designed to fit businesses of any size. You can choose a plan that suits your needs, whether you're a small business handling a few Form 593 E documents or a larger enterprise requiring high-volume document management. Contact our sales team for customized pricing options.

-

Can I integrate airSlate SignNow with my existing tools for handling Form 593 E?

Yes, airSlate SignNow seamlessly integrates with various tools and applications that you may already use for handling Form 593 E. These integrations enhance productivity by allowing you to manage documents within your existing workflows. Popular integrations include CRM systems, project management tools, and storage solutions.

-

What are the benefits of using airSlate SignNow for Form 593 E?

Using airSlate SignNow for Form 593 E provides numerous benefits, such as improved efficiency and enhanced accuracy. The platform allows for easy document sharing and eSigning, which signNowly speeds up the completion of tax-related processes. Additionally, it offers secure storage options for your completed forms.

-

Is airSlate SignNow secure for submitting Form 593 E?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents, including Form 593 E, are protected. The platform employs advanced encryption and supports compliance with legal regulations, giving users peace of mind when handling sensitive information.

-

How does eSigning the Form 593 E work with airSlate SignNow?

The eSigning process on airSlate SignNow for Form 593 E is straightforward and user-friendly. Once you fill out the form, you can send it to signers via email, where they can review and eSign securely from any device. The completed document is then stored for your records, simplifying document management.

Get more for Form 593 E

Find out other Form 593 E

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form