Puerto Rico Tax Form Exemption 2015

What is the Puerto Rico Tax Form Exemption

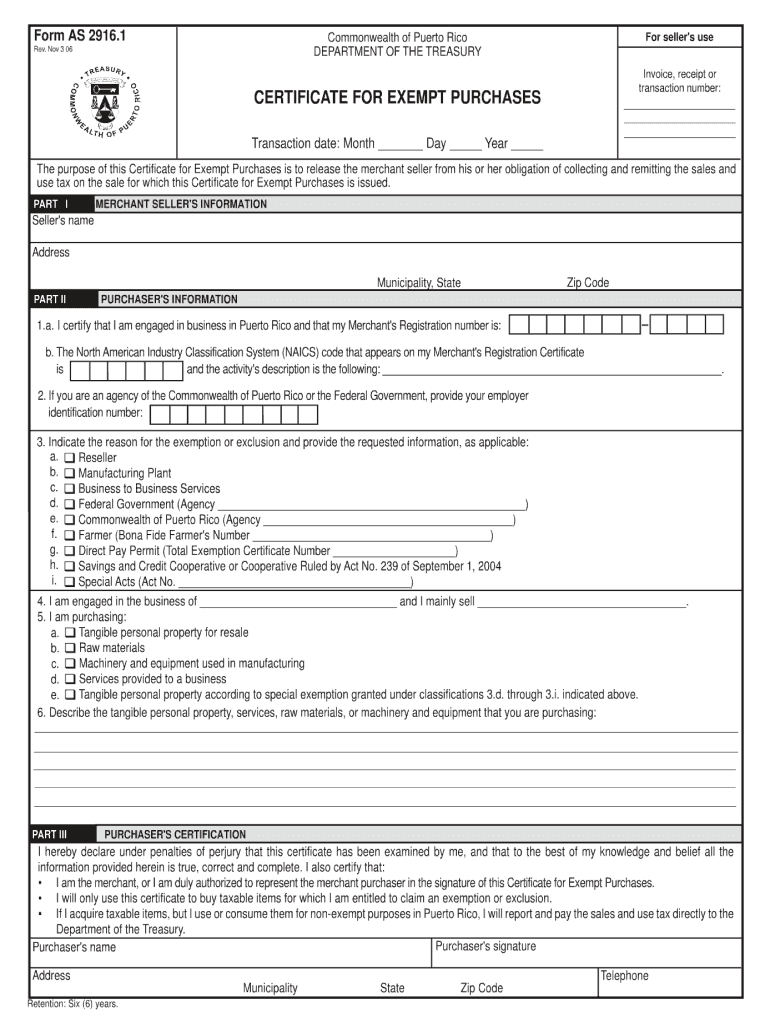

The Puerto Rico Tax Form Exemption is a specific document that allows eligible individuals and businesses to exempt certain income from taxation in Puerto Rico. This exemption is particularly beneficial for those who meet specific criteria set forth by the Puerto Rican government. Understanding this form is essential for taxpayers who want to ensure compliance with local tax laws while maximizing their tax benefits.

How to use the Puerto Rico Tax Form Exemption

Using the Puerto Rico Tax Form Exemption involves several steps to ensure proper completion and submission. Taxpayers must first determine their eligibility based on the criteria outlined by the Puerto Rican tax authorities. Once eligibility is confirmed, the form can be filled out accurately, ensuring that all required information is provided. After completing the form, it must be submitted to the appropriate tax office, either electronically or by mail, depending on the guidelines provided by the local tax authority.

Steps to complete the Puerto Rico Tax Form Exemption

Completing the Puerto Rico Tax Form Exemption requires careful attention to detail. Follow these steps:

- Gather all necessary documentation, including proof of income and residency.

- Download the form from the official tax authority website or obtain a physical copy.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the tax office either online or via mail.

Eligibility Criteria

To qualify for the Puerto Rico Tax Form Exemption, applicants must meet specific eligibility criteria. Generally, these criteria include residency requirements, income thresholds, and the nature of the income being exempted. Taxpayers should review the latest regulations to confirm their eligibility before applying for the exemption. This ensures that they are not only compliant but also able to take full advantage of the available tax benefits.

Required Documents

When applying for the Puerto Rico Tax Form Exemption, several documents are typically required to support the application. These may include:

- Proof of residency in Puerto Rico.

- Documentation of income sources.

- Identification documents such as a driver's license or social security number.

- Any previous tax returns that may be relevant.

Having these documents ready can streamline the application process and help ensure that the form is completed accurately.

Form Submission Methods

The Puerto Rico Tax Form Exemption can be submitted through various methods, depending on the preferences of the taxpayer and the guidelines set by the tax authority. Common submission methods include:

- Online submission through the official tax authority portal.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if available.

Choosing the right submission method can enhance the efficiency of the process and ensure timely processing of the exemption request.

Quick guide on how to complete puerto rico tax form exemption 2006

Complete Puerto Rico Tax Form Exemption effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Puerto Rico Tax Form Exemption on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

The simplest way to modify and electronically sign Puerto Rico Tax Form Exemption with ease

- Find Puerto Rico Tax Form Exemption and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Puerto Rico Tax Form Exemption and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct puerto rico tax form exemption 2006

Create this form in 5 minutes!

How to create an eSignature for the puerto rico tax form exemption 2006

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Puerto Rico Tax Form Exemption and how does it work?

The Puerto Rico Tax Form Exemption allows eligible individuals and businesses to avoid certain tax liabilities when filing. This exemption is particularly beneficial for those who meet specific criteria, ensuring that they comply with local tax laws while maximizing their savings.

-

How does airSlate SignNow facilitate the Puerto Rico Tax Form Exemption process?

airSlate SignNow simplifies the process of securing a Puerto Rico Tax Form Exemption by providing an easy-to-use platform for eSigning documents. Our solution ensures that all necessary forms are completed and submitted correctly, reducing the time and hassle for users.

-

Is there a cost associated with utilizing airSlate SignNow for Puerto Rico Tax Form Exemption?

airSlate SignNow offers competitive pricing plans tailored for businesses looking to file for the Puerto Rico Tax Form Exemption. We provide different subscription levels that cater to various needs, ensuring that every user finds a plan that fits their budget.

-

What features does airSlate SignNow offer for managing tax-related documents?

Our platform includes features such as document templates, eSignature capabilities, and secure storage to manage your Puerto Rico Tax Form Exemption papers effectively. With these tools, users can streamline their documentation process and maintain compliance easily.

-

Can airSlate SignNow integrate with accounting software for Puerto Rico Tax Form Exemption?

Yes, airSlate SignNow seamlessly integrates with popular accounting software to help manage the Puerto Rico Tax Form Exemption process. This integration allows users to synchronize their documents and streamline their workflow for better efficiency.

-

What are the benefits of using airSlate SignNow for Puerto Rico Tax Form Exemption?

By using airSlate SignNow for your Puerto Rico Tax Form Exemption, you gain quick and secure online document management. Our platform not only saves time but also reduces errors, ensuring that your tax filing process is both efficient and compliant.

-

How secure is my information when using airSlate SignNow for tax forms?

airSlate SignNow prioritizes the security of your information, especially when handling sensitive documents like the Puerto Rico Tax Form Exemption. Our platform employs advanced encryption and security protocols to protect your data at all times.

Get more for Puerto Rico Tax Form Exemption

Find out other Puerto Rico Tax Form Exemption

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document