Home Exemption Property Tax Paper Work Form

What is the Home Exemption Property Tax Paper Work

The Home Exemption Property Tax paperwork is essential for homeowners in Texas seeking to reduce their property tax burden. This documentation allows eligible individuals to apply for exemptions that can significantly lower their taxable property value. The most common exemptions include the general homestead exemption, which is available to homeowners who occupy their property as their primary residence, and additional exemptions for seniors, disabled individuals, and veterans. Understanding the specific requirements and benefits of these exemptions can help homeowners save money on their property taxes.

Eligibility Criteria for Home Exemption Property Tax Paper Work

To qualify for the Home Exemption Property Tax paperwork in Texas, applicants must meet specific eligibility criteria. Generally, the applicant must own the property and use it as their principal residence. Additional criteria may include:

- Age: Applicants must be at least sixty-five years old for the over-65 exemption.

- Disability: Individuals who are disabled may qualify for additional exemptions.

- Veteran Status: Veterans may be eligible for exemptions based on their service.

Each exemption type may have unique requirements, so it's important for applicants to review the specific guidelines for the exemption they are applying for.

Steps to Complete the Home Exemption Property Tax Paper Work

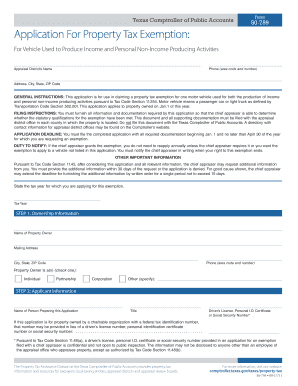

Completing the Home Exemption Property Tax paperwork involves several key steps to ensure the application is processed correctly. Here is a simplified guide:

- Gather Required Documents: Collect necessary documentation, such as proof of identity, property ownership, and any supporting documents related to age or disability.

- Obtain the Correct Form: Access the Texas property tax form, typically the Texas Comptroller 50-129 or the specific form for the exemption you are applying for.

- Fill Out the Form: Carefully complete the form, ensuring all information is accurate and complete.

- Submit the Application: Send the completed form along with any required documentation to your local appraisal district office. This can often be done online, by mail, or in person.

Following these steps can help streamline the application process and increase the chances of approval.

Form Submission Methods for Home Exemption Property Tax Paper Work

Submitting the Home Exemption Property Tax paperwork can be done through various methods, depending on the local appraisal district's capabilities. Common submission methods include:

- Online Submission: Many appraisal districts offer online portals for submitting forms electronically, making the process quick and efficient.

- Mail: Applicants can print the completed form and send it via postal mail to their local appraisal district office.

- In-Person: Submitting the form in person at the appraisal district office is also an option for those who prefer direct interaction.

Choosing the right submission method can depend on personal preference and the specific requirements of the local appraisal district.

Legal Use of the Home Exemption Property Tax Paper Work

The legal use of the Home Exemption Property Tax paperwork is crucial for ensuring compliance with Texas property tax laws. This paperwork must be completed accurately and submitted within the designated deadlines to be considered valid. Failure to comply with these regulations may result in denial of the exemption or penalties. Additionally, the use of electronic signatures is permissible under Texas law, provided that the eSignature meets the necessary legal standards. Utilizing a reliable eSignature platform can enhance the security and legality of the submission process.

Required Documents for Home Exemption Property Tax Paper Work

To successfully complete the Home Exemption Property Tax paperwork, applicants must provide several required documents. These may include:

- Proof of Identity: A government-issued ID, such as a driver's license or passport.

- Property Ownership Documents: Deeds or tax statements that confirm ownership of the property.

- Supporting Documentation: Additional documents that verify age, disability status, or veteran status, if applicable.

Having all necessary documents ready can facilitate a smoother application process and help avoid delays.

Quick guide on how to complete home exemption property tax paper work

Complete Home Exemption Property Tax Paper Work seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Handle Home Exemption Property Tax Paper Work on any platform with airSlate SignNow's Android or iOS applications and simplify any document-oriented process today.

How to modify and eSign Home Exemption Property Tax Paper Work effortlessly

- Locate Home Exemption Property Tax Paper Work and then click Obtain Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Completed button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, frustrating searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Home Exemption Property Tax Paper Work and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the home exemption property tax paper work

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF on Android devices

People also ask

-

What is the texas property tax form and why is it important?

The texas property tax form is a document required by property owners in Texas to report the value of their property to local tax authorities. It's important because it ensures that property owners are taxed accurately and can help you avoid penalties associated with late or incorrect submissions.

-

How can airSlate SignNow assist with completing the texas property tax form?

airSlate SignNow provides an easy-to-use platform that allows you to complete and eSign your texas property tax form quickly. You can fill out the form electronically, ensuring accuracy, and then securely send it directly to the relevant office, streamlining the entire process.

-

What features does airSlate SignNow offer for managing the texas property tax form?

With airSlate SignNow, you can access features like document templates, collaboration tools, and secure eSigning specifically designed for managing the texas property tax form. These features enhance your efficiency and ensure that your submissions are both accurate and timely.

-

Is airSlate SignNow affordable for individuals filing a texas property tax form?

Yes, airSlate SignNow offers various pricing plans that make it a cost-effective solution for individuals needing to file a texas property tax form. Whether you're a homeowner or a property manager, you can find a plan that fits your budget while providing you with powerful tools.

-

Can I integrate airSlate SignNow with other software for handling the texas property tax form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage your texas property tax form alongside your other accounting or property management tools. This integration helps streamline your workflow and enhances efficiency.

-

What are the benefits of using airSlate SignNow for the texas property tax form?

Using airSlate SignNow for your texas property tax form simplifies the filing process, minimizes errors, and saves time. The platform also provides security features, ensuring your sensitive information is protected while you eSign and submit documents.

-

How secure is my information when using airSlate SignNow for the texas property tax form?

airSlate SignNow employs high-level encryption and security protocols to protect your information when submitting the texas property tax form. With these measures in place, you can confidently eSign and send your documents without worrying about data bsignNowes.

Get more for Home Exemption Property Tax Paper Work

Find out other Home Exemption Property Tax Paper Work

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online