3561c Form

What is the 3561c?

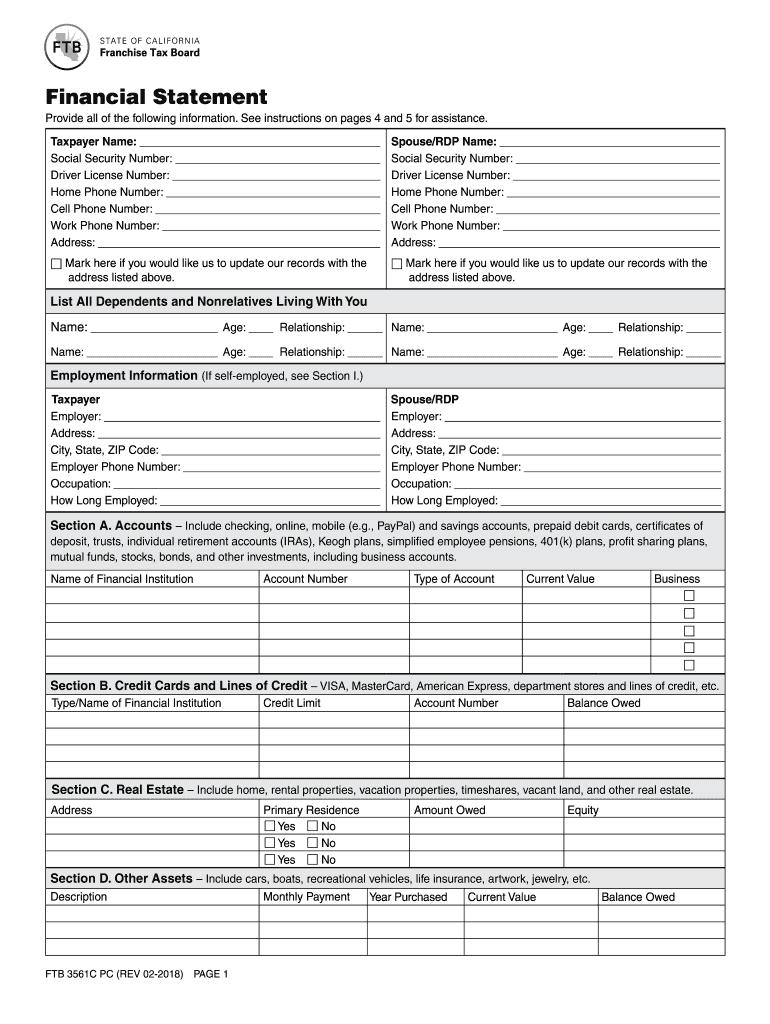

The ftb 3561c, also known as the California Financial Statement, is a form used by individuals and businesses to report their financial status to the California Franchise Tax Board (FTB). This form is essential for various tax-related purposes, including establishing eligibility for certain tax relief programs. It captures detailed information about income, assets, liabilities, and other financial aspects, helping the FTB assess tax obligations accurately.

How to use the 3561c

Using the form 3561c involves several steps. First, gather all necessary financial documents, such as income statements, bank statements, and records of assets and liabilities. Next, fill out the form accurately, ensuring that all information is complete and up-to-date. After completing the form, review it for any errors before submission. The form can be submitted electronically or via mail, depending on your preference and the requirements set by the FTB.

Steps to complete the 3561c

Completing the ftb 3561c requires a systematic approach:

- Gather necessary financial documents, including income and asset records.

- Fill out the personal information section, including your name and address.

- Provide detailed information about your income, assets, and liabilities.

- Review all entries for accuracy and completeness.

- Submit the form electronically or by mail as per the FTB guidelines.

Legal use of the 3561c

The ftb financial 3561c is legally binding when completed correctly and submitted as required. It must comply with the relevant laws and regulations governing financial disclosures in California. Utilizing a secure platform for electronic submission can enhance the legal standing of the form, ensuring that it meets the standards set by the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA).

Form Submission Methods

The tax form 3561c can be submitted through various methods, including:

- Online Submission: Use the FTB's online portal for a quick and efficient submission process.

- Mail: Print the completed form and send it to the designated FTB address.

- In-Person: Visit a local FTB office to submit the form directly.

Required Documents

To complete the form 3561c, you will need several key documents:

- Income statements, such as W-2s or 1099s.

- Bank statements to verify assets.

- Documentation of any liabilities, including loans and credit card statements.

- Previous tax returns for reference.

Quick guide on how to complete 3561c

Easily Prepare 3561c on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-conscious substitute to conventional printed and signed documents, as you can locate the correct form and securely archive it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents quickly and efficiently. Handle 3561c on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The Simplest Way to Edit and Electronically Sign 3561c with Ease

- Find 3561c and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the papers or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Decide how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 3561c and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 3561c

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the ftb 3561c form, and how can airSlate SignNow help?

The ftb 3561c form is a California tax form used for various reporting purposes. With airSlate SignNow, you can easily fill out, sign, and send this document electronically, streamlining your tax reporting process while ensuring compliance and security.

-

How much does it cost to use airSlate SignNow for ftb 3561c submissions?

airSlate SignNow offers flexible pricing plans that cater to different needs. You'll find that these plans are cost-effective and offer great value, making it easy to manage your ftb 3561c submissions without breaking the bank.

-

What features does airSlate SignNow offer for managing the ftb 3561c?

airSlate SignNow includes essential features such as document templates, customizable workflows, and real-time tracking. These features make it easy to manage your ftb 3561c effectively, enhancing your overall document signing experience.

-

Can I integrate airSlate SignNow with other applications for ftb 3561c processing?

Yes, airSlate SignNow allows seamless integrations with various applications like Google Drive, Dropbox, and CRM systems. This makes it easier to handle your ftb 3561c documentation alongside other business processes, boosting productivity.

-

Is it safe to use airSlate SignNow for my ftb 3561c documents?

Absolutely! airSlate SignNow employs state-of-the-art security measures, including encryption and secure storage, to protect your sensitive information. When using airSlate SignNow for your ftb 3561c documents, you can trust that your data is in good hands.

-

How can I ensure compliance when using airSlate SignNow for ftb 3561c?

airSlate SignNow is designed to help you maintain compliance through features like audit trails and secure document handling. By following these protocols while preparing your ftb 3561c, you can confidently submit your documents knowing you are compliant with regulations.

-

Can airSlate SignNow help with collaboration on the ftb 3561c form?

Yes, airSlate SignNow facilitates collaborative work by allowing multiple users to access and edit the ftb 3561c form simultaneously. This feature ensures that your team can work together efficiently, leading to faster completion and submission of key documents.

Get more for 3561c

- Strengths and needs assessment example form

- Hair loss questionnaire form

- Vikariatsrapport form

- Territorial army photo and signature size form

- Affidavit for lost passport kenya pdf form

- Wedding intake form st joseph lake orion

- Canine dental assessment chart form

- Contractor pre qualification checklist form

Find out other 3561c

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement