St 5c Form

What is the St 5c

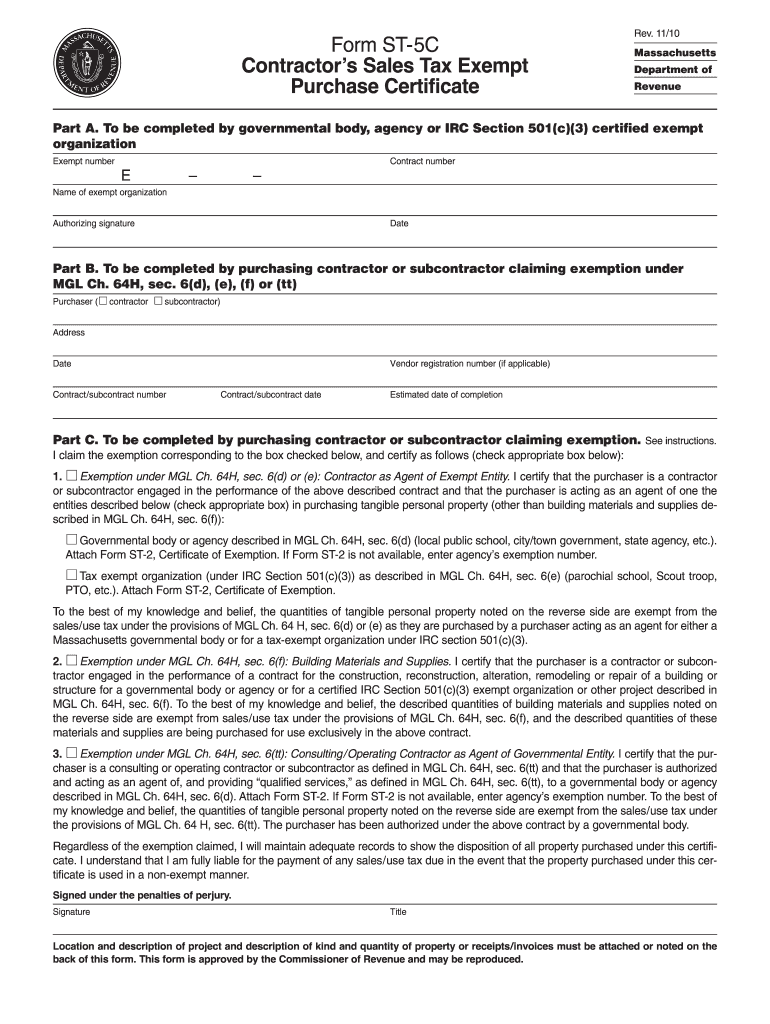

The St 5c form, also known as the Massachusetts Tax Exempt Certificate, is a crucial document used by businesses and individuals in Massachusetts to make tax-exempt purchases. This form allows eligible purchasers, such as contractors and non-profit organizations, to buy goods and services without paying sales tax. The St 5c serves as proof of the buyer's tax-exempt status and is essential for compliance with state tax regulations.

How to use the St 5c

To effectively use the St 5c form, the purchaser must complete it accurately and present it to the seller at the time of purchase. The form requires specific information, including the purchaser's name, address, and the reason for the tax exemption. By providing this certificate, the buyer ensures that they are not charged sales tax on eligible purchases, which can lead to significant savings, especially for contractors who frequently buy materials.

Steps to complete the St 5c

Completing the St 5c form involves several straightforward steps:

- Download the St 5c form from a reliable source.

- Fill in the purchaser's name and address accurately.

- Indicate the type of tax-exempt purchase being made.

- Provide a valid reason for the exemption, such as being a contractor or a non-profit organization.

- Sign and date the form to validate it.

Once completed, the form should be presented to the seller to avoid sales tax charges on the purchase.

Legal use of the St 5c

The legal use of the St 5c form is governed by Massachusetts state tax laws. To ensure compliance, the purchaser must meet the eligibility criteria for tax exemption. This includes being a recognized tax-exempt organization or a contractor purchasing materials for resale. Misuse of the St 5c, such as using it for personal purchases, can result in penalties and legal repercussions.

Eligibility Criteria

Eligibility to use the St 5c form is limited to specific entities and purposes. Generally, the following groups may qualify:

- Non-profit organizations recognized under IRS regulations.

- Government entities making purchases for public use.

- Contractors purchasing materials for resale or for use in tax-exempt projects.

It is important for users to verify their eligibility before using the St 5c to avoid complications with tax authorities.

Form Submission Methods

The St 5c form can be submitted in various ways, depending on the seller's policies. Common submission methods include:

- Presenting a physical copy of the completed form at the point of sale.

- Sending a scanned copy via email if the seller accepts electronic submissions.

- Submitting through online platforms that facilitate tax-exempt purchases.

Understanding the preferred submission method of the seller can streamline the purchasing process and ensure compliance with tax regulations.

Quick guide on how to complete st 5c

Easily Prepare St 5c on Any Device

Managing documents online has become increasingly favored by both companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, adjust, and eSign your documents promptly without delays. Handle St 5c on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

Editing and eSigning St 5c with Ease

- Find St 5c and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information, then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign St 5c to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 5c

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The way to create an eSignature for a PDF file on Android devices

People also ask

-

What is the st 5c feature in airSlate SignNow?

The st 5c feature in airSlate SignNow refers to our streamlined document signing process designed to enhance user experience. This feature allows you to manage, send, and eSign documents efficiently, making it an essential tool for businesses looking to simplify their workflows.

-

How does pricing work for st 5c with airSlate SignNow?

Pricing for airSlate SignNow's st 5c solutions is competitive and tailored to meet the needs of different businesses. We offer various plans based on features and usage, ensuring that users receive the value they need while maintaining cost-effectiveness.

-

What benefits does st 5c provide for businesses?

The st 5c capability within airSlate SignNow offers several benefits, including reduced turnaround time for document approvals and enhanced team collaboration. Businesses can leverage this feature to improve efficiency, minimize errors, and boost overall productivity.

-

Can I integrate st 5c with my existing software?

Yes, airSlate SignNow supports seamless integration with various software applications, enhancing your st 5c experience. Integrating with popular tools like CRM systems and project management software can effortlessly improve your document workflows.

-

Is there a mobile version for st 5c in airSlate SignNow?

Absolutely! The st 5c feature in airSlate SignNow is optimized for mobile devices, allowing users to send and eSign documents on the go. This flexibility ensures that important documents can be managed anytime, anywhere, without compromising functionality.

-

What types of documents can I send using st 5c?

With airSlate SignNow's st 5c, you can send a variety of documents, including contracts, agreements, and forms. This versatility makes it suitable for many industries, enabling businesses to streamline their document processes effectively.

-

How secure is the st 5c feature in airSlate SignNow?

The st 5c feature is designed with security in mind, employing advanced encryption methods and compliance with industry standards. This ensures that your documents remain safe and secure throughout the signing process, giving you peace of mind.

Get more for St 5c

Find out other St 5c

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document