593 E Form 2019

What is the 593 E Form

The 593 E Form is a tax document used primarily in the United States for reporting certain transactions involving real estate. This form is essential for individuals or entities that are involved in the sale or transfer of real property, particularly when it comes to withholding requirements for non-resident sellers. The form helps ensure compliance with federal tax laws and provides necessary information to the Internal Revenue Service (IRS) regarding the transaction.

How to use the 593 E Form

Using the 593 E Form involves several key steps to ensure that all required information is accurately reported. First, gather all necessary details about the transaction, including the seller's information, buyer's information, and specifics about the property. Next, complete the form by filling in the required fields, such as the amount realized from the sale and any applicable withholding amounts. Finally, submit the completed form to the appropriate tax authority, ensuring that copies are retained for your records.

Steps to complete the 593 E Form

Completing the 593 E Form requires careful attention to detail. Follow these steps:

- Gather pertinent information about the property and the parties involved.

- Fill out the seller's and buyer's information accurately.

- Indicate the total amount realized from the sale.

- Calculate any withholding amounts required by law.

- Review the form for accuracy before submission.

Once completed, ensure that the form is submitted by the relevant deadline to avoid penalties.

Legal use of the 593 E Form

The legal use of the 593 E Form is crucial for compliance with U.S. tax regulations. It serves as a formal declaration of the transaction and ensures that the IRS is informed of any withholding obligations. Failure to use this form appropriately can lead to penalties for both the buyer and the seller. It is advisable to consult with a tax professional to understand the legal implications fully and ensure that all requirements are met.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 593 E Form. These guidelines outline the necessary information to be reported, the deadlines for submission, and the penalties for non-compliance. It is important to review these guidelines to ensure that all aspects of the form are completed correctly and submitted on time. For the most accurate and up-to-date information, refer directly to the IRS publications related to the 593 E Form.

Filing Deadlines / Important Dates

Filing deadlines for the 593 E Form are critical to avoid penalties. Generally, the form must be submitted by the due date of the tax return for the year in which the transaction occurred. It is essential to keep track of these dates, as late submissions can result in fines or additional tax liabilities. Always verify the specific deadlines for the current tax year to ensure compliance.

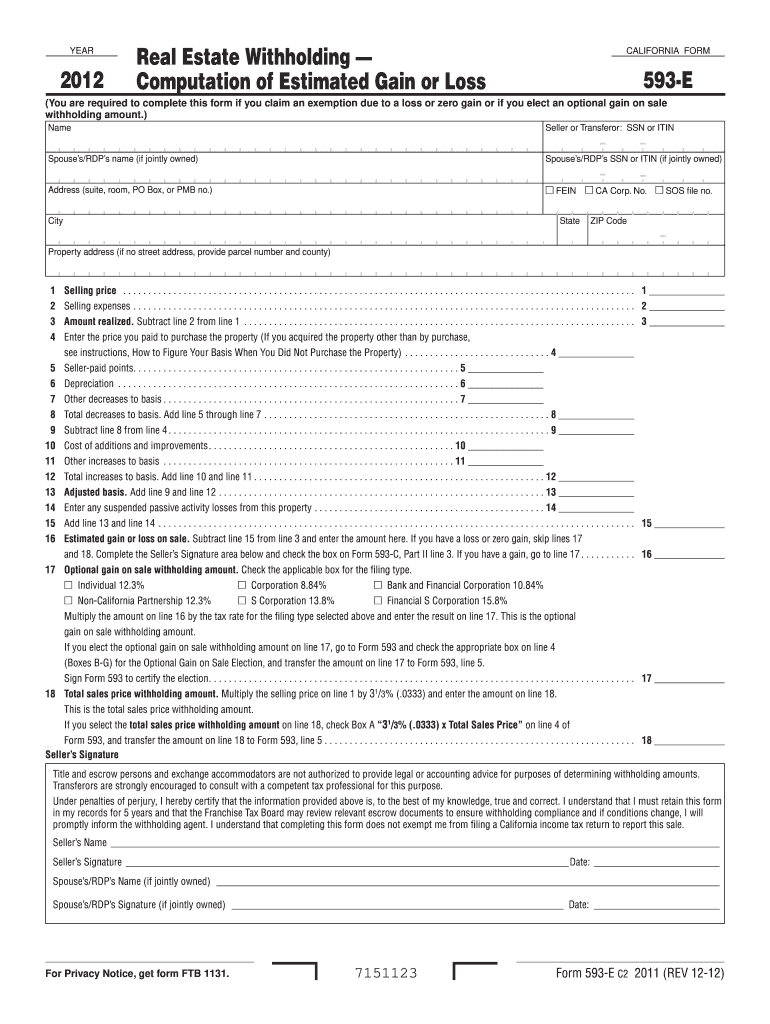

Quick guide on how to complete 593 e 2012 form

Effortlessly Prepare 593 E Form on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right format and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Manage 593 E Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign 593 E Form with Ease

- Obtain 593 E Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether it be via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign 593 E Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 593 e 2012 form

Create this form in 5 minutes!

How to create an eSignature for the 593 e 2012 form

The best way to generate an eSignature for a PDF online

The best way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

How to create an eSignature for a PDF on Android

People also ask

-

What is the 593 E Form?

The 593 E Form is a tax exemption certificate required in California for certain real estate transactions. It serves to inform the state about tax withholdings related to property sales. Understanding the 593 E Form is essential for sellers to ensure compliance and avoid unnecessary tax penalties.

-

How can airSlate SignNow help with the 593 E Form?

airSlate SignNow offers a seamless solution to complete and eSign the 593 E Form online. Our platform ensures your document is securely signed, stored, and shared, making the entire process efficient. This simplifies compliance for real estate transactions and saves you valuable time.

-

What features does airSlate SignNow offer for the 593 E Form?

With airSlate SignNow, you have access to features like customizable templates, electronic signatures, and real-time tracking for your 593 E Form. These tools help you manage your documents effortlessly and ensure that every step is streamlined. The platform also provides integration options to fit your business needs.

-

Is airSlate SignNow cost-effective for handling the 593 E Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the 593 E Form and other documents. Our pricing plans are designed to fit businesses of all sizes, ensuring that you only pay for what you need. By utilizing our platform, you can save both time and money on document management.

-

What are the benefits of using airSlate SignNow for the 593 E Form?

Using airSlate SignNow for the 593 E Form enhances efficiency and accuracy in your document management process. Our platform reduces the risk of errors associated with traditional paper forms and speeds up the signing process. Additionally, you gain access to a secure environment for sensitive tax-related documents.

-

Can the 593 E Form be integrated with other software using airSlate SignNow?

Absolutely! airSlate SignNow provides integration capabilities with various software solutions, allowing you to link the 593 E Form with your existing tools. This flexibility ensures that you can incorporate seamless workflows within your business environment, maximizing productivity and efficiency.

-

How do I ensure compliance when using the 593 E Form with airSlate SignNow?

To ensure compliance when using the 593 E Form with airSlate SignNow, follow California's guidelines closely and utilize our features to maintain accurate records. Our platform aids in the version control of documents, ensuring that you always use the latest form. Additionally, our support and resources can guide you through the compliance process.

Get more for 593 E Form

Find out other 593 E Form

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online

- How Do I eSign Maine Revocation of Power of Attorney

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple