Annual Employer Withholding Reconciliation Return DUE DATE 2020

What is the Annual Employer Withholding Reconciliation Return DUE DATE

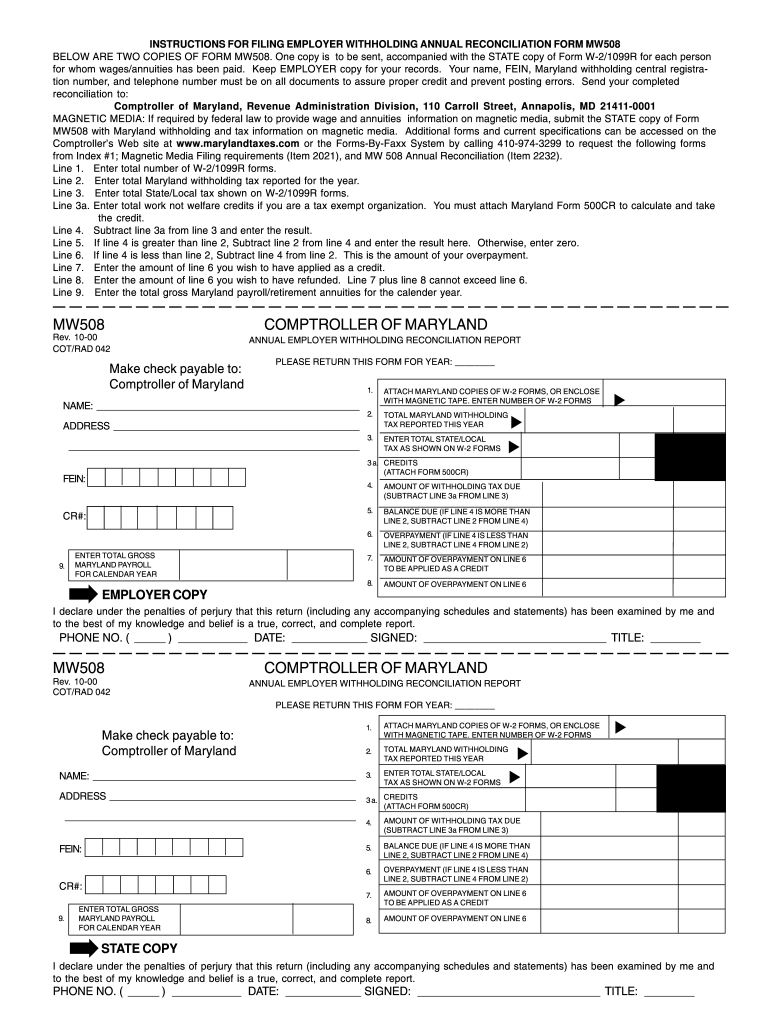

The Annual Employer Withholding Reconciliation Return is a critical form for employers in the United States. It serves to reconcile the amounts withheld from employees' wages throughout the year against what has been reported to the IRS. The due date for this form is essential for compliance, as it ensures that all withholding amounts are accurately reported and any discrepancies are addressed. This form typically includes details such as total wages paid, total tax withheld, and any adjustments necessary to align with federal tax obligations.

Steps to complete the Annual Employer Withholding Reconciliation Return DUE DATE

Completing the Annual Employer Withholding Reconciliation Return involves several key steps. First, gather all relevant payroll records for the year, including W-2 forms and any 1099s issued. Next, calculate the total wages paid and the total amount of federal income tax withheld. Ensure that these figures match the amounts reported on your quarterly tax filings. After verifying the accuracy of your calculations, fill out the reconciliation return form, ensuring that all required fields are completed. Finally, submit the form by the due date, either electronically or by mail, depending on your preference and the requirements set by the IRS.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Annual Employer Withholding Reconciliation Return is crucial for maintaining compliance. Typically, this form is due by January thirty-first of the following year. If January thirty-first falls on a weekend or holiday, the due date is extended to the next business day. Employers should also be aware of any state-specific deadlines that may apply, as these can vary. Keeping a calendar of important dates can help ensure timely submissions and avoid penalties.

Penalties for Non-Compliance

Failure to file the Annual Employer Withholding Reconciliation Return by the due date can result in significant penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, inaccuracies in the reported amounts may lead to further penalties and interest on unpaid taxes. Employers should be proactive in ensuring that they meet all filing requirements to avoid these financial repercussions. Regular audits of payroll records can help identify potential issues before they lead to non-compliance.

Legal use of the Annual Employer Withholding Reconciliation Return DUE DATE

The legal use of the Annual Employer Withholding Reconciliation Return is grounded in federal tax law. This form is required for employers to report withholding amounts accurately, ensuring compliance with IRS regulations. Proper completion and timely submission of the form can protect employers from legal issues related to tax liabilities. Additionally, using a reliable electronic signature solution can enhance the legal validity of the submissions, ensuring that all signatures are secure and compliant with electronic signature laws.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Annual Employer Withholding Reconciliation Return. The form can be filed electronically through the IRS e-file system, which is often the preferred method due to its speed and efficiency. Alternatively, employers may choose to mail the completed form to the appropriate IRS address. In-person submissions are generally not available for this form. Regardless of the method chosen, it is important to retain proof of submission for record-keeping and compliance purposes.

Quick guide on how to complete annual employer withholding reconciliation return due date

Prepare Annual Employer Withholding Reconciliation Return DUE DATE effortlessly on any device

Online document management has gained traction among organizations and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, enabling you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Annual Employer Withholding Reconciliation Return DUE DATE on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest method to modify and eSign Annual Employer Withholding Reconciliation Return DUE DATE effortlessly

- Obtain Annual Employer Withholding Reconciliation Return DUE DATE and click Get Form to initiate.

- Employ the tools we provide to fill out your form.

- Mark important sections of your documents or conceal sensitive details using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Annual Employer Withholding Reconciliation Return DUE DATE to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual employer withholding reconciliation return due date

Create this form in 5 minutes!

How to create an eSignature for the annual employer withholding reconciliation return due date

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is the Annual Employer Withholding Reconciliation Return DUE DATE?

The Annual Employer Withholding Reconciliation Return DUE DATE refers to the specific deadline by which employers must submit their reconciliation returns for withholding taxes, typically occurring at the end of the calendar year. This ensures compliance with tax regulations and helps avoid potential penalties for late submissions. Understanding this date is crucial for proper payroll processing and tax reporting.

-

How can airSlate SignNow help with the Annual Employer Withholding Reconciliation Return DUE DATE?

airSlate SignNow streamlines the process of preparing and submitting your Annual Employer Withholding Reconciliation Return DUE DATE by providing a secure platform for eSigning and sending necessary documents. This reduces the risk of errors and ensures timely submission. With our solution, businesses can manage their tax documentation efficiently and comply with state requirements.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers flexible pricing plans to accommodate various business sizes and needs when managing tax documents like the Annual Employer Withholding Reconciliation Return DUE DATE. These plans are designed to be cost-effective while providing comprehensive features such as document management and eSigning, which can help streamline your workflow.

-

What features does airSlate SignNow offer for handling tax forms?

airSlate SignNow includes features such as secure eSigning, document templates, and form creation tools aimed at simplifying the submission of tax forms like the Annual Employer Withholding Reconciliation Return DUE DATE. Additionally, the platform allows for easy tracking of document status and compliance, making tax season much less stressful.

-

Are there integrations available with airSlate SignNow for tax preparation software?

Absolutely! airSlate SignNow integrates seamlessly with popular tax preparation software, facilitating a smooth workflow for preparing your Annual Employer Withholding Reconciliation Return DUE DATE. These integrations allow users to easily transfer data between systems, improving efficiency and reducing the potential for errors.

-

How does eSigning work with airSlate SignNow?

eSigning with airSlate SignNow is simple and user-friendly. Users can upload documents, add signature fields, and send them to recipients for electronic signature, which is particularly beneficial for documents related to the Annual Employer Withholding Reconciliation Return DUE DATE. The process is secure, legally binding, and saves time compared to traditional methods.

-

Can I track the status of my tax documents using airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking features that allow you to monitor the status of your tax documents related to the Annual Employer Withholding Reconciliation Return DUE DATE. This ensures you stay updated on who has signed your documents and when, enabling efficient management of compliance deadlines.

Get more for Annual Employer Withholding Reconciliation Return DUE DATE

Find out other Annual Employer Withholding Reconciliation Return DUE DATE

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application