Renter's Property Tax Refund Minnesota Department of Revenue 2020

What is the Renter's Property Tax Refund Minnesota Department Of Revenue

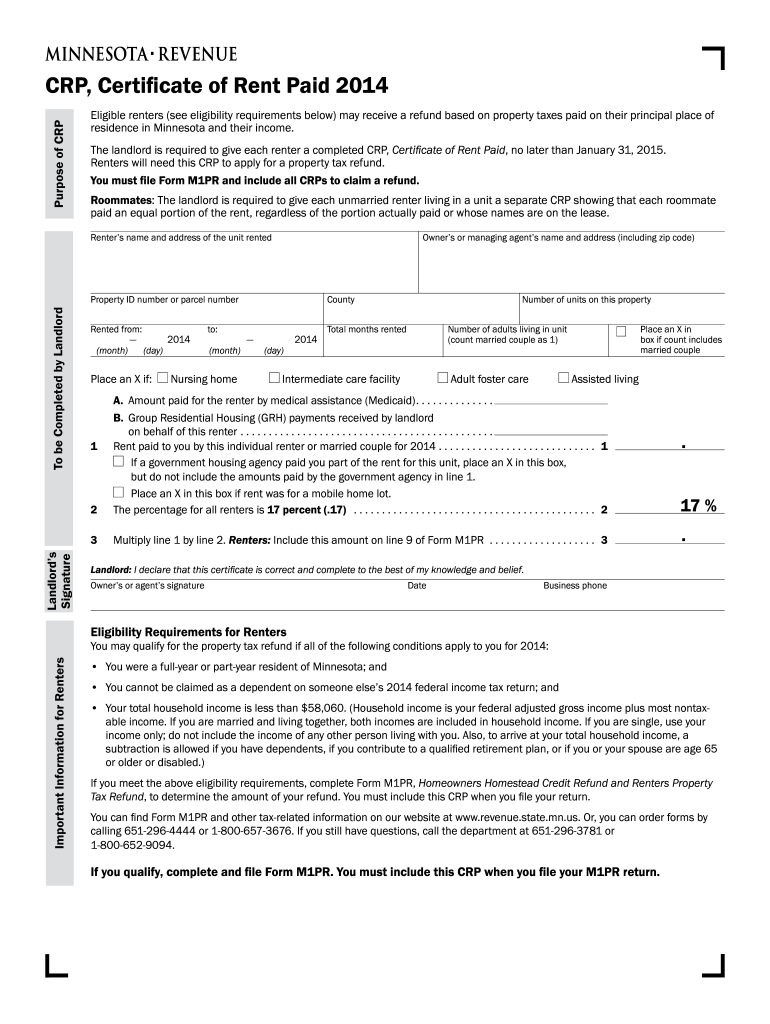

The Renter's Property Tax Refund is a program administered by the Minnesota Department of Revenue designed to provide financial relief to eligible renters. This refund aims to assist individuals who pay rent in Minnesota and meet specific income and residency criteria. The program acknowledges that renters contribute to property taxes indirectly through their rent payments, and it seeks to alleviate some of the financial burden associated with housing costs.

Eligibility Criteria

To qualify for the Renter's Property Tax Refund, applicants must meet several criteria:

- Be a resident of Minnesota for at least half of the year.

- Have paid rent on a principal residence in Minnesota.

- Meet the income limits set by the Minnesota Department of Revenue.

- Be at least 18 years old or have a spouse who meets the age requirement.

It is essential to review the specific income thresholds and other requirements each year, as these can change based on state regulations.

Steps to Complete the Renter's Property Tax Refund Minnesota Department Of Revenue

Completing the Renter's Property Tax Refund form involves several key steps:

- Gather necessary documentation, including proof of rent paid and income statements.

- Obtain the Renter's Property Tax Refund form from the Minnesota Department of Revenue website or local offices.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form by the specified deadline, either online or via mail.

Taking the time to ensure accuracy can help prevent delays in processing and potential issues with your refund.

Required Documents

When applying for the Renter's Property Tax Refund, certain documents are necessary to support your application:

- Proof of rent payments, such as lease agreements or rent receipts.

- Income documentation, which may include W-2 forms, pay stubs, or tax returns.

- Identification, such as a driver's license or state ID.

Having these documents ready will streamline the application process and ensure compliance with the requirements set forth by the Minnesota Department of Revenue.

Form Submission Methods

Applicants can submit the Renter's Property Tax Refund form through various methods:

- Online submission via the Minnesota Department of Revenue's e-Services portal.

- Mailing a completed paper form to the appropriate address provided by the department.

- In-person submission at designated state or local offices.

Choosing the online method may expedite processing times, while mailing or in-person options can be useful for those who prefer traditional methods.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Renter's Property Tax Refund. Typically, applications must be submitted by August 15 of the year following the tax year for which the refund is claimed. Keeping track of these dates ensures that you do not miss the opportunity to receive your refund.

Quick guide on how to complete renters property tax refund minnesota department of revenue

Manage Renter's Property Tax Refund Minnesota Department Of Revenue easily on any device

Digital document management has become widely adopted by companies and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, enabling you to obtain the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, edit, and electronically sign your files swiftly without delays. Handle Renter's Property Tax Refund Minnesota Department Of Revenue on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Renter's Property Tax Refund Minnesota Department Of Revenue effortlessly

- Obtain Renter's Property Tax Refund Minnesota Department Of Revenue and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes moments and holds the same legal validity as an ink signature.

- Review all the details and click on the Done button to store your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, time-consuming form searches, or errors necessitating reprints. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Renter's Property Tax Refund Minnesota Department Of Revenue and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct renters property tax refund minnesota department of revenue

Create this form in 5 minutes!

How to create an eSignature for the renters property tax refund minnesota department of revenue

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is the Renter's Property Tax Refund from the Minnesota Department Of Revenue?

The Renter's Property Tax Refund from the Minnesota Department Of Revenue is a financial program designed to provide relief to eligible renters who pay property taxes through their rent. This refund helps alleviate the tax burden and is based on the amount of rent paid and the renter's income level. By understanding this program, you can make the most of your potential tax refund.

-

Who is eligible for the Renter's Property Tax Refund in Minnesota?

Eligibility for the Renter's Property Tax Refund from the Minnesota Department Of Revenue typically includes renters who have lived in Minnesota for at least 183 days in the year and meet specific income limits. Additionally, the property must be subject to property taxes, which can include various rental properties. It's essential to check the criteria annually to ensure you qualify.

-

How do I apply for the Renter's Property Tax Refund in Minnesota?

To apply for the Renter's Property Tax Refund from the Minnesota Department Of Revenue, you'll need to complete Form M1PR, which can be found on their website. The form requires information about your rental payments and your income for the year. Submitting the application accurately and on time is crucial to securing your refund.

-

What documents do I need for the Renter's Property Tax Refund application?

When applying for the Renter's Property Tax Refund from the Minnesota Department Of Revenue, you'll need proof of your income, your rental payment details, and potentially your landlord's information. Collecting these documents beforehand can streamline the application process and increase the chances of receiving your refund promptly.

-

What is the average refund amount for the Renter's Property Tax Refund in Minnesota?

The average refund amount for the Renter's Property Tax Refund from the Minnesota Department Of Revenue can vary based on your rental payments and income level. While some renters may receive a few hundred dollars, others may qualify for larger refunds based on their circumstances. It's advantageous to calculate your potential refund to understand the financial benefit.

-

How long does it take to receive the Renter's Property Tax Refund in Minnesota?

After submitting your application for the Renter's Property Tax Refund from the Minnesota Department Of Revenue, it typically takes 8 to 12 weeks to process and receive your refund. Delays can occur based on the volume of applications or if additional information is needed. Keeping track of your application status can help you stay updated.

-

Can I track my Renter's Property Tax Refund application status?

Yes, you can track your application status for the Renter's Property Tax Refund from the Minnesota Department Of Revenue online through their official website. They provide tools to check the progress of your application and to see any additional requirements. This transparency allows you to stay informed throughout the process.

Get more for Renter's Property Tax Refund Minnesota Department Of Revenue

Find out other Renter's Property Tax Refund Minnesota Department Of Revenue

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization