Maryland Homestead Tax Credit Form

What is the Maryland Homestead Tax Credit

The Maryland Homestead Tax Credit is a program designed to provide property tax relief to eligible homeowners. This credit limits the amount of property tax increase on a principal residence to a maximum of ten percent per year. It aims to assist homeowners in maintaining affordability in their property taxes, especially for those who have lived in their homes for an extended period. The program is particularly beneficial for individuals facing financial challenges due to rising property values.

Eligibility Criteria for the Maryland Homestead Tax Credit

To qualify for the Maryland Homestead Tax Credit, applicants must meet specific eligibility criteria. Homeowners must occupy the property as their principal residence, and the property must be owned by the applicant. Additionally, the homeowner must not have claimed the credit on any other property. The property must also be assessed for tax purposes, and the applicant must provide proof of residency. These criteria ensure that the credit is awarded to those who genuinely need assistance with their property taxes.

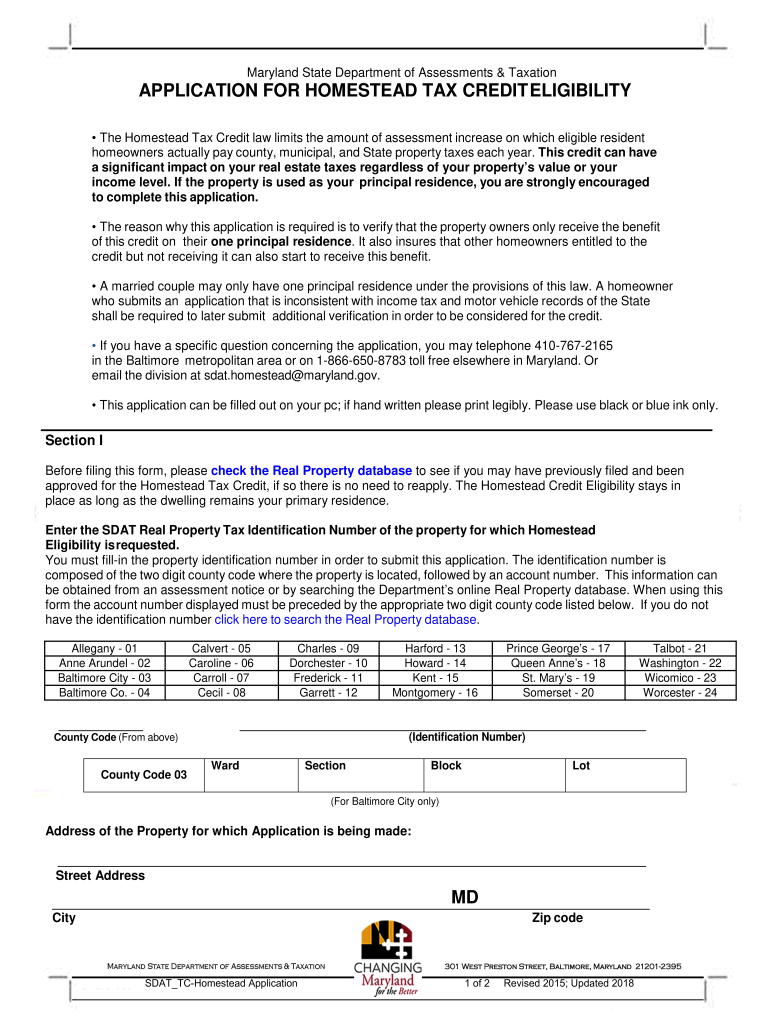

Steps to Complete the Maryland Homestead Tax Credit Application

Completing the Maryland Homestead Tax Credit application involves several straightforward steps:

- Gather necessary documentation, including proof of residency and ownership.

- Obtain the Maryland Homestead Tax Credit application form, which can be accessed online or through local tax offices.

- Fill out the application form with accurate information regarding your property and personal details.

- Submit the completed application either online, by mail, or in person at your local tax office.

- Await confirmation of your application status and any further instructions from the tax authority.

Required Documents for the Maryland Homestead Tax Credit Application

When applying for the Maryland Homestead Tax Credit, applicants must provide specific documents to support their application. Required documents typically include:

- Proof of identity, such as a driver's license or state ID.

- Documentation showing ownership of the property, such as a deed.

- Evidence of residency, which may include utility bills or bank statements with your name and address.

Having these documents ready can streamline the application process and help ensure a successful submission.

Form Submission Methods for the Maryland Homestead Tax Credit

Applicants have multiple options for submitting the Maryland Homestead Tax Credit application. The methods include:

- Online submission through the Maryland State Department of Assessments and Taxation website.

- Mailing the completed application to the local tax office.

- In-person submission at the local tax office, where assistance may be available.

Choosing the most convenient submission method can facilitate a smoother application process.

Key Elements of the Maryland Homestead Tax Credit

Understanding the key elements of the Maryland Homestead Tax Credit is essential for potential applicants. Some important aspects include:

- The credit applies only to the principal residence of the homeowner.

- It limits the increase in property tax assessments to a maximum of ten percent annually.

- Homeowners must reapply if they change their principal residence or if their ownership status changes.

These elements help ensure that the credit effectively supports homeowners in managing their property tax obligations.

Quick guide on how to complete maryland homestead tax credit

Manage Maryland Homestead Tax Credit effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed papers, allowing you to access the right form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and efficiently. Handle Maryland Homestead Tax Credit on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Maryland Homestead Tax Credit seamlessly

- Locate Maryland Homestead Tax Credit and then click Get Form to begin.

- Utilize the available tools to fill out your form.

- Emphasize critical areas of your documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether through email, SMS, a sharing link, or by downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and electronically sign Maryland Homestead Tax Credit, ensuring clear communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland homestead tax credit

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is homestead tax credit and how can it benefit me?

The homestead tax credit is a tax benefit that reduces the amount of property tax you owe on your primary residence. By qualifying for this credit, homeowners can signNowly lower their tax burden, making homeownership more affordable. Understanding what is homestead tax credit is essential for maximizing your financial benefits as a homeowner.

-

How do I apply for the homestead tax credit?

To apply for the homestead tax credit, you need to complete a specific application form provided by your state or locality. Typically, documentation proving your residency and ownership will be required. Knowing how to apply effectively is crucial to ensuring you receive this beneficial tax reduction.

-

Are there any eligibility requirements for the homestead tax credit?

Eligibility for the homestead tax credit varies by state, but generally, you must own and occupy your home as your primary residence. Some states may also consider income levels and other factors. Understanding what is homestead tax credit can help you determine if you meet the criteria.

-

What information do I need to gather for the homestead tax credit application?

When applying for the homestead tax credit, you’ll typically need your property tax details, proof of ownership, and evidence of residency, such as utility bills. Having this information organized will streamline your application process. Knowing what is homestead tax credit can make this step easier.

-

Can the homestead tax credit be combined with other tax benefits?

Yes, in many cases, the homestead tax credit can be combined with other tax benefits, such as senior or disabled person tax exemptions. It’s important to check with your local tax authority for specifics regarding eligibility. Understanding what is homestead tax credit will help you leverage multiple benefits effectively.

-

How does the homestead tax credit affect my overall financial planning?

The homestead tax credit can have a signNow positive impact on your overall financial planning by reducing your tax liability and freeing up funds for other expenses. It's a vital consideration for homeowners looking to manage budgets effectively. Being informed about what is homestead tax credit aids in effective financial decision-making.

-

Is there a deadline for applying for the homestead tax credit?

Most states set specific deadlines for applying for the homestead tax credit, often coinciding with property tax deadlines. Missing this deadline could mean delaying or forgoing your tax savings for that year. Understanding what is homestead tax credit helps ensure you stay on top of important dates.

Get more for Maryland Homestead Tax Credit

Find out other Maryland Homestead Tax Credit

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF