New Mexico Rpd 41367 Form 2019

What is the New Mexico Rpd 41367 Form

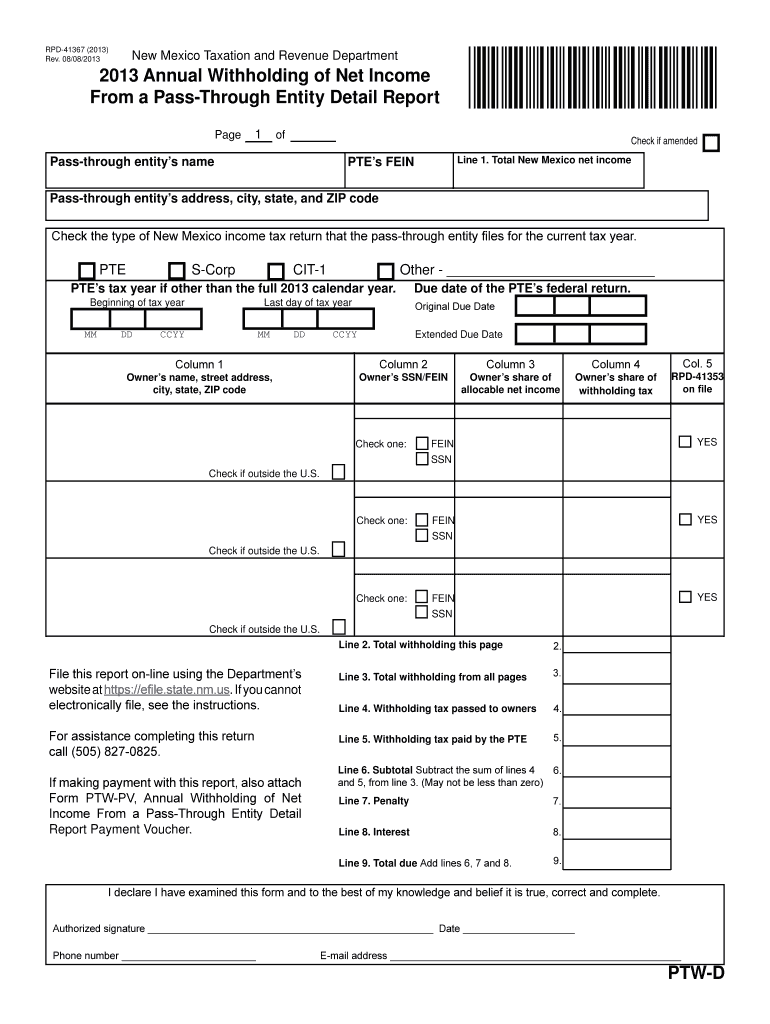

The New Mexico Rpd 41367 Form is a specific document used for tax purposes within the state of New Mexico. This form typically serves to report certain financial information to the New Mexico Taxation and Revenue Department. It is essential for individuals and businesses to accurately complete this form to ensure compliance with state tax regulations.

How to obtain the New Mexico Rpd 41367 Form

The New Mexico Rpd 41367 Form can be obtained through the New Mexico Taxation and Revenue Department's official website. Additionally, physical copies may be available at local tax offices or government buildings. It is advisable to ensure you are using the most current version of the form, as updates may occur periodically.

Steps to complete the New Mexico Rpd 41367 Form

Completing the New Mexico Rpd 41367 Form involves several key steps:

- Gather necessary financial documents, including income statements and receipts.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the information for accuracy to prevent errors.

- Sign and date the form to validate it.

- Submit the form according to the specified submission methods.

Legal use of the New Mexico Rpd 41367 Form

The legal use of the New Mexico Rpd 41367 Form is critical for ensuring compliance with state tax laws. When filled out correctly, this form can serve as a legal document for reporting income, expenses, and other financial activities. It is important to adhere to all guidelines provided by the New Mexico Taxation and Revenue Department to avoid potential legal issues.

Key elements of the New Mexico Rpd 41367 Form

Key elements of the New Mexico Rpd 41367 Form include:

- Taxpayer identification information, such as name and Social Security number or Employer Identification Number.

- Details regarding income sources and amounts.

- Information on deductions or credits being claimed.

- Signature of the taxpayer or authorized representative.

Form Submission Methods

The New Mexico Rpd 41367 Form can be submitted through various methods. Taxpayers may choose to file the form online via the New Mexico Taxation and Revenue Department's website, or they may opt to mail a physical copy to the appropriate address. In-person submissions may also be accepted at designated tax offices, providing flexibility for individuals and businesses.

Quick guide on how to complete new mexico rpd 41367 2013 form

Complete New Mexico Rpd 41367 Form smoothly on any device

Managing documents online has gained popularity among both companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage New Mexico Rpd 41367 Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign New Mexico Rpd 41367 Form effortlessly

- Obtain New Mexico Rpd 41367 Form and then click Get Form to begin.

- Make use of the tools provided to complete your form.

- Highlight important sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet signature.

- Verify all the details and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management requirements with just a few clicks from your preferred device. Modify and eSign New Mexico Rpd 41367 Form to ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new mexico rpd 41367 2013 form

Create this form in 5 minutes!

How to create an eSignature for the new mexico rpd 41367 2013 form

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the New Mexico Rpd 41367 Form?

The New Mexico Rpd 41367 Form is a document used for tax purposes in the state of New Mexico. It is essential for reporting certain transactions and ensuring compliance with state regulations. Understanding how to properly fill out this form can help businesses avoid potential penalties from tax authorities.

-

How can airSlate SignNow help with the New Mexico Rpd 41367 Form?

airSlate SignNow simplifies the process of completing and submitting the New Mexico Rpd 41367 Form. With our intuitive eSigning and document management features, you can easily input all necessary data and securely send the form to the relevant parties. This saves time and ensures accuracy in your submissions.

-

Is there a cost associated with using airSlate SignNow for the New Mexico Rpd 41367 Form?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. While there is a cost involved, many users find that the time saved and the ease of use make it a cost-effective solution for managing the New Mexico Rpd 41367 Form and other documentation.

-

What features does airSlate SignNow offer for the New Mexico Rpd 41367 Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking of document status. These tools enhance your ability to handle the New Mexico Rpd 41367 Form efficiently and effectively, ensuring all necessary steps are completed accurately.

-

Can I integrate airSlate SignNow with other applications for the New Mexico Rpd 41367 Form?

Absolutely! airSlate SignNow offers integration with various applications, allowing you to streamline your workflow when dealing with the New Mexico Rpd 41367 Form. This means you can connect your existing software systems and share data seamlessly, enhancing productivity.

-

Are there any customer support options available for questions about the New Mexico Rpd 41367 Form?

Yes, airSlate SignNow provides excellent customer support to assist users with any questions regarding the New Mexico Rpd 41367 Form. Whether it's via live chat, email, or phone, our support team is available to ensure you have all the information you need.

-

How secure is the process of sending the New Mexico Rpd 41367 Form with airSlate SignNow?

Security is a top priority at airSlate SignNow. When sending the New Mexico Rpd 41367 Form, we employ advanced encryption protocols to protect your data. This ensures that your documents remain confidential and secure throughout the entire process.

Get more for New Mexico Rpd 41367 Form

Find out other New Mexico Rpd 41367 Form

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document