Tax Forgiveness PA Department of Revenue Homepage Form

Understanding Tax Forgiveness in Pennsylvania

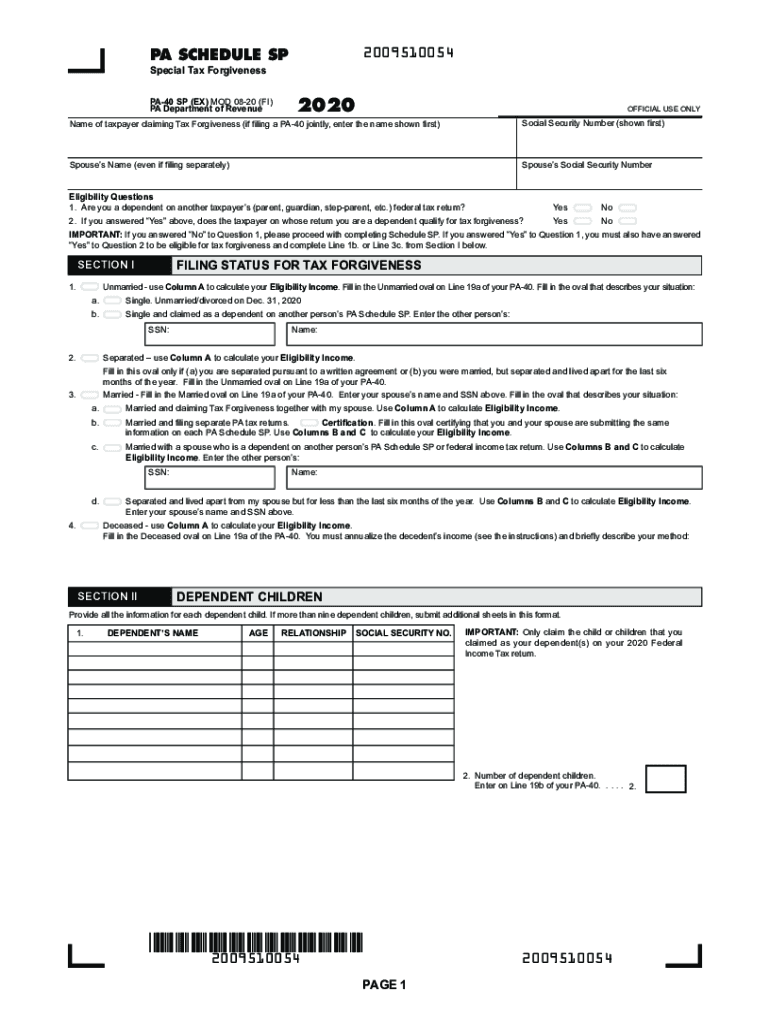

The Tax Forgiveness program in Pennsylvania is designed to provide relief for eligible taxpayers, allowing them to reduce or eliminate their tax liabilities. This initiative is particularly beneficial for low-income individuals and families, helping to alleviate the financial burden of state taxes. Eligibility is primarily based on income levels, family size, and other specific criteria outlined by the Pennsylvania Department of Revenue. Understanding these parameters is essential for taxpayers seeking to benefit from this program.

Eligibility Criteria for Tax Forgiveness

To qualify for the Tax Forgiveness program, applicants must meet certain income thresholds and family size requirements. Generally, the program is aimed at individuals and families with lower incomes. The Pennsylvania Department of Revenue provides specific income limits that vary based on the number of dependents claimed. It is crucial for applicants to review these criteria thoroughly to determine their eligibility before applying.

Steps to Complete the Tax Forgiveness Application

Completing the Tax Forgiveness application involves several straightforward steps:

- Gather necessary documentation, including income statements and personal identification.

- Access the appropriate form, typically the PA-40 or PA-40 SP, which includes sections for tax forgiveness.

- Fill out the form accurately, ensuring all income and family size information is correct.

- Submit the completed form either online, by mail, or in person at designated locations.

Following these steps carefully will help ensure a smooth application process.

Form Submission Methods

Taxpayers have multiple options for submitting their Tax Forgiveness applications. The primary methods include:

- Online Submission: Utilizing the Pennsylvania Department of Revenue's online portal for electronic filing.

- Mail: Sending the completed form to the appropriate address as specified in the form instructions.

- In-Person: Delivering the application directly to local tax offices for immediate processing.

Choosing the right submission method can expedite the processing time and ensure timely receipt of any tax forgiveness benefits.

Required Documents for Tax Forgiveness

When applying for Tax Forgiveness, certain documents are necessary to support the application. These typically include:

- Proof of income, such as W-2 forms or 1099 statements.

- Identification documents, including a driver's license or Social Security card.

- Any additional forms that may be required based on specific circumstances, such as proof of dependents.

Having these documents ready can facilitate a smoother application process and help verify eligibility quickly.

Important Filing Deadlines

Timely submission of the Tax Forgiveness application is crucial. The Pennsylvania Department of Revenue sets specific deadlines for filing, typically aligned with the annual tax return deadlines. Taxpayers should be aware of these dates to avoid penalties or missed opportunities for tax relief. It is advisable to check the department's official communications for the most current deadlines.

Quick guide on how to complete tax forgiveness pa department of revenue homepage

Effortlessly Prepare Tax Forgiveness PA Department Of Revenue Homepage on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly solution to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without delays. Manage Tax Forgiveness PA Department Of Revenue Homepage on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Ways to Modify and eSign Tax Forgiveness PA Department Of Revenue Homepage with Ease

- Locate Tax Forgiveness PA Department Of Revenue Homepage and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Highlight important sections of your documents or redact sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Tax Forgiveness PA Department Of Revenue Homepage and ensure smooth communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax forgiveness pa department of revenue homepage

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is a PA schedule SP?

A PA schedule SP is a specific scheduling option within the airSlate SignNow platform designed to streamline document signing processes. It allows users to schedule and manage signings conveniently, ensuring efficient workflow. With this feature, businesses can enhance their document management efficiency.

-

How does airSlate SignNow handle pricing for PA schedule SP?

airSlate SignNow offers competitive pricing options for the PA schedule SP feature, making it accessible for businesses of all sizes. Pricing plans often depend on factors like the number of users and document volume, ensuring you get the best value. Interested parties can visit our pricing page for detailed information.

-

What are the key features of the PA schedule SP?

Key features of the PA schedule SP include automated reminders, customizable signing workflows, and real-time tracking. These features help users manage document signings efficiently and reduce turnaround time. airSlate SignNow ensures a user-friendly experience while maintaining robust security protocols.

-

Can I integrate PA schedule SP with other applications?

Yes, airSlate SignNow supports seamless integrations with various third-party applications. This includes popular tools like Google Drive, Dropbox, and CRM systems, enhancing the overall efficiency of your workflows. The PA schedule SP feature works hand in hand with these applications to streamline document management.

-

What benefits does using a PA schedule SP provide for businesses?

Using the PA schedule SP can signNowly reduce the time and effort spent on document signing and approval processes. It enhances organizational efficiency and helps to mitigate delays in contract execution. Additionally, businesses enjoy improved compliance and security when using airSlate SignNow’s solutions.

-

Is it easy to set up the PA schedule SP feature?

Yes, setting up the PA schedule SP feature on airSlate SignNow is straightforward and user-friendly. The intuitive interface allows users to set up scheduling in minutes without requiring extensive technical knowledge. Our customer support team is also available to assist with any setup questions.

-

What types of documents can I manage with the PA schedule SP?

The PA schedule SP feature can manage a wide range of documents, including contracts, agreements, and forms. It accommodates various file formats, making it versatile for different business needs. Whether you’re sending a simple notice or a complex contract, airSlate SignNow can handle it efficiently.

Get more for Tax Forgiveness PA Department Of Revenue Homepage

Find out other Tax Forgiveness PA Department Of Revenue Homepage

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now