Form 941 X PR Rev July Internal Revenue Service

What is the Form 941 PR?

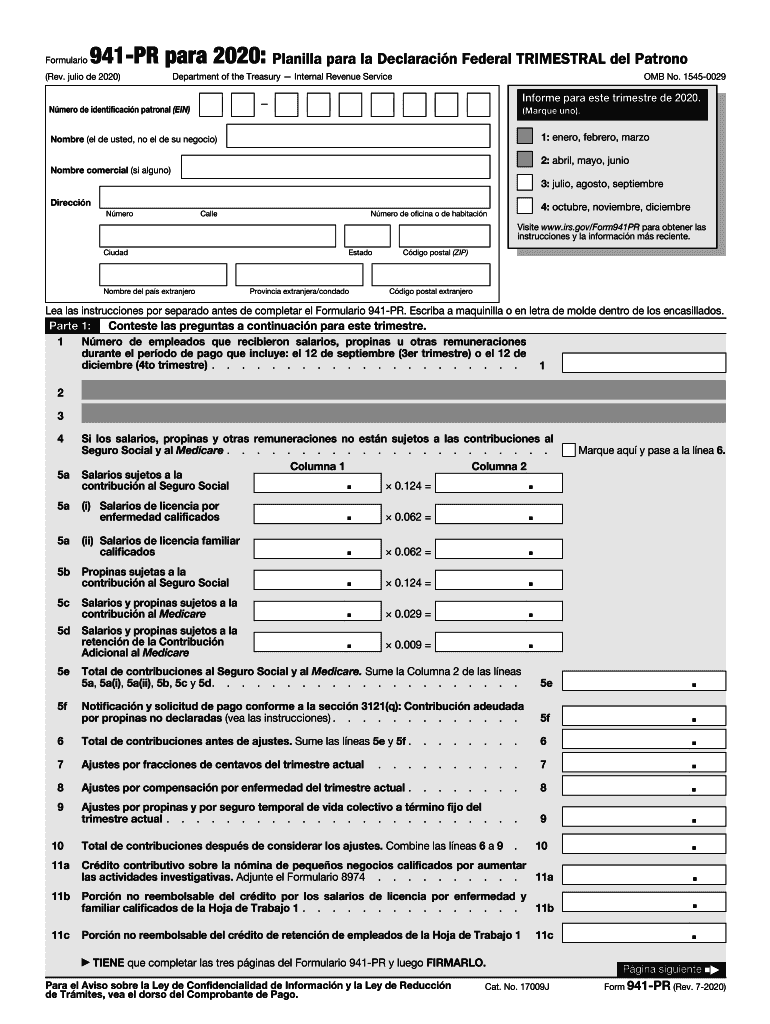

The Form 941 PR is a quarterly tax return used by employers in Puerto Rico to report income taxes withheld from employee wages, as well as the employer's share of Social Security and Medicare taxes. This form is essential for ensuring compliance with federal tax obligations and is specifically tailored to meet the needs of businesses operating in Puerto Rico. It captures vital information, including the number of employees, total wages paid, and the amounts withheld for taxes.

How to Obtain the Form 941 PR

To obtain the Form 941 PR, businesses can visit the official Internal Revenue Service (IRS) website, where the form is available for download in PDF format. The form can also be requested by contacting the IRS directly. It is important to ensure that you are using the correct version of the form, as updates may occur that reflect changes in tax laws or regulations.

Steps to Complete the Form 941 PR

Completing the Form 941 PR involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN) and payroll records.

- Fill out the form with accurate details regarding employee wages, tax withholdings, and any adjustments.

- Calculate the total taxes owed for the quarter and ensure all figures are accurate.

- Review the completed form for any errors or omissions before submission.

Legal Use of the Form 941 PR

The Form 941 PR serves as a legal document that must be filed by employers to report payroll taxes. Proper completion and timely submission of this form are critical to avoid penalties and ensure compliance with federal tax regulations. The form must be signed by an authorized representative of the business, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Form 941 PR to avoid late fees and penalties. The form is due on the last day of the month following the end of each quarter. For example, the deadline for the first quarter is April 30, while the second quarter is due by July 31. It is essential to mark these dates on your calendar to ensure timely submissions.

Penalties for Non-Compliance

Failure to file the Form 941 PR on time or submitting inaccurate information can result in significant penalties. The IRS imposes fines based on the amount of tax owed and the length of time the form is late. Employers may also face interest charges on unpaid taxes, making timely and accurate filing crucial for maintaining compliance and avoiding unnecessary financial burdens.

Quick guide on how to complete form 941 x pr rev july 2020 internal revenue service

Manage Form 941 X PR Rev July Internal Revenue Service seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the necessary form and safely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly and without delays. Handle Form 941 X PR Rev July Internal Revenue Service on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 941 X PR Rev July Internal Revenue Service without any hassle

- Locate Form 941 X PR Rev July Internal Revenue Service and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 941 X PR Rev July Internal Revenue Service and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 941 x pr rev july 2020 internal revenue service

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is the 2020 941 pr planilla and why is it important?

The 2020 941 pr planilla is a crucial document for businesses in Puerto Rico, used for reporting quarterly payroll taxes. Understanding this form ensures compliance with tax regulations and helps avoid penalties, making it essential for any business operation.

-

How can airSlate SignNow help with the 2020 941 pr planilla?

airSlate SignNow provides an efficient platform for businesses to complete and eSign the 2020 941 pr planilla electronically. This streamlines the process, ensuring your documents are signed quickly and securely, which saves you time and reduces hassle.

-

Is there a cost associated with using airSlate SignNow for the 2020 941 pr planilla?

Yes, airSlate SignNow offers competitive pricing plans tailored to businesses of all sizes. Pricing varies depending on the features you choose, but the investment can lead to signNow time savings and enhanced efficiency in handling your 2020 941 pr planilla and other documents.

-

What features does airSlate SignNow offer for managing the 2020 941 pr planilla?

airSlate SignNow includes features like customizable templates, secure cloud storage, and real-time tracking. These tools make it easier to create, manage, and eSign your 2020 941 pr planilla, ensuring all your documents are organized and accessible.

-

Can airSlate SignNow integrate with other software for filing the 2020 941 pr planilla?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software. This integration simplifies the process of preparing the 2020 941 pr planilla, as you can transfer data directly without manual entry.

-

How secure is airSlate SignNow for handling the 2020 941 pr planilla?

Security is paramount at airSlate SignNow. The platform employs advanced encryption methods and compliance with data protection regulations, ensuring that your 2020 941 pr planilla and other sensitive documents are kept safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for the 2020 941 pr planilla?

Using airSlate SignNow for the 2020 941 pr planilla brings numerous benefits, including faster processing times and reduced paperwork. The ability to eSign documents enables quicker collaboration, ensuring your tax filings are completed efficiently and on time.

Get more for Form 941 X PR Rev July Internal Revenue Service

Find out other Form 941 X PR Rev July Internal Revenue Service

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement