Form 211

What is the Form 211

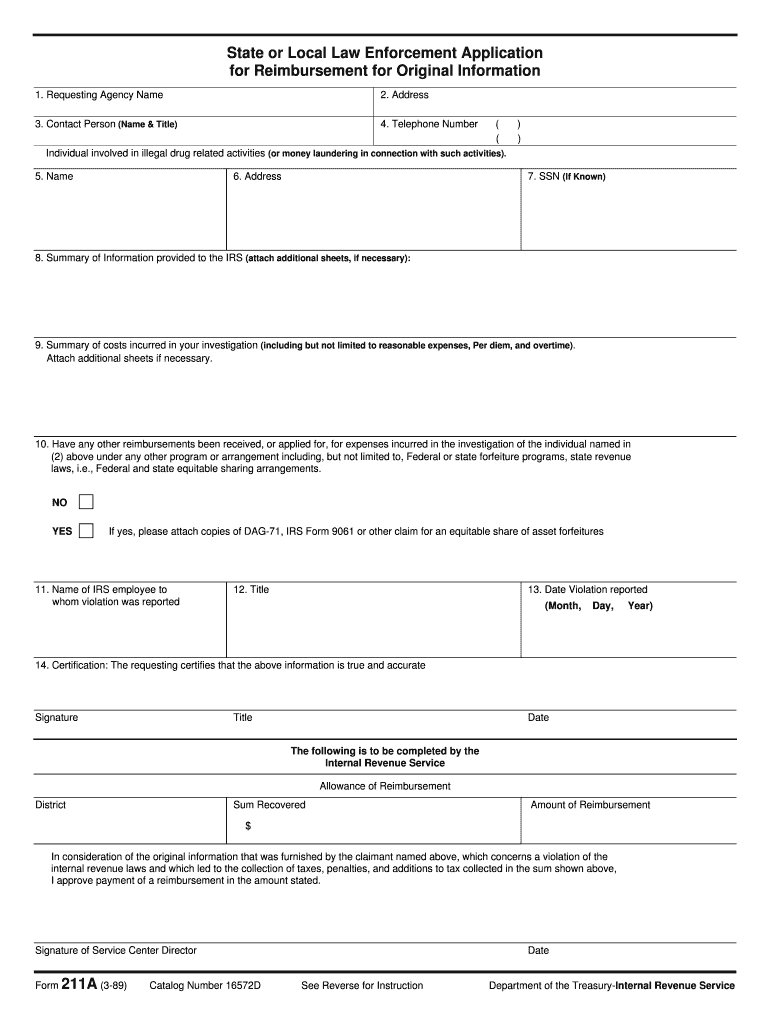

The IRS Form 211, also known as the Form 211, is a document used to report information related to whistleblower claims. This form allows individuals to provide information about violations of tax laws that may lead to the recovery of taxes, penalties, and interest. The form is essential for those who wish to report misconduct while potentially receiving a monetary reward based on the amount collected by the IRS as a result of the information provided.

How to use the Form 211

Using the IRS Form 211 involves several steps. First, gather all necessary information regarding the tax violation you wish to report. This includes details about the taxpayer, the nature of the violation, and any supporting documentation. Once you have compiled this information, complete the form by following the instructions provided. It is important to ensure that all sections are filled out accurately to avoid delays in processing your claim.

Steps to complete the Form 211

Completing the IRS Form 211 involves a systematic approach:

- Download the Form 211 from the IRS website or access it through a digital platform.

- Fill in your personal information, including your name, address, and contact details.

- Provide detailed information about the tax violation, including the taxpayer's name, the amount involved, and the nature of the violation.

- Attach any supporting documentation that can substantiate your claim.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Form 211

The IRS Form 211 is legally recognized as a valid means of reporting tax fraud and other violations. To ensure its legal standing, the information provided must be truthful and complete. Whistleblowers are protected under federal law, which means they cannot be retaliated against for reporting violations. However, it is crucial to understand that false claims can lead to severe penalties.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 211 can be submitted through various methods. While the form itself is typically submitted by mail, some digital platforms may offer options for electronic submission. If mailing the form, ensure it is sent to the correct IRS address specified in the form instructions. For those opting for in-person submission, visiting a local IRS office may be an option, but it is advisable to check for any necessary appointments or requirements beforehand.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 211. These guidelines include instructions on how to fill out each section of the form, what information is required, and how to submit supporting documents. Adhering to these guidelines is essential to ensure that your claim is processed efficiently and effectively. It is also recommended to review any updates to the guidelines annually, as they may change based on new regulations or policies.

Quick guide on how to complete irs form 211 online

Prepare Form 211 effortlessly on any device

Web-based document management has gained signNow traction among enterprises and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without hindrances. Manage Form 211 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 211 with ease

- Locate Form 211 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature through the Sign tool, which only takes seconds and holds the same legal authority as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 211 and ensure outstanding communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

-

How do I fill out an Indian passport form online?

You need to be careful while filling up the Passport form online. If is better if you download the Passport form and fill it up offline. You can upload the form again after you completely fill it up. You can check the complete procedure to know : How to Apply for Indian Passport Online ?

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

What is the procedure for filling out the CPT registration form online?

CHECK-LIST FOR FILLING-UP CPT JUNE - 2017 EXAMINATION APPLICATION FORM1 - BEFORE FILLING UP THE FORM, PLEASE DETERMINE YOUR ELIGIBILITY AS PER DETAILS GIVEN AT PARA 1.3 (IGNORE FILLING UP THE FORM IN CASE YOU DO NOT COMPLY WITH THE ELIGIBILITY REQUIREMENTS).2 - ENSURE THAT ALL COLUMNS OF THE FORM ARE FILLED UP/SELECTED CORRECTLY AND ARE CORRECTLY APPEARING IN THE PDF.3 - CENTRE IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF. (FOR REFERENCE SEE APPENDIX-A).4 - MEDIUM OF THE EXAMINATION IS SELECTED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.5 - THE SCANNED COPY OF THE DECLARATION UPLOADED PERTAINS TO THE CURRENT EXAM CYCLE.6 - ENSURE THAT PHOTOGRAPHS AND SIGNATURES HAVE BEEN AFFIXED (If the same are not appearing in the pdf) AT APPROPRIATE COLUMNS OF THE PRINTOUT OF THE EXAM FORM.7 - ADDRESS HAS BEEN RECORDED CORRECTLY AND IS CORRECTLY APPEARING IN THE PDF.8 - IN CASE THE PDF IS NOT CONTAINING THE PHOTO/SIGNATURE THEN CANDIDATE HAS TO GET THE DECLARATION SIGNED AND PDF IS GOT ATTESTED.9 - RETAIN A COPY OF THE PDF/FILLED-IN FORM FOR YOUR FUTURE REFERENCE.10 - IN CASE THE PHOTO/SIGN IS NOT APPEARING IN THE PDF, PLEASE TAKE ATTESTATIONS AND SEND THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION BY SPEED POST/REGISTERED POST ONLY.11 - KEEP IN SAFE CUSTODY THE SPEED POST/REGISTERED POST RECEIPT ISSUED BY POSTAL AUTHORITY FOR SENDING THE PDF (PRINT OUT) OF THE ONLINE SUMBITTED EXAMINATION APPLICATION FORM TO THE INSTITUTE/ RECEIPT ISSUED BY ICAI IN CASE THE APPLICATION IS DEPOSITED BY HAND.Regards,Scholar For CA089773 13131Like us on facebookScholar for ca,cma,cs https://m.facebook.com/scholarca...Sambamurthy Nagar, 5th Street, Kakinada, Andhra Pradesh 533003https://g.co/kgs/VaK6g0

Create this form in 5 minutes!

How to create an eSignature for the irs form 211 online

How to make an eSignature for the Irs Form 211 Online in the online mode

How to make an eSignature for your Irs Form 211 Online in Google Chrome

How to make an eSignature for signing the Irs Form 211 Online in Gmail

How to make an eSignature for the Irs Form 211 Online right from your smartphone

How to generate an electronic signature for the Irs Form 211 Online on iOS

How to make an electronic signature for the Irs Form 211 Online on Android devices

People also ask

-

What is Form 211 and how does it work with airSlate SignNow?

Form 211 is a standardized document used for various purposes, including tax exemptions and information requests. With airSlate SignNow, you can easily create, send, and eSign Form 211, streamlining your workflow and ensuring secure document handling. Our platform supports the efficient management of Form 211 and similar documents, making it a cost-effective solution for businesses.

-

How much does it cost to use airSlate SignNow for Form 211?

airSlate SignNow offers flexible pricing plans tailored to meet diverse business needs. You can easily manage and eSign Form 211 at a competitive rate while enjoying all the features our platform has to offer. Visit our pricing page to find the best plan for your organization and start simplifying your Form 211 processes today.

-

Can I customize my Form 211 using airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize your Form 211 to suit your specific requirements. You can add logos, modify text fields, and incorporate any additional elements necessary for your document. This customization ensures that your Form 211 aligns perfectly with your brand identity and meets your business needs.

-

What features does airSlate SignNow provide for managing Form 211?

airSlate SignNow offers a range of features to enhance the management of Form 211, including secure eSigning, document tracking, and automated workflows. You can quickly send out Form 211 for signatures, monitor its status in real-time, and ensure compliance with all necessary regulations. These features help save time and improve efficiency in your document management.

-

Is airSlate SignNow compliant with regulations for using Form 211?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations, ensuring that your Form 211 is processed securely and legally. Our platform adheres to industry standards for data protection and electronic signatures, providing peace of mind as you manage your important documents.

-

Can I integrate airSlate SignNow with other software for my Form 211?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing you to enhance your Form 211 processes further. Whether you use CRM systems, cloud storage solutions, or other business tools, our platform can connect with them to streamline your workflow and improve efficiency.

-

How does airSlate SignNow enhance the eSigning experience for Form 211?

airSlate SignNow enhances the eSigning experience for Form 211 by providing a user-friendly interface and robust security features. Signers can easily access and complete Form 211 from any device, ensuring a smooth and efficient process. With our advanced authentication options, you can trust that your Form 211 is signed securely.

Get more for Form 211

Find out other Form 211

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure