Michigan Homestead Property Form

What is the Michigan Homestead Property

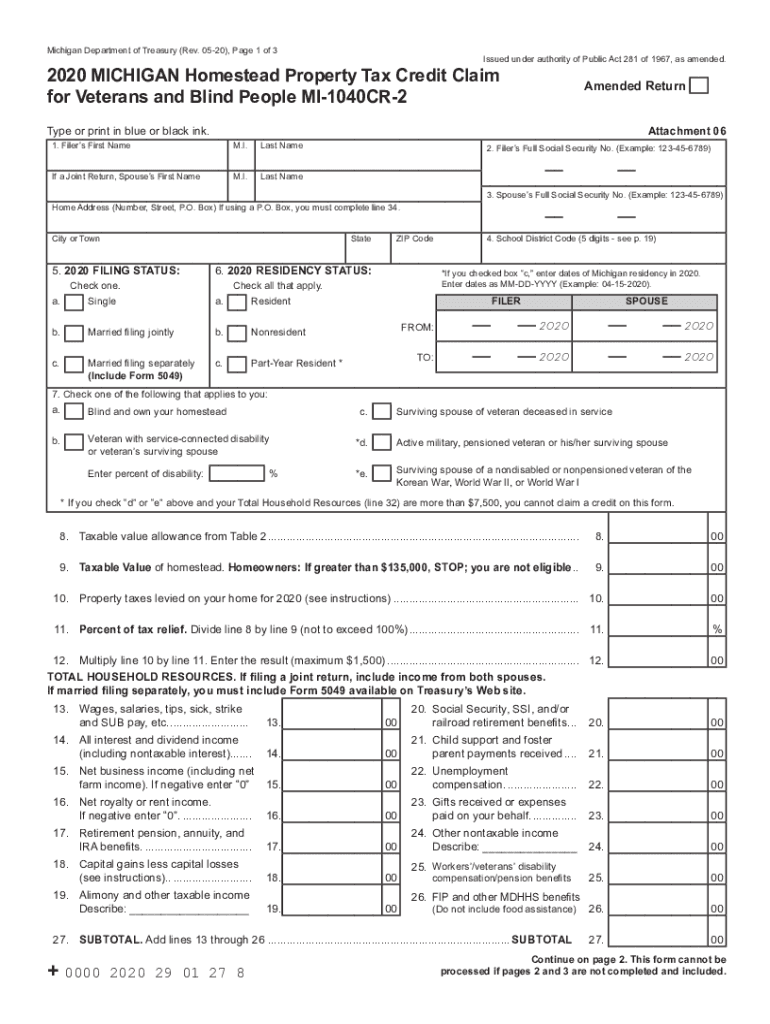

The Michigan Homestead Property refers to a primary residence that qualifies for specific tax benefits under Michigan law. This designation allows homeowners to receive a homestead property tax credit, which can significantly reduce their property tax burden. The homestead classification is essential for those seeking financial relief, especially for low-income residents, seniors, and disabled individuals. Understanding the criteria for what constitutes a homestead property is crucial for homeowners looking to take advantage of these benefits.

Eligibility Criteria

To qualify for the Michigan Homestead Property tax credit, homeowners must meet several eligibility requirements. These include:

- The property must be the primary residence of the owner.

- Homeowners must have a total household income below a specified threshold.

- Applicants must own the property or have a long-term lease.

- Taxpayers must file the appropriate forms, such as the MI-1040CR, to claim the credit.

These criteria ensure that the benefits are directed toward those who need them most, providing essential support for maintaining homeownership.

Steps to Complete the Michigan Homestead Property

Completing the necessary forms for the Michigan Homestead Property tax credit involves several key steps:

- Gather required documentation, including proof of income and property ownership.

- Obtain the MI-1040CR form, which is used to claim the homestead property tax credit.

- Fill out the form accurately, ensuring all information is complete and correct.

- Submit the form by the designated deadline, either online, by mail, or in person.

Following these steps carefully can help ensure that the application process goes smoothly and that homeowners receive the tax relief they are entitled to.

Required Documents

When applying for the Michigan Homestead Property tax credit, homeowners need to provide specific documents to support their application. These typically include:

- Proof of income, such as tax returns or pay stubs.

- Property deed or lease agreement to verify ownership or residency.

- Previous year’s property tax statement.

- Any additional documentation that may be required based on individual circumstances.

Having these documents ready can expedite the application process and help avoid delays in receiving the tax credit.

Form Submission Methods

Homeowners can submit their Michigan Homestead Property tax credit application through various methods:

- Online: Many residents prefer to submit their forms electronically, which can be done through the Michigan Department of Treasury's website.

- Mail: Completed forms can be printed and mailed to the appropriate local tax office.

- In-Person: Homeowners may also choose to submit their applications in person at their local tax office for immediate assistance.

Choosing the right submission method can help ensure that applications are processed efficiently.

Penalties for Non-Compliance

Failing to comply with the requirements for the Michigan Homestead Property tax credit can result in several penalties. Homeowners may face:

- Loss of the tax credit for the current year, leading to higher property taxes.

- Potential fines or interest on any unpaid taxes.

- Legal action if discrepancies are found during audits or reviews.

Understanding these penalties emphasizes the importance of accurate and timely submissions to avoid unnecessary financial consequences.

Quick guide on how to complete 2020 michigan homestead property

Effortlessly prepare Michigan Homestead Property on any device

The management of documents online has gained signNow traction among organizations and individuals. It offers a flawless eco-friendly substitute to conventional printed and signed paperwork, as you can easily retrieve the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Handle Michigan Homestead Property on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and electronically sign Michigan Homestead Property with ease

- Find Michigan Homestead Property and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Michigan Homestead Property and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 michigan homestead property

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to Michigan property tax?

airSlate SignNow is a powerful eSigning platform that facilitates document management, including those related to Michigan property tax transactions. By using SignNow, businesses can streamline the process of signing forms and contracts necessary for managing property tax in Michigan efficiently.

-

How can airSlate SignNow help with completing Michigan property tax documents?

With airSlate SignNow, users can easily fill out and eSign Michigan property tax documents online. The platform allows for effortless collaboration and secure signing, eliminating the hassle of paper forms and ensuring that all necessary tax documents are properly completed and submitted on time.

-

What are the pricing plans for airSlate SignNow that would suit Michigan property tax needs?

airSlate SignNow offers several pricing plans that cater to diverse business needs, including those focused on Michigan property tax documentation. You can choose from basic to advanced options, depending on your requirements for document management, eSigning, and workflow automation.

-

Does airSlate SignNow integrate with other software for managing Michigan property tax?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, making it easier to manage Michigan property tax workflows. Whether you need to link to accounting software or document storage solutions, SignNow's integrations enhance its utility for handling property tax management effectively.

-

What features does airSlate SignNow offer for managing Michigan property tax documents?

airSlate SignNow boasts important features like customizable templates, multi-party signing, and robust security measures that are essential for managing Michigan property tax documents. These features ensure that users can not only create but also manage and store their tax files securely and efficiently.

-

Is airSlate SignNow user-friendly for handling Michigan property tax processes?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes it simple to navigate through the processes of handling Michigan property tax forms. Even those who aren't tech-savvy will find it easy to use, ensuring that all necessary documents can be managed without complications.

-

Can airSlate SignNow help ensure compliance with Michigan property tax regulations?

Yes, using airSlate SignNow can help businesses maintain compliance with Michigan property tax regulations. The platform provides a trail of signed documents and timestamps, ensuring that all paperwork is correctly completed and submitted, mitigating the risk of errors that could lead to compliance issues.

Get more for Michigan Homestead Property

Find out other Michigan Homestead Property

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word