Irs Form 990 Pf

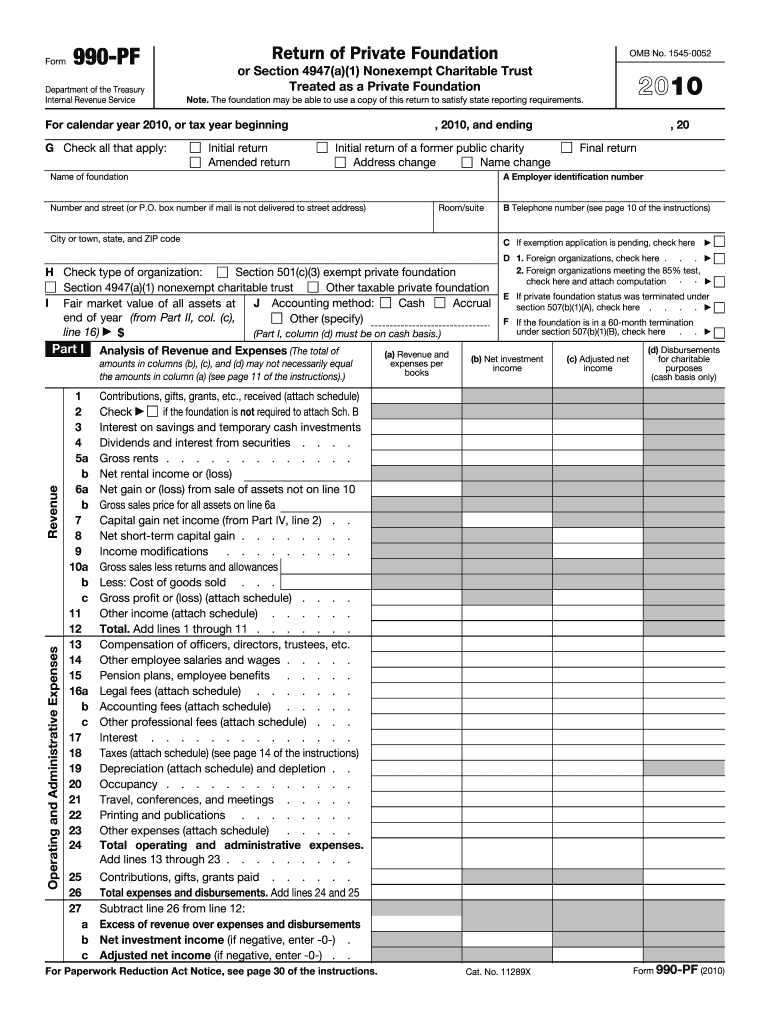

What is the IRS Form 990-PF?

The IRS Form 990-PF is a tax return specifically designed for private foundations in the United States. This form provides the IRS with essential information about the foundation's financial activities, including income, expenses, and distributions made to charitable organizations. It is crucial for maintaining transparency and compliance with federal tax regulations. Private foundations must file this form annually, regardless of their income level, to report their financial status and activities to the IRS.

Steps to Complete the IRS Form 990-PF

Completing the IRS Form 990-PF involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and records of grants made during the tax year. Next, fill out the form by providing detailed information about the foundation's revenue, expenses, and assets. It is important to accurately report any distributions made to charitable organizations, as these figures are closely scrutinized by the IRS. After completing the form, review it for any errors or omissions before submission.

How to Obtain the IRS Form 990-PF

The IRS Form 990-PF can be obtained directly from the IRS website or through various tax preparation software platforms. The form is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many accounting firms and tax professionals can provide assistance in obtaining and completing the form. It is important to ensure that you are using the most current version of the form, as updates may occur annually.

Legal Use of the IRS Form 990-PF

The legal use of the IRS Form 990-PF is essential for private foundations to maintain their tax-exempt status. This form must be filed accurately and on time to comply with IRS regulations. Failure to file or inaccuracies in reporting can lead to penalties, including the loss of tax-exempt status. It is vital for foundations to understand the legal implications of the information reported on this form, as it reflects their commitment to charitable activities and compliance with federal laws.

Filing Deadlines / Important Dates

The filing deadline for the IRS Form 990-PF is typically the 15th day of the fifth month after the end of the foundation's fiscal year. For foundations operating on a calendar year, this means the form is due by May 15. Extensions may be requested, allowing an additional six months for filing. However, it is important to note that any extensions do not extend the time for payment of any taxes owed. Keeping track of these deadlines is crucial for maintaining compliance and avoiding penalties.

Penalties for Non-Compliance

Non-compliance with the IRS Form 990-PF filing requirements can result in significant penalties. Foundations that fail to file the form on time may incur a penalty of $20 per day, up to a maximum of $10,000. In cases of willful neglect or failure to file for three consecutive years, the IRS may revoke the foundation's tax-exempt status. It is essential for private foundations to prioritize timely and accurate filing to avoid these serious consequences.

Quick guide on how to complete irs 2010 form 990 pf

Complete Irs Form 990 Pf effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage Irs Form 990 Pf on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Irs Form 990 Pf with ease

- Find Irs Form 990 Pf and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or via an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow manages all your document handling needs in just a few clicks from any device you choose. Edit and eSign Irs Form 990 Pf and ensure superb communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What is a good way to learn how to read an IRS form 990?

You may find the instructions to prepare Form 990 at the website below: https://www.irs.gov/pub/irs-pdf/...Hope this is helpful.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How can I fill out my PF form when I am currently working abroad?

Try to withdraw onlineMore info comment or check contacts info

-

Is it necessary to fill out form 15G to withdraw PF?

Greeting !!!Below are basic details for Form 15G or form 15HForm 15G or form 15H is submitted to request income provider for not deducting TDS for prescribed income. In that form, declaration maker declares that his estimated taxable income for the same year is Nil.If you fulfill following conditions, submit form 15G / form 15H:1. Your estimated tax liability for the current year is NIL and2. Your interest for financial year does not exceed basic exemption limit + relief under section 87A.Only resident Indian can submit form 15G / form 15H. NRI cannot submit those forms. Also note that individual and person can submit form 15G/ H and company and firm cannot submit those forms. However, AOP and HUF can submit those forms.Consequences of wrongly submitting form 15G or form 15H:If your estimated income from all the sources is more than thebasic exemption limit ( + relief under section 87A if applicable), don’t submitform 15G or form 15H to income provider. Wrongly submission of form 15G / form15H will attract section 277 of income tax act.Be Peaceful !!!

-

Can I fill out the PF form online?

Yes you can go to EPFO members home click claim form 10c and 19 c

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

Create this form in 5 minutes!

How to create an eSignature for the irs 2010 form 990 pf

How to generate an eSignature for your Irs 2010 Form 990 Pf online

How to make an eSignature for the Irs 2010 Form 990 Pf in Chrome

How to generate an electronic signature for putting it on the Irs 2010 Form 990 Pf in Gmail

How to generate an eSignature for the Irs 2010 Form 990 Pf from your smart phone

How to create an electronic signature for the Irs 2010 Form 990 Pf on iOS devices

How to create an eSignature for the Irs 2010 Form 990 Pf on Android

People also ask

-

What is the Irs Form 990 Pf and why is it important?

The Irs Form 990 Pf is a crucial tax form that private foundations must file annually with the IRS. It provides transparency about the foundation's financial activities, helping to ensure accountability and compliance with federal regulations. Understanding this form is essential for maintaining tax-exempt status and informing stakeholders about the foundation's operations.

-

How can airSlate SignNow help with completing the Irs Form 990 Pf?

airSlate SignNow simplifies the process of completing the Irs Form 990 Pf by allowing users to fill out, sign, and send the document electronically. With our intuitive interface, you can easily manage the necessary signatures and securely store your forms for future reference. This streamlines the filing process, ensuring you meet deadlines efficiently.

-

What features does airSlate SignNow offer for managing the Irs Form 990 Pf?

airSlate SignNow offers features such as customizable templates for the Irs Form 990 Pf, electronic signatures, and secure document storage. These tools enhance productivity and ensure that your forms are always compliant with IRS guidelines. Additionally, you can track the status of your documents in real time, making management effortless.

-

Is airSlate SignNow a cost-effective solution for filing Irs Form 990 Pf?

Yes, airSlate SignNow provides a cost-effective solution for filing your Irs Form 990 Pf. Our pricing plans cater to various needs, allowing you to choose the option that fits your budget while still accessing powerful features. This makes it easier for organizations of all sizes to manage their tax documentation without breaking the bank.

-

Can I integrate airSlate SignNow with other software for my Irs Form 990 Pf?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow when handling the Irs Form 990 Pf. This includes integrations with popular accounting and tax software, ensuring that you can easily import and export data between platforms for greater efficiency.

-

How secure is airSlate SignNow for handling sensitive documents like Irs Form 990 Pf?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure data storage practices to protect your sensitive documents, including the Irs Form 990 Pf. You can confidently manage your forms, knowing that your information is safeguarded against unauthorized access.

-

What support does airSlate SignNow offer for questions about the Irs Form 990 Pf?

Our dedicated support team is available to assist you with any questions regarding the Irs Form 990 Pf. Whether you need help navigating the platform or have specific inquiries about form requirements, we are here to provide guidance. You can signNow out via chat, email, or phone for prompt assistance.

Get more for Irs Form 990 Pf

- Kindness gram form

- Red cross training partner application form

- Research finance form

- Transcript request form lakehead university

- What is psychological first aid form

- 3215 fr06 purchasing card request formits your yale

- In home nursing care application af1042e complete this form to apply for manulife affinity markets in home nursing care af1042e

- Business declaration form ab0705e complete this form when you need to make a business declaration for a client ab0705e

Find out other Irs Form 990 Pf

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter